Get Dream Car Effortlessly With Low Interest Loans

You can effortlessly drive your dream car sooner than you think by exploring low-interest loan options that make luxury more accessible and affordable—browse options now to see how you can turn this dream into a reality.

Understanding Low-Interest Car Loans

Low-interest car loans are financial products that provide you with the funds needed to purchase a vehicle while minimizing the amount of interest you pay over the life of the loan. These loans are particularly appealing because they reduce the overall cost of borrowing, allowing you to allocate more of your budget towards the car itself rather than interest payments. With interest rates often being the most significant expense in financing a car, securing a low rate can lead to substantial savings.

Benefits of Low-Interest Loans

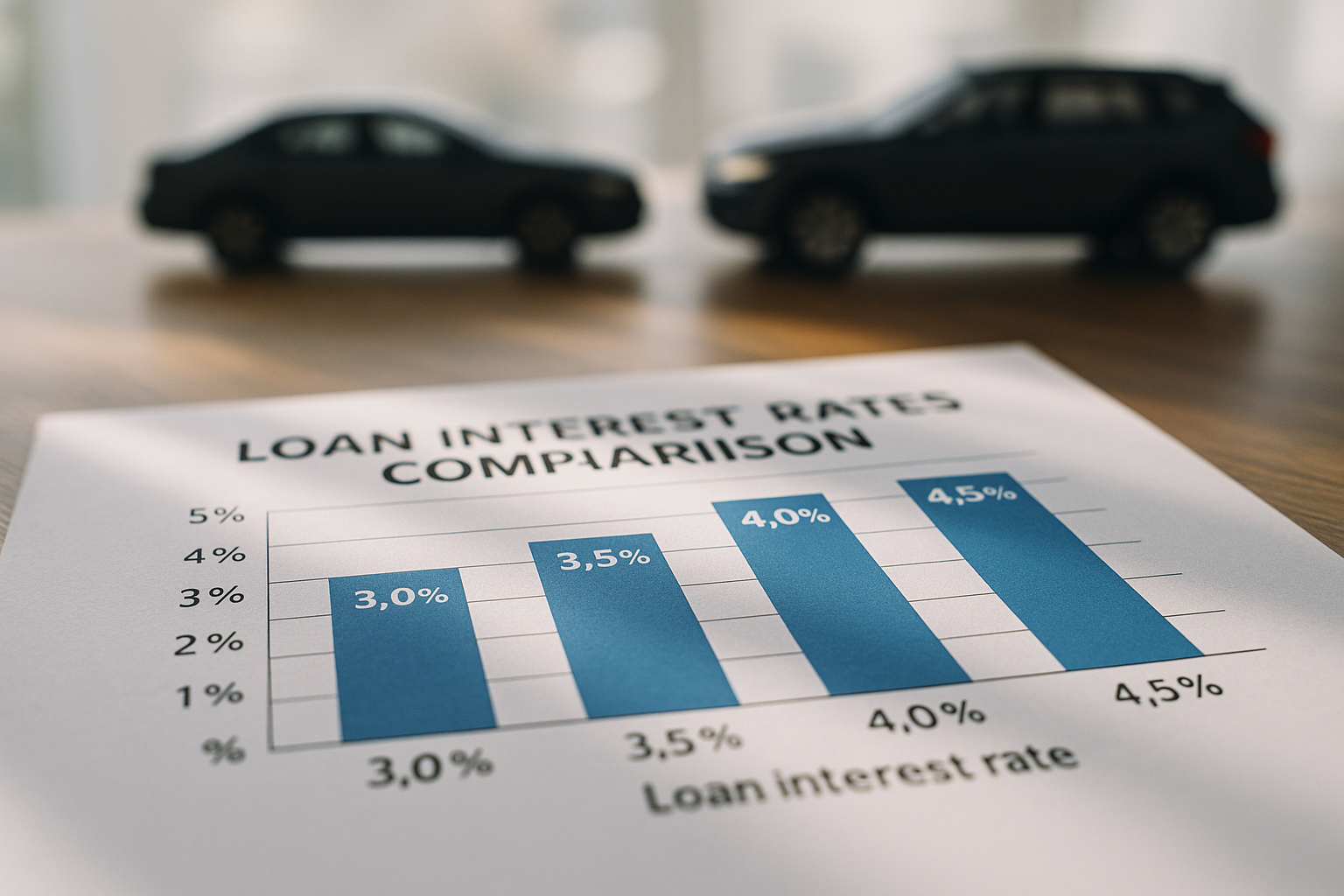

The primary benefit of low-interest car loans is the cost savings on interest payments. For instance, a reduction in interest rate from 5% to 3% on a $30,000 loan over five years can save you over $1,500 in interest alone1. Additionally, lower monthly payments can improve your cash flow, making it easier to manage your finances and potentially allowing you to afford a higher-quality vehicle.

Another advantage is the potential for faster repayment. With less money going towards interest, you can pay off the principal balance more quickly, freeing up your finances for other investments or savings. This flexibility is particularly beneficial if you plan to upgrade your vehicle in the future.

How to Secure a Low-Interest Car Loan

To secure a low-interest car loan, start by checking your credit score, as lenders typically offer the best rates to borrowers with excellent credit histories. You can improve your score by paying down existing debts and ensuring timely payments on all your accounts. Once your credit is in good shape, shop around and compare offers from various lenders, including banks, credit unions, and online financial institutions. Many lenders offer pre-approval processes that allow you to see potential rates without impacting your credit score.

Additionally, consider the loan term. While longer terms may offer lower monthly payments, they often come with higher interest rates. Opting for a shorter term can reduce the total interest paid, even if the monthly payments are higher.

Exploring Additional Resources

There are numerous online resources and tools available to assist you in finding the best low-interest car loan. Websites like AutoTrader, Edmunds, and Kelley Blue Book provide comprehensive comparisons of loan offers, helping you to identify the most competitive rates and terms2. Additionally, many automotive forums and consumer review sites offer insights into lender reputations and customer experiences, which can be invaluable when making your decision.

Real-World Examples and Opportunities

Many automakers and dealerships frequently offer promotional financing deals, such as 0% APR for qualified buyers or cashback incentives that can further reduce the cost of your loan3. These promotions are often available during specific times of the year, such as end-of-year sales events or model changeovers, making it an excellent time to purchase.

Moreover, leveraging trade-in values can also impact the affordability of your new car. By applying the trade-in value of your current vehicle towards the down payment, you can lower the loan amount, potentially qualifying for better interest rates and reducing your monthly payments.

Low-interest car loans offer a practical and financially savvy way to make your dream car a reality. By understanding the benefits, securing favorable terms, and exploring available resources, you can enjoy the luxury of driving the car you desire without breaking the bank. As you embark on this journey, consider visiting websites and exploring options to ensure you make the most informed and beneficial decision possible.