Save Big Comparing Top Home Equity Loan Secrets

Unlock the secrets to saving big on home equity loans by browsing options that could transform your financial landscape and maximize your savings potential.

Understanding Home Equity Loans

Home equity loans are a popular financial tool that allows homeowners to borrow against the equity they have built up in their property. This type of loan can be an effective way to access funds for major expenses, such as home renovations, education, or debt consolidation. By understanding the intricacies of home equity loans, you can make informed decisions that align with your financial goals.

How Home Equity Loans Work

A home equity loan is essentially a second mortgage that provides a lump sum of money based on the equity in your home. The loan is repaid over a fixed term with a set interest rate, making it predictable and easy to budget for. The amount you can borrow is typically determined by the lender's loan-to-value (LTV) ratio, which is the percentage of your home's appraised value that they are willing to lend. Most lenders allow a maximum LTV of 80%1.

Benefits of Home Equity Loans

One of the primary benefits of home equity loans is the ability to secure a lower interest rate compared to other forms of credit, such as personal loans or credit cards. This is because the loan is secured by your home, reducing the risk for lenders. Additionally, the interest paid on home equity loans may be tax-deductible, further enhancing their appeal2.

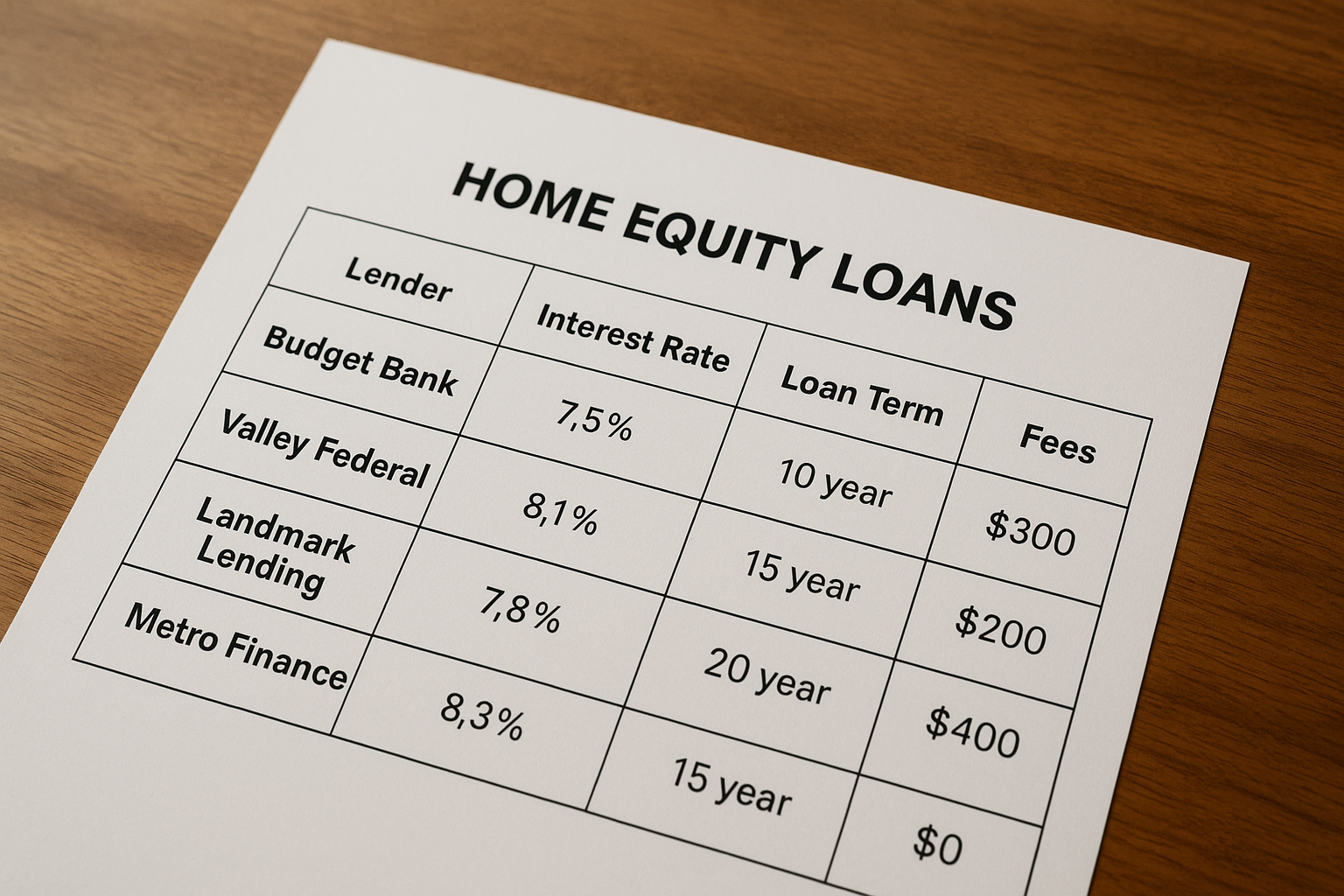

Comparing Home Equity Loan Options

When comparing home equity loan options, it's essential to consider several factors, including interest rates, fees, and repayment terms. Many lenders offer competitive rates, but it's crucial to shop around to find the best deal. Some lenders may also offer special promotions or discounts for new customers, so be sure to visit websites and explore these opportunities.

Real-World Examples and Statistics

According to a recent survey, the average interest rate for a home equity loan is approximately 6.03%3. However, this rate can vary significantly based on your credit score, loan amount, and lender. For instance, borrowers with excellent credit may qualify for rates as low as 3.5%, while those with lower credit scores might face rates exceeding 8%4.

Steps to Secure the Best Home Equity Loan

- Evaluate Your Financial Situation: Before applying for a home equity loan, assess your financial needs and determine how much equity you have available.

- Compare Lenders: Use online tools to search options and compare rates and terms from multiple lenders.

- Check Your Credit Score: A higher credit score can lead to better loan terms, so ensure your credit report is accurate and address any issues before applying.

- Gather Documentation: Be prepared to provide proof of income, employment, and property value to expedite the application process.

- Negotiate Terms: Don't hesitate to negotiate with lenders to secure the best possible terms for your loan.

Exploring Specialized Services

For those seeking tailored solutions, many financial institutions offer specialized home equity loan services designed to meet unique needs. These options can include adjustable-rate loans, interest-only payments, or loans with flexible repayment terms. By exploring these specialized services, you can find a loan that perfectly aligns with your financial strategy.

By taking the time to understand and compare top home equity loan secrets, you can unlock substantial savings and make informed decisions that enhance your financial well-being. Be sure to browse options and visit websites to find the best deals and opportunities available to you.