Top Secret Best Home Equity Loan Explored Today

If you're seeking to unlock the hidden potential of your home's equity, now is the perfect time to browse options and discover the top secret best home equity loans available today, offering you financial flexibility and empowerment.

Understanding Home Equity Loans

Home equity loans are a popular financial product that allow homeowners to borrow against the value of their home. Essentially, they provide a way to access the equity you've built up over the years, offering a lump sum of money that can be used for a variety of purposes, such as home improvements, debt consolidation, or even funding a child's education. These loans typically come with fixed interest rates, making them a stable option for borrowers who prefer predictable monthly payments.

Why Consider a Home Equity Loan?

There are several compelling reasons to consider a home equity loan. Firstly, the interest rates on home equity loans are generally lower than those on credit cards or personal loans, primarily because the loan is secured by your home. This can lead to significant savings over time. Additionally, the interest paid on a home equity loan may be tax-deductible, though it's important to consult with a tax advisor to understand your specific situation1.

Types of Home Equity Loans

Home equity loans come in two main types: the traditional home equity loan and the home equity line of credit (HELOC). A traditional home equity loan provides a one-time lump sum with a fixed interest rate, while a HELOC offers more flexibility, functioning like a credit card with a revolving line of credit and variable interest rates. Each type has its own advantages, and the best choice depends on your financial needs and repayment preferences.

Exploring the Best Deals

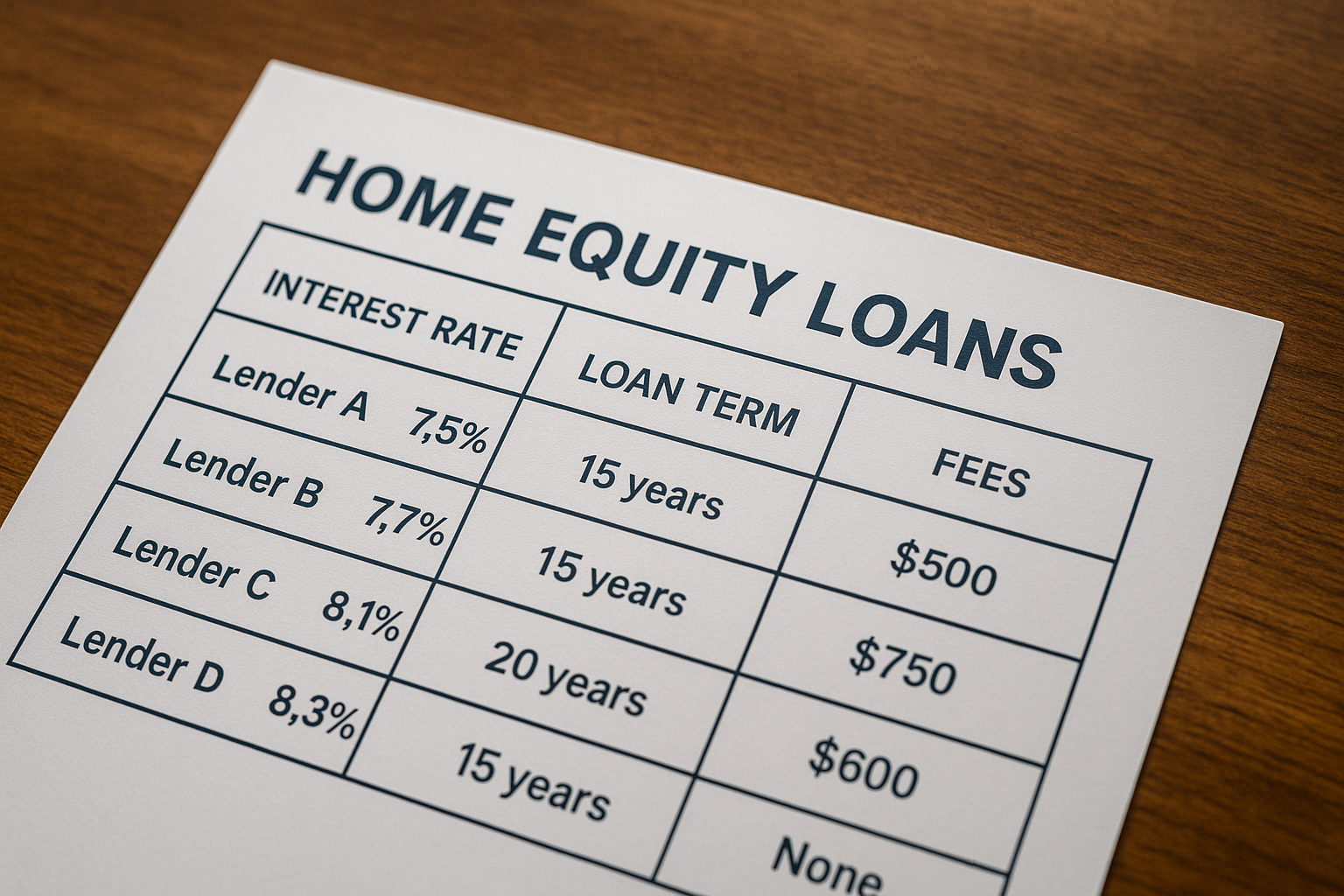

While specific deals and promotions can vary, many lenders offer competitive rates and terms for home equity loans. It's crucial to shop around and compare different lenders to find the best option for your financial situation. Some lenders may offer reduced fees or special introductory rates, making it even more attractive to consider a home equity loan2.

Real-World Examples and Benefits

Consider a homeowner who uses a home equity loan to renovate their kitchen. Not only does this improve the home's value, but it also enhances the homeowner's quality of life. Similarly, using a home equity loan to consolidate high-interest debt can simplify finances and reduce overall interest payments, leading to long-term savings3.

Important Considerations

Before taking out a home equity loan, it's essential to assess your financial situation carefully. Ensure that you can comfortably manage the monthly payments, as defaulting could put your home at risk. Additionally, consider the loan's impact on your long-term financial goals and whether it aligns with your overall strategy.

In summary, home equity loans offer a valuable opportunity to leverage the equity in your home for various financial needs. By exploring the options and understanding the benefits, you can make an informed decision that supports your financial goals. Remember, there are numerous resources and specialized services available to guide you in selecting the best home equity loan for your situation.