Michigan Renters Save Big with Low-Cost Insurance Facts

If you're looking to protect your belongings while saving money, exploring low-cost renters insurance options in Michigan can offer you peace of mind and financial security—browse options today to find the best fit for your needs.

Understanding Renters Insurance in Michigan

Renters insurance is an essential yet often overlooked safeguard for tenants. In Michigan, this type of insurance offers a cost-effective way to protect your personal property against unexpected events like theft, fire, or water damage. With the rising costs of living, finding affordable renters insurance can significantly ease financial burdens. Policies typically cover personal belongings, liability, and additional living expenses if your rental becomes uninhabitable due to a covered peril.

Why Renters Insurance Is a Smart Choice

Many renters mistakenly believe their landlord's insurance will cover their personal belongings in case of damage or theft. However, a landlord's policy usually only covers the building structure, not your possessions. Renters insurance fills this gap by offering comprehensive protection for your items. Another compelling reason to invest in renters insurance is the liability coverage it provides. In the event someone is injured in your rental space, your policy can help cover medical expenses and legal fees if you're found responsible.

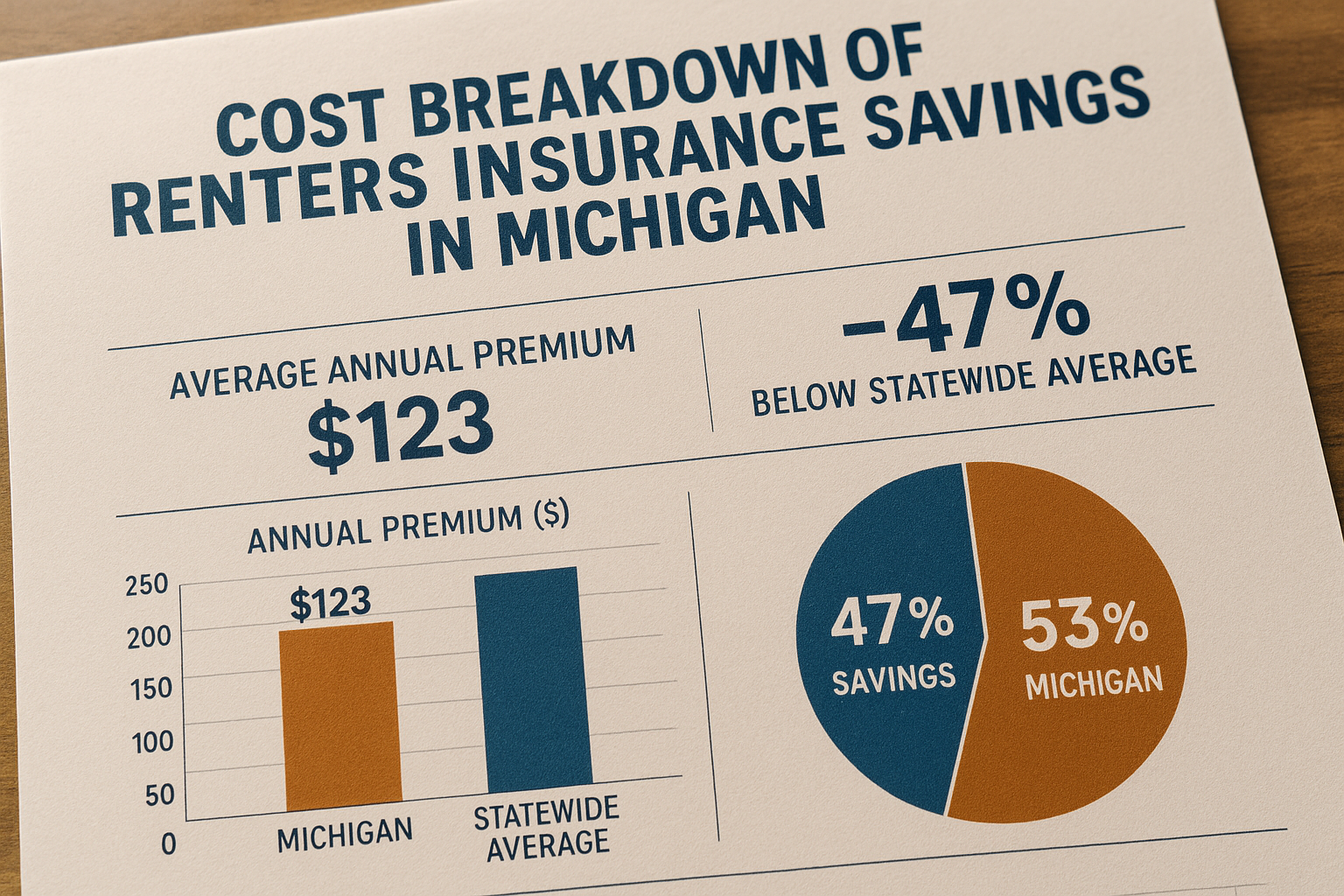

Cost-Effective Options and Savings

Renters insurance in Michigan is surprisingly affordable, with average premiums ranging from $10 to $20 per month1. This small monthly investment can save you thousands of dollars in potential losses. Additionally, many insurance companies offer discounts if you bundle renters insurance with other policies, such as auto insurance. By bundling, you can often reduce your overall insurance costs by 5% to 10%2.

Factors Affecting Renters Insurance Costs

Several factors can influence the cost of your renters insurance premium. These include the location of your rental, the coverage amount you choose, your deductible, and any additional riders you add to your policy. For example, living in an area with a high crime rate may increase your premium. Conversely, installing safety features like smoke detectors or security systems can reduce your costs3.

How to Choose the Right Policy

When selecting a renters insurance policy, it's crucial to assess your personal needs. Start by taking an inventory of your belongings to determine the coverage amount you require. Consider whether you need additional coverage for high-value items like jewelry or electronics. Compare quotes from multiple insurers to ensure you're getting the best deal. Many companies offer online tools to customize your policy and see potential savings instantly.

Real-World Example

Consider Sarah, a Michigan resident who rented an apartment in Detroit. She opted for a renters insurance policy costing $15 per month. When a kitchen fire caused significant smoke damage, her policy covered the cost of replacing her damaged furniture and electronics, totaling over $5,000. Without renters insurance, Sarah would have faced a substantial financial setback.

By understanding the benefits and cost-saving opportunities of renters insurance in Michigan, you can make an informed decision that protects your assets and offers peace of mind. Visit websites of top insurance providers to compare options and secure a policy that meets your needs today.