Unveil Secret Renters Insurance Benefits That Save Thousands

Unlock the hidden potential of renters insurance and discover how you can save thousands by exploring a range of options that cater to your specific needs and budget.

Understanding the Core Benefits of Renters Insurance

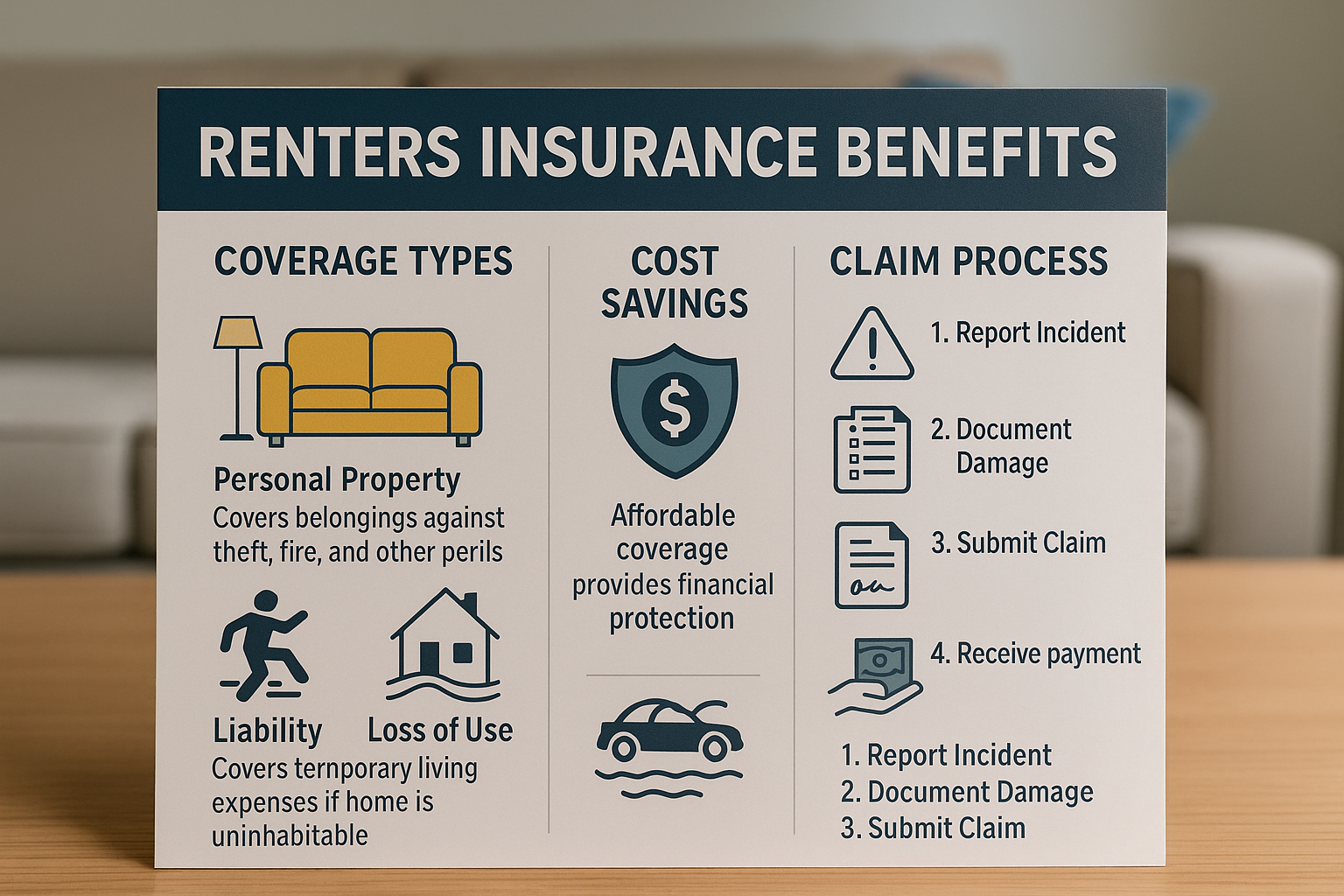

Renters insurance is often overlooked, yet it provides a safety net that can protect you from significant financial loss. The primary components of renters insurance include personal property coverage, liability protection, and additional living expenses. Personal property coverage ensures that your belongings are protected against theft, fire, or other covered perils. Liability protection covers you in case someone is injured in your rental property, while additional living expenses can help cover costs if your home becomes uninhabitable due to a covered event.

Financial Savings Through Discount Opportunities

Many insurance providers offer discounts that can significantly reduce your premium costs. For instance, bundling your renters insurance with auto insurance often results in a multi-policy discount. Additionally, installing safety features like smoke detectors or security systems can lead to further savings. Some insurers also offer discounts to non-smokers or for setting up automatic payments. By taking the time to browse options and compare policies, you can find a plan that maximizes these savings opportunities.

Liability Coverage: A Shield Against Unexpected Costs

Liability coverage is a crucial aspect of renters insurance that can save you from unexpected financial burdens. If someone is injured in your apartment, your policy can cover medical expenses and legal fees, up to the policy limit. This coverage extends beyond your home, protecting you against claims for incidents that occur elsewhere. For example, if you accidentally cause damage to someone else's property, your renters insurance can help cover the costs.

Additional Living Expenses: A Safety Net During Displacement

In the unfortunate event that your rental becomes uninhabitable due to a covered peril, renters insurance provides additional living expenses (ALE) coverage. This benefit helps cover the cost of temporary housing, meals, and other expenses incurred while your home is being repaired. The peace of mind that ALE coverage offers is invaluable, ensuring that an unexpected event doesn't derail your financial stability.

Exploring Specialized Coverage Options

Beyond the standard coverage, renters insurance policies can be tailored to meet specific needs. For instance, if you own high-value items like jewelry or electronics, you may need additional coverage known as a rider or floater. These options provide higher limits for specific items, ensuring they are fully protected. It's important to review your belongings and assess whether additional coverage is necessary to avoid out-of-pocket expenses in the event of a loss.

Real-World Examples and Statistics

According to the Insurance Information Institute, the average cost of renters insurance in the United States is about $174 per year1. This small investment can save you thousands in the event of a loss. Additionally, a study by the National Association of Insurance Commissioners found that nearly 40% of renters do not have insurance2, highlighting a significant gap in protection that could lead to financial hardship.

Taking Action: How to Choose the Right Policy

When selecting renters insurance, it's crucial to compare different providers and policies. Consider factors such as coverage limits, deductibles, and additional options. Many insurance companies offer online tools to help you calculate the amount of coverage you need based on your personal belongings. By visiting websites of various insurers, you can get quotes and tailor a policy that fits your lifestyle and budget.

In summary, renters insurance is an essential tool that provides comprehensive protection for your personal property and financial well-being. By understanding the benefits and exploring the available options, you can find a policy that offers peace of mind and significant savings. Don't wait to safeguard your future—browse options today and ensure you're fully covered.