Why Do Apartments Require Renters Insurance Discover Why Now

If you've ever wondered why apartments require renters insurance, you're about to uncover the essential reasons and benefits that can save you from unexpected financial burdens, and as you browse options or visit websites, you'll find tailored solutions to meet your needs.

Understanding Renters Insurance: A Necessity, Not a Luxury

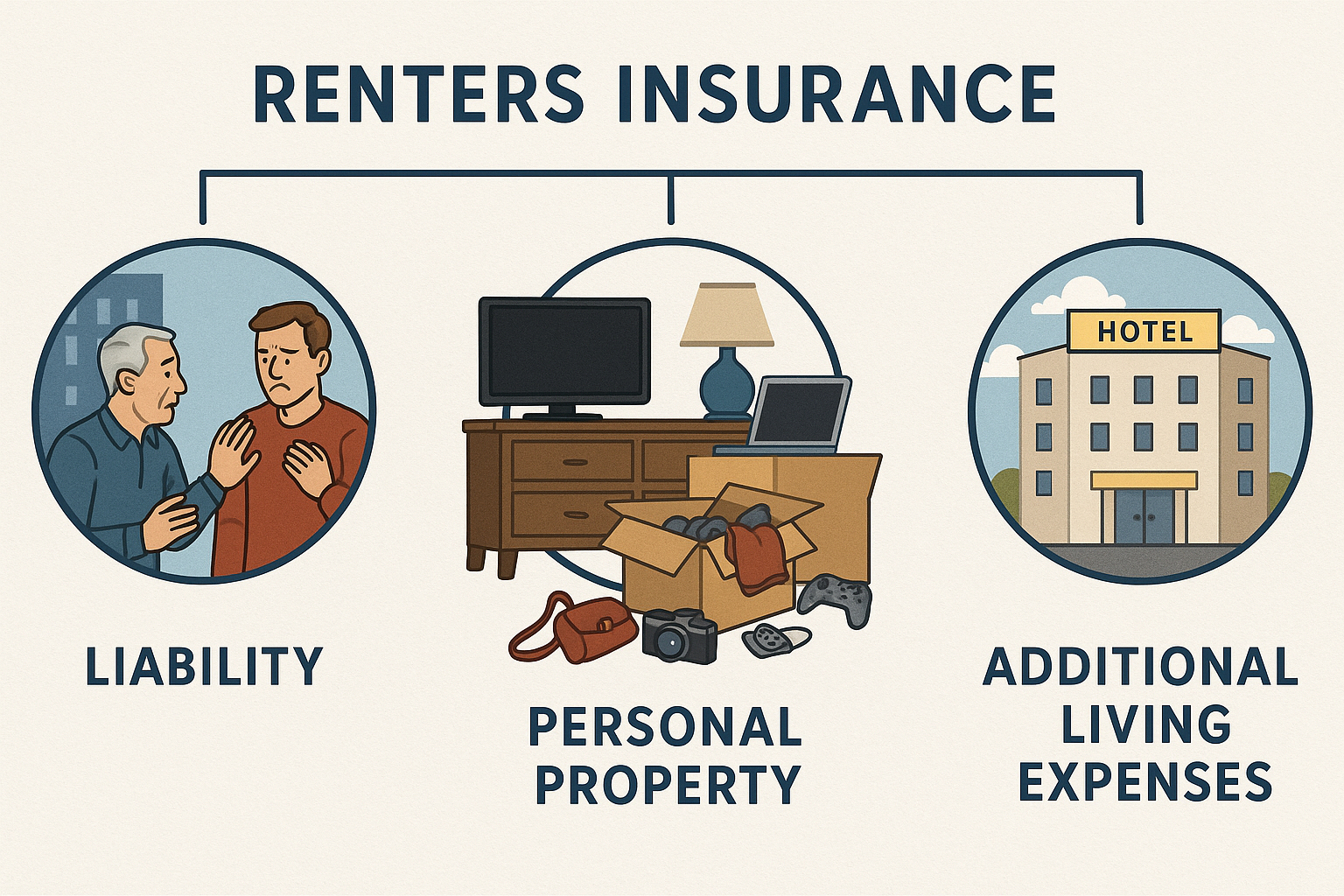

Renters insurance is often misunderstood as an optional add-on, but it's a vital component of living in a rental property. This type of insurance provides coverage for your personal belongings, liability protection, and sometimes additional living expenses if your rented home becomes uninhabitable. While landlords typically insure the building, their policy does not cover your personal possessions or protect you from liability claims. Therefore, renters insurance fills this gap, offering peace of mind and financial protection.

Personal Property Protection

One of the primary reasons apartments require renters insurance is to ensure tenants have coverage for their personal belongings. In the event of theft, fire, or other disasters, renters insurance can help replace or repair your possessions. Considering that the average renter owns thousands of dollars' worth of personal property, this coverage is invaluable1. Many policies also cover items stolen from your car or lost while traveling, providing broader protection than you might expect.

Liability Coverage

Another critical aspect of renters insurance is liability coverage. This protects you if someone is injured in your apartment or if you accidentally cause damage to someone else's property. For instance, if a guest slips and falls or if a fire from your unit damages neighboring apartments, liability coverage can help cover legal fees and medical expenses. Without this protection, you could face significant financial liability2.

Additional Living Expenses

In cases where your apartment becomes uninhabitable due to a covered peril, renters insurance can cover additional living expenses. This includes costs for temporary housing, meals, and other necessary expenses incurred while your home is being repaired. Such coverage ensures that you're not left without a place to stay or forced to dip into savings to cover these unexpected costs3.

Cost-Effectiveness and Accessibility

Renters insurance is often more affordable than people assume. The average policy costs between $15 and $30 per month, depending on the coverage limits and deductible chosen4. Given the extensive protection it offers, renters insurance is a cost-effective way to safeguard your financial well-being. Many insurance providers offer customizable plans, allowing you to select the coverage that best fits your personal needs and budget.

Why Landlords Mandate Renters Insurance

Landlords require renters insurance to mitigate risk and ensure that tenants are financially responsible for their personal property and potential liabilities. By mandating insurance, landlords protect themselves from potential disputes and liabilities arising from tenant-related incidents. This requirement also encourages tenants to maintain a level of responsibility and awareness regarding their living situation.

Renters insurance is not just a formality; it's a practical and necessary safeguard for both tenants and landlords. As you explore these options, consider the comprehensive protection and peace of mind renters insurance can provide, ensuring you're prepared for life's unexpected events.