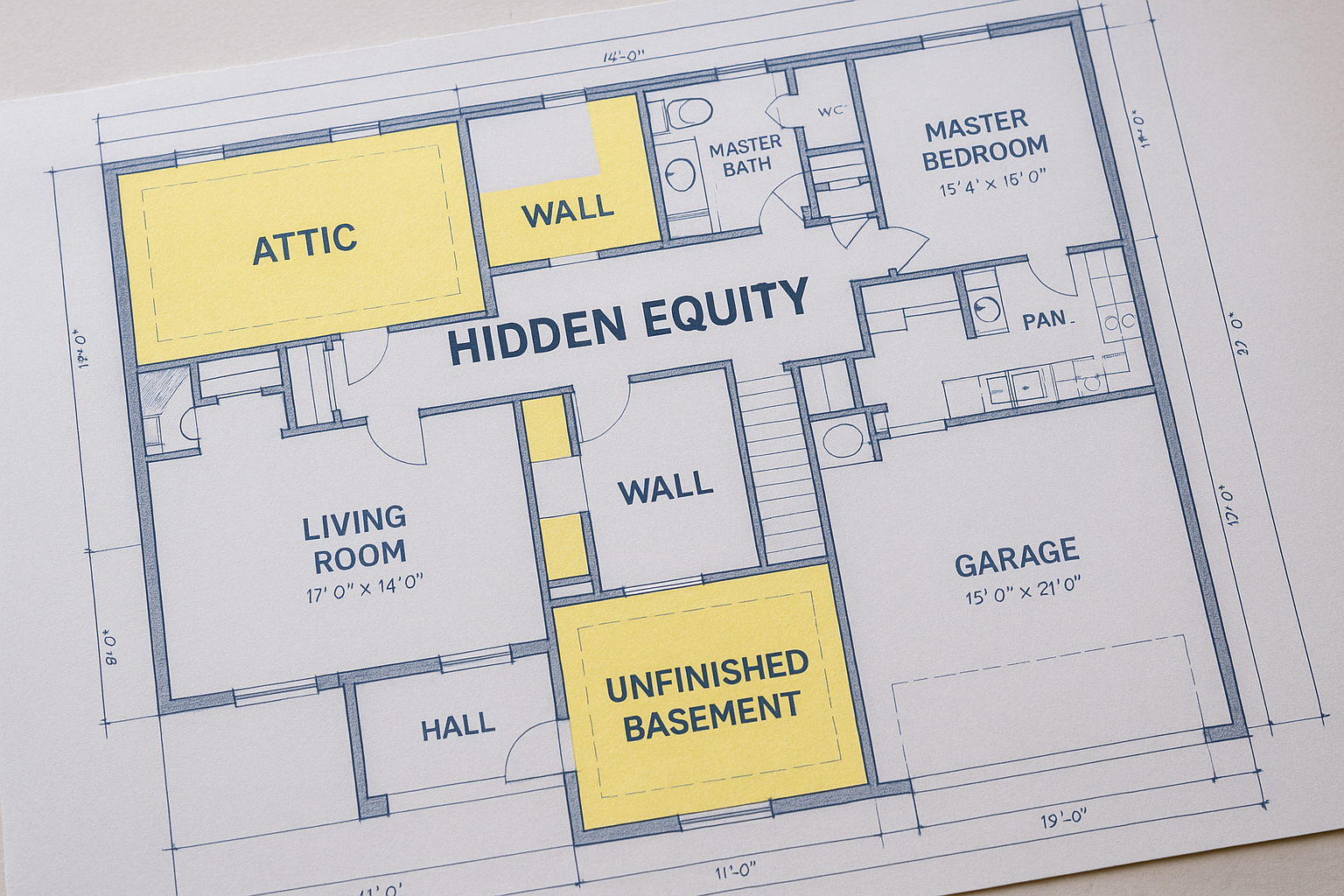

Find Out Your Home's Hidden Equity Twists Reality

Unlock the true potential of your home's hidden equity and transform your financial future by exploring options that could redefine your reality; browse options and visit websites to discover the wealth you didn't know you had.

Understanding Home Equity

Home equity is the portion of your property that you truly own, calculated by subtracting the amount you owe on your mortgage from your home's current market value. This seemingly simple formula hides a world of financial opportunities, often untapped by homeowners. As property values rise, so does your equity, potentially offering you a financial cushion or investment capital without selling your home.

The Hidden Potential of Home Equity

Many homeowners are unaware of the various ways they can leverage their home equity. From financing renovations to consolidating debt or even funding a child's education, the options are vast. By unlocking your home's hidden equity, you could access funds at lower interest rates compared to other borrowing methods, providing a more manageable financial solution.

Exploring Home Equity Loans and Lines of Credit

A popular option for tapping into home equity is through a Home Equity Loan or a Home Equity Line of Credit (HELOC). These financial products allow you to borrow against the equity you've built up. A Home Equity Loan provides a lump sum at a fixed interest rate, ideal for large, one-time expenses. In contrast, a HELOC offers flexibility, functioning like a credit card with a revolving balance and variable interest rates, suitable for ongoing projects or expenses.

Current Market Trends and Opportunities

The real estate market has seen significant fluctuations, with home values appreciating in many areas. According to the Federal Housing Finance Agency, U.S. house prices rose 18.5% from the second quarter of 2020 to the second quarter of 20211. This increase has expanded the equity available to homeowners, presenting a timely opportunity to explore financial products that capitalize on this growth.

Risks and Considerations

While tapping into your home's equity can provide financial relief or investment capital, it's essential to consider the risks. Borrowing against your home increases your debt and could lead to financial strain if not managed carefully. It's crucial to evaluate your ability to repay the loan, keeping in mind that your home is the collateral.

How to Assess Your Home's Equity

To accurately determine your home's equity, start by obtaining an up-to-date appraisal of your property's value. Subtract your outstanding mortgage balance from this value to calculate your equity. Various online tools and calculators can help you estimate this amount, but consulting with a financial advisor or mortgage professional can provide a more precise assessment.

Additional Resources and Specialized Services

For homeowners looking to delve deeper into their options, numerous resources and services can assist in navigating the complexities of home equity. Financial advisors, mortgage brokers, and real estate professionals can offer personalized advice tailored to your specific situation. Additionally, many financial institutions provide online resources and tools to help you explore your options further.

Understanding and leveraging your home's hidden equity can open doors to financial opportunities that may have previously seemed out of reach. By exploring your options and consulting with professionals, you can transform your equity into a powerful tool for achieving your financial goals. Don't miss out on the chance to browse options and visit websites that can guide you toward tapping into this valuable asset.