Apartment Building Insurance Offers Hidden Profit Strategies

Unlock hidden profit opportunities in your apartment building investments by exploring the often-overlooked benefits of comprehensive insurance strategies, and see these options that could significantly enhance your financial returns.

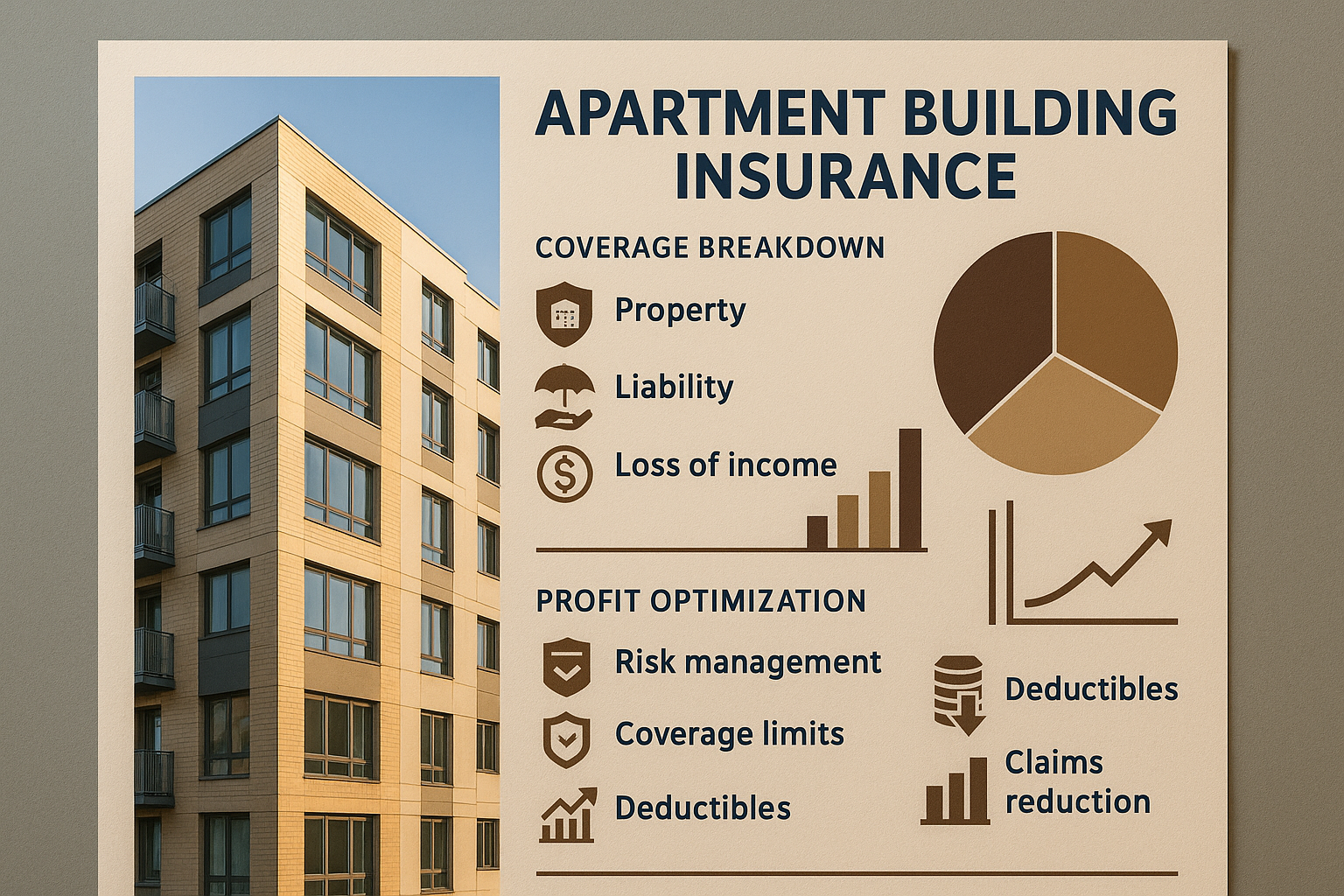

Understanding Apartment Building Insurance

Apartment building insurance is not just a safety net; it's a strategic tool that can boost your investment's profitability. This type of insurance typically covers property damage, liability claims, and loss of rental income, ensuring that your asset is protected from unforeseen events. By carefully selecting the right insurance package, you can mitigate risks and enhance the value of your real estate portfolio.

Types of Coverage and Their Benefits

When considering apartment building insurance, it's crucial to understand the different types of coverage available. Standard policies include property insurance, which covers damages to the building from hazards like fire and storms. Liability insurance protects against legal claims if someone is injured on the property. Business income insurance covers lost rental income if the building becomes uninhabitable due to a covered peril1.

These coverages not only protect your investment but also provide a competitive edge by maintaining cash flow during disruptions. Additionally, some insurers offer specialized add-ons like equipment breakdown coverage or ordinance and law coverage, which can be particularly beneficial in older buildings requiring updates to meet current codes2.

Hidden Profit Strategies

The hidden profit strategies in apartment building insurance lie in optimizing your coverage to reduce costs and maximize returns. One effective approach is to bundle insurance policies, which can lead to significant discounts. Many insurers offer multi-policy discounts if you combine property, liability, and business income insurance under one provider3.

Another strategy is to regularly review and adjust your coverage. As property values and rental incomes change, your insurance needs may also evolve. Periodic assessments can prevent over-insurance, where you're paying for more coverage than necessary, or under-insurance, which could leave you exposed to financial loss4.

Real-World Examples and Statistics

Consider the case of a property owner who saved over 20% on their annual premium by switching to a provider that offered a comprehensive bundle discount. This adjustment not only reduced costs but also provided better coverage tailored to their specific needs. According to industry data, property owners who actively manage their insurance policies can save an average of 15% annually5.

Moreover, a study by the Insurance Information Institute found that properties with adequate insurance coverage are more likely to recover quickly from disasters, minimizing downtime and loss of rental income6.

Exploring Further Opportunities

For those looking to dive deeper into optimizing their apartment building insurance, numerous resources and specialized services are available. Consulting with an insurance broker who specializes in real estate can provide personalized insights and recommendations. Additionally, visiting websites of major insurance providers can offer a wealth of information on the latest deals and coverage options tailored to your investment needs.

By leveraging the hidden profit strategies within apartment building insurance, you can protect your investment while enhancing your financial returns. Don't miss the opportunity to browse options and explore the wealth of resources available to optimize your insurance strategy.