Capitalize Wealth With Smart Single Family Investments Now

If you're looking to capitalize on your wealth through smart investments, exploring single-family properties now could be your golden opportunity, and you can browse options to make informed decisions that align with your financial goals.

Understanding Single-Family Investments

Single-family investments refer to purchasing standalone residential properties intended for rental income or resale at a profit. Unlike multi-family properties, which house multiple units within a single building, single-family homes cater to one family or tenant at a time. This type of investment is attractive due to its simplicity, lower entry cost, and the steady demand for housing1.

Benefits of Investing in Single-Family Homes

Investing in single-family properties offers several advantages. First, these investments typically require less capital compared to multi-family units, making them accessible to more investors2. Additionally, single-family homes often appreciate faster, providing potential for significant returns on investment. The rental market for these properties is robust, as many families prefer the privacy and space they offer compared to apartments.

Another benefit is the ease of management. Single-family homes typically require less maintenance than larger properties, and property management services can streamline operations, ensuring a hassle-free experience for investors3.

Market Trends and Opportunities

The current real estate market presents numerous opportunities for single-family investments. Due to ongoing housing shortages and increasing demand for rental properties, single-family homes are in high demand. This trend is expected to continue, driven by factors such as urban migration and the growing preference for suburban living4.

Investors can take advantage of this trend by purchasing properties in high-demand areas, which are more likely to yield higher rental income and appreciation. Additionally, many markets offer incentives for first-time investors, such as lower interest rates and tax benefits, which can enhance profitability5.

Financial Considerations

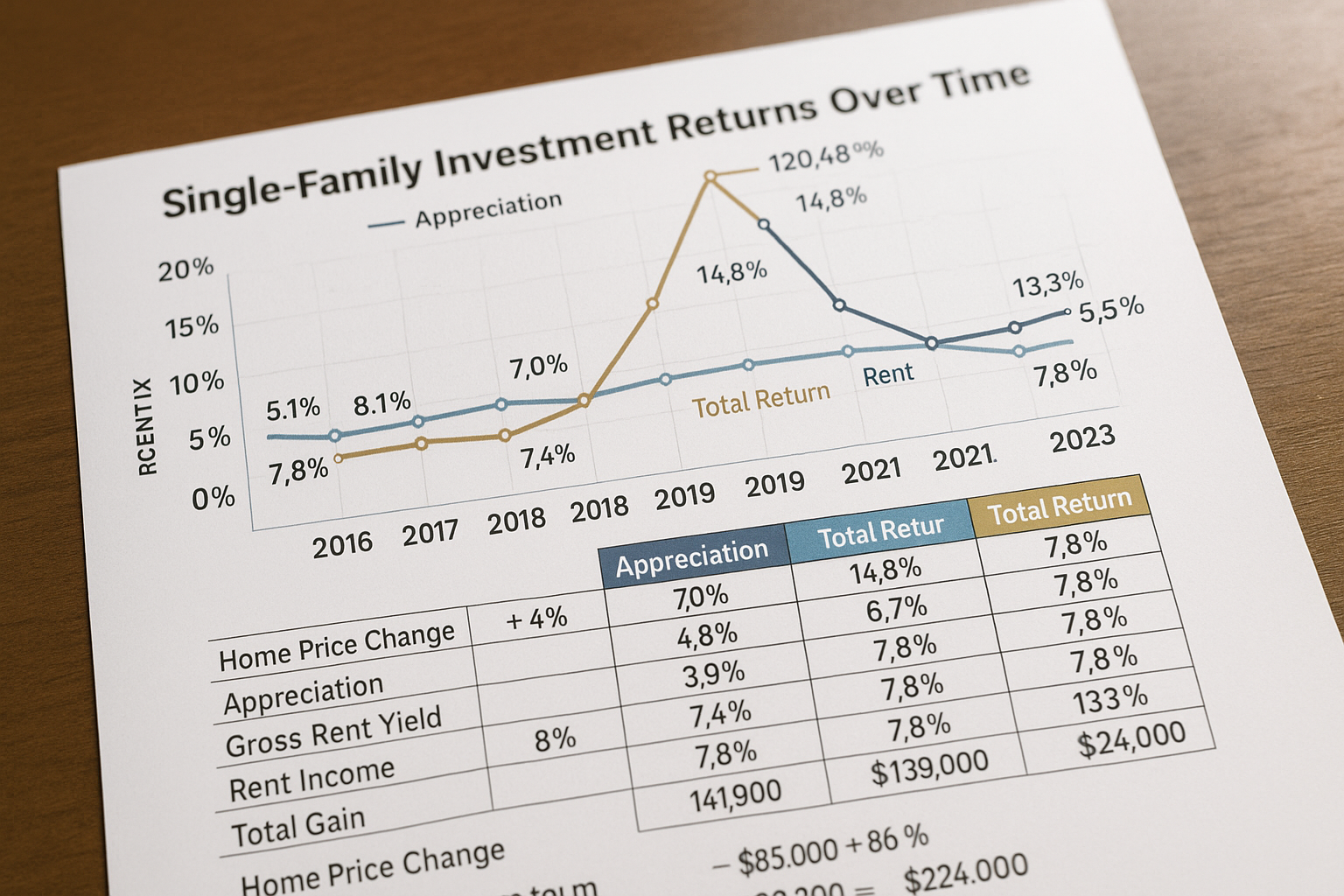

When investing in single-family homes, it's crucial to consider the financial implications. Initial costs include the purchase price, closing costs, and any necessary renovations or repairs. However, these investments can offer substantial returns through rental income and property appreciation. On average, single-family rental properties yield a 6-8% return, depending on location and market conditions6.

Financing options are abundant, with many lenders offering competitive mortgage rates for investment properties. It's essential to shop around and compare offers to secure the best terms. Additionally, some investors may choose to leverage their existing home equity to finance new purchases, further enhancing their investment potential7.

Exploring Investment Options

For those ready to dive into single-family investments, numerous resources are available to guide your journey. Real estate platforms and investment websites offer comprehensive listings, market analyses, and expert insights to help you make informed decisions. By visiting these websites, you can explore various properties, compare market trends, and identify lucrative investment opportunities.

Single-family investments provide a compelling opportunity to build wealth through real estate. With the right approach, you can capitalize on market trends, enjoy steady rental income, and benefit from property appreciation. As you explore your options, consider leveraging available resources to enhance your investment strategy and maximize your returns.

References

- Investopedia: Pros and Cons of Investing in Single-Family Homes

- Forbes: Why Single-Family Homes Are a Great Investment

- BiggerPockets: Benefits of Investing in Single-Family Homes

- National Association of Realtors: Housing Market Trends and Outlook

- Bankrate: Real Estate Investment Trends

- Roofstock: Average Return on Rental Property

- NerdWallet: Investment Property Mortgage Rates