Apartment building insurance calculator transforms property protection instantly

If you're looking for a way to enhance your property protection while saving time and money, the latest apartment building insurance calculators offer a quick and efficient solution you can explore by browsing options online.

Understanding the Role of Apartment Building Insurance Calculators

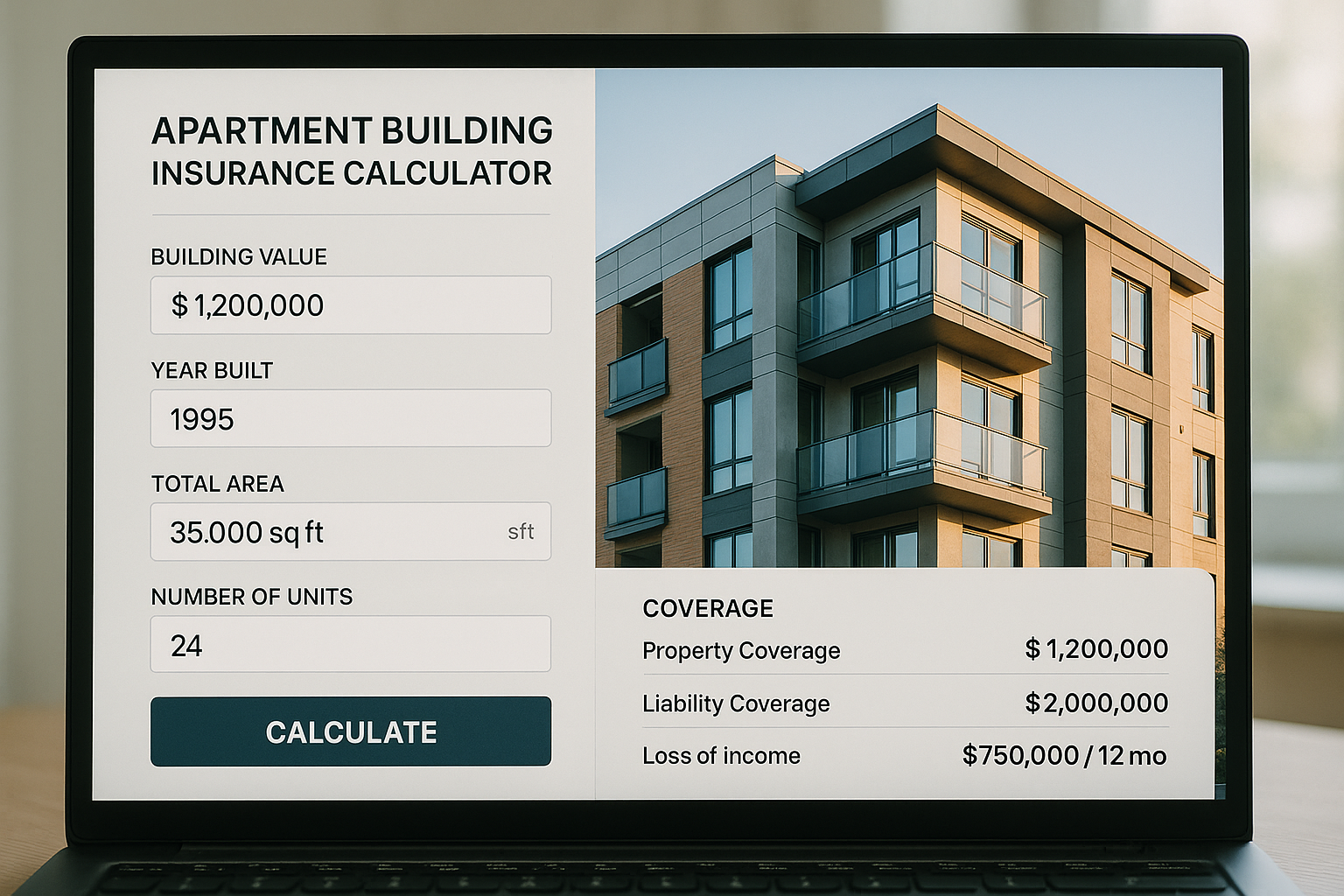

Apartment building insurance calculators have revolutionized the process of securing comprehensive coverage for property owners. These digital tools enable you to instantly estimate your insurance needs, providing a tailored approach to protect your investment. By inputting specific details about your property, such as its size, location, and construction type, you can quickly receive an estimate that aligns with your unique requirements. This not only streamlines the insurance selection process but also helps you make informed decisions by comparing different policies and coverage options.

How These Calculators Transform Property Protection

One of the primary benefits of using an insurance calculator is its ability to offer immediate insights into potential coverage gaps. By identifying areas where your current policy may fall short, you can proactively address these vulnerabilities, ensuring that your property is adequately protected against unforeseen events. Furthermore, these tools often provide access to a variety of coverage options, allowing you to customize your policy to include additional protections such as liability coverage, loss of rent, and more. This level of customization ensures that you are not overpaying for unnecessary coverage while still securing comprehensive protection.

Financial Advantages and Cost Savings

Utilizing an apartment building insurance calculator can also lead to significant cost savings. Many calculators are designed to highlight potential discounts and deals that you might not otherwise be aware of. For instance, bundling policies or implementing safety measures could lower your premiums, offering a more economical insurance solution. Moreover, by comparing multiple quotes from different insurers, you can ensure that you are getting the best possible rate for the coverage you need. This competitive edge is crucial in a market where insurance costs can vary widely based on factors such as location and building characteristics.

Real-World Examples and Case Studies

Consider a property owner in a metropolitan area who used an insurance calculator to reassess their policy. By doing so, they discovered that their existing coverage did not account for recent renovations, potentially leaving them exposed to significant financial risk. After revisiting their options and adjusting their coverage, they not only enhanced their protection but also found a policy that offered a 10% discount for installing updated fire safety systems, resulting in substantial annual savings1.

Exploring Additional Resources

For those seeking to further optimize their property protection strategy, many insurance providers offer specialized services and consultations. These resources can provide deeper insights into risk management and help you navigate complex coverage options. By visiting websites dedicated to property insurance, you can access a wealth of information and tools designed to support your decision-making process.

In summary, apartment building insurance calculators offer a powerful means to enhance your property protection strategy, delivering personalized coverage solutions and potential cost savings. By leveraging these tools, you can gain a competitive advantage in securing the best possible insurance for your property. For more detailed information and to explore specific options, consider visiting specialized resources and insurance provider websites.