Avoid Medicare Part D Penalties With Expert Guidance

Avoid costly Medicare Part D penalties by exploring expert guidance options that help you navigate the complexities of prescription drug plans and ensure you're making the most informed decisions—browse options today to protect your health and finances.

Understanding Medicare Part D Penalties

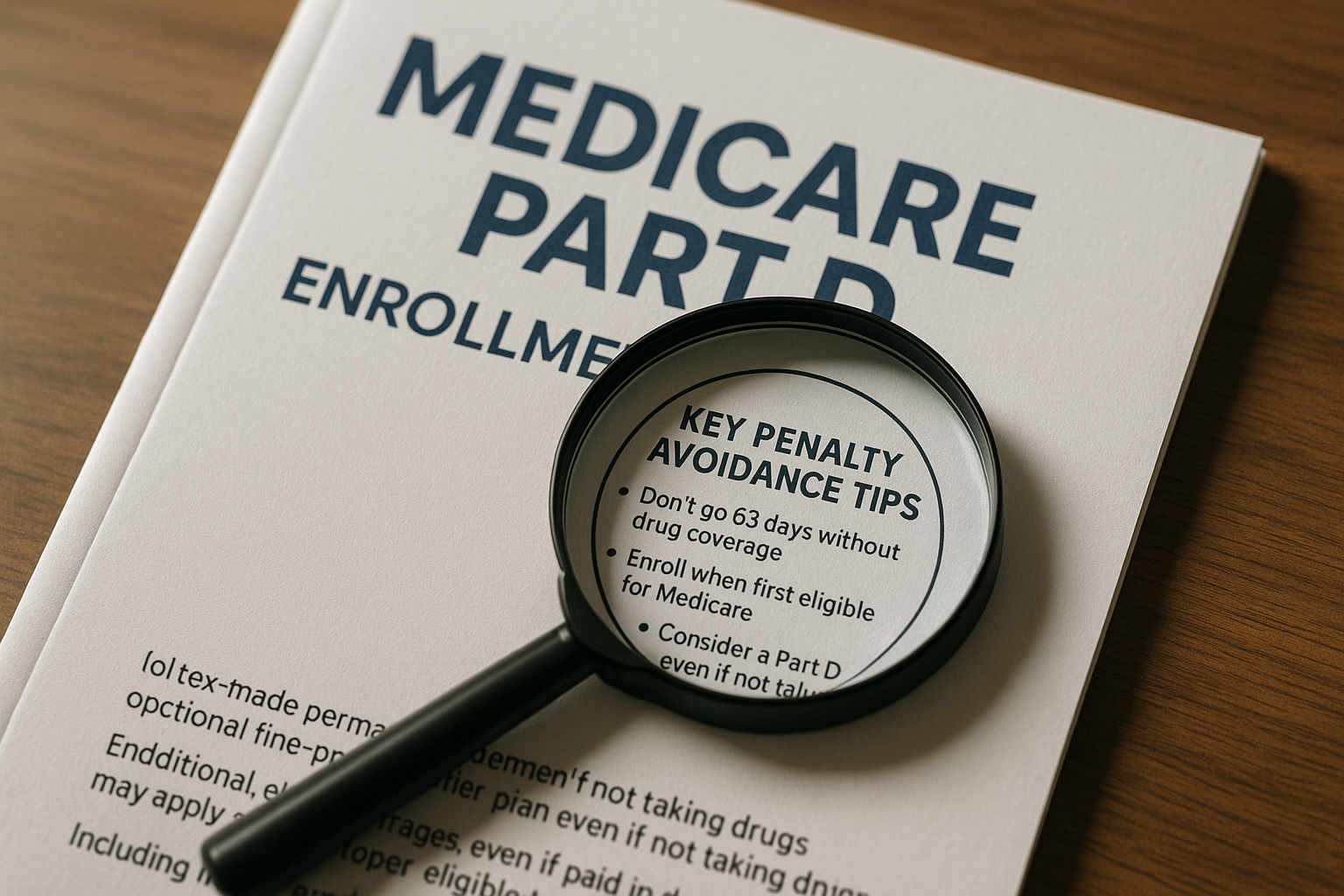

Medicare Part D provides essential prescription drug coverage for millions of Americans, but enrolling at the wrong time can lead to unexpected penalties. The penalty is a lifetime fee added to your premium if you don't sign up when first eligible and don't have other credible prescription drug coverage. This penalty is calculated based on the number of months you were eligible but didn't sign up, amounting to 1% of the national base beneficiary premium for each month you delayed1.

Why Expert Guidance Matters

Navigating the intricacies of Medicare Part D can be daunting, especially with the myriad of plans available and the potential for penalties. Expert guidance can help you:

- **Identify the Right Plan**: With numerous plans offering different coverage options and costs, an advisor can help you compare and contrast based on your unique needs.

- **Avoid Penalties**: Professionals can ensure you enroll during the correct periods, avoiding costly penalties.

- **Maximize Benefits**: Experts can help you understand how to make the most of your plan, potentially saving you money on prescriptions.

Enrollment Periods and Special Circumstances

Understanding when to enroll is crucial. The Initial Enrollment Period (IEP) for Part D coincides with your Medicare Part A and B enrollment, typically around your 65th birthday. Missing this window without credible coverage leads to penalties. However, there are Special Enrollment Periods (SEPs) for specific circumstances, such as losing employer coverage or moving out of your plan’s service area2.

Real-World Examples and Savings

Consider the case of a retiree who delayed enrolling in Part D by 20 months. With the 2023 national base beneficiary premium at $32.74, their penalty would be approximately $6.55 added to their monthly premium for life3. By consulting with a Medicare expert, they could have avoided this additional cost and chosen a plan that better suited their prescription needs.

Exploring Specialized Services

For those seeking tailored solutions, numerous services offer personalized Medicare counseling. These services can provide detailed plan comparisons, enrollment assistance, and ongoing support to ensure your coverage remains optimal. Exploring these options can lead to significant savings and peace of mind.

In summary, understanding and avoiding Medicare Part D penalties is crucial for maintaining affordable healthcare coverage. By leveraging expert guidance, you can navigate the enrollment process efficiently, maximize your benefits, and avoid unnecessary costs. Take the time to explore options and seek professional advice to ensure your Medicare Part D plan is the best fit for your needs.