Effortless D&O Insurance Automation Perfect for 3PL Success

Effortless automation of Directors and Officers (D&O) insurance for third-party logistics (3PL) companies can transform your business operations, and you can browse options to discover how these innovations can streamline your success.

Understanding D&O Insurance in the 3PL Sector

Directors and Officers insurance is a critical component for any business, especially in the 3PL sector, where the complexities of logistics and supply chain management can expose directors and officers to various liabilities. D&O insurance provides protection against personal losses and covers legal fees, settlements, and other costs associated with defending against allegations of wrongful acts. For 3PL companies, this insurance is not just a safeguard but a necessity to ensure seamless operations and mitigate risks.

The Role of Automation in D&O Insurance

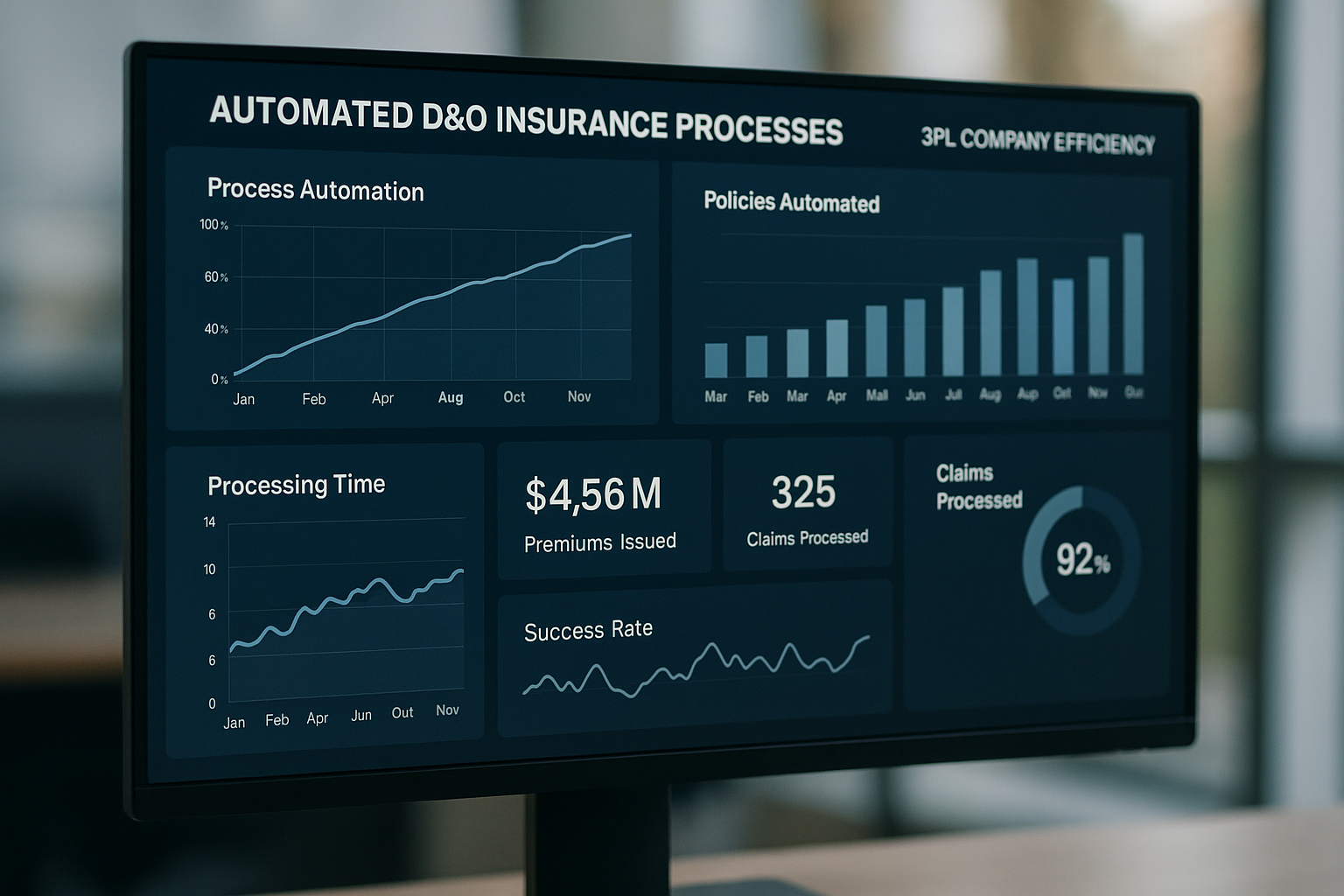

Automation in D&O insurance is revolutionizing how 3PL companies manage their risk profiles. By leveraging technology, businesses can streamline the insurance process, from policy management to claims processing, reducing the administrative burden and minimizing human error. Automated systems can quickly analyze vast amounts of data to provide customized insurance solutions tailored to the unique needs of each company. This efficiency allows businesses to focus more on strategic growth rather than administrative tasks.

Benefits of Automated D&O Insurance for 3PL Companies

The benefits of automating D&O insurance are manifold. Firstly, it significantly reduces the time spent on policy management, allowing companies to allocate resources more effectively. Automated systems can also enhance accuracy in policy documentation and claims processing, minimizing the risk of costly errors. Furthermore, automation can lead to cost savings by optimizing policy coverage and identifying the most competitive rates in the market. Many providers offer discounts for companies that utilize automated systems, making it a financially savvy choice1.

Real-World Applications and Success Stories

Several 3PL companies have already embraced D&O insurance automation with remarkable results. For instance, a mid-sized logistics firm reported a 30% reduction in administrative costs and a 20% improvement in claims processing time after implementing an automated insurance platform2. These improvements not only enhance operational efficiency but also bolster the company's reputation by ensuring prompt and accurate handling of any claims or legal issues.

Exploring Your Options

For 3PL companies eager to capitalize on these benefits, exploring the available options for D&O insurance automation is a crucial step. Many insurance providers offer tailored solutions that cater specifically to the logistics industry, providing platforms that integrate seamlessly with existing business processes. By visiting websites of leading insurance providers, you can compare features, pricing, and support services to find the best fit for your company’s needs.

Key Takeaways

Incorporating automation into D&O insurance is not just a trend but a strategic move that can drive significant benefits for 3PL companies. From reducing administrative burdens to optimizing cost savings and enhancing policy accuracy, the advantages are clear. As the logistics industry continues to evolve, staying ahead of the curve with automated solutions will be essential for maintaining competitive advantage. By following the options to explore these automated insurance solutions, 3PL companies can ensure they are well-protected and poised for success.