Exclusive Technology E&O Insurance Solution for Behavioral Clinics

Are you ready to protect your behavioral clinic from unexpected liabilities while exploring exclusive technology E&O insurance solutions that can save you time and money? Browse options to discover how specialized coverage can safeguard your practice and enhance your peace of mind.

Understanding Technology E&O Insurance for Behavioral Clinics

In the rapidly evolving field of behavioral health, maintaining the integrity and security of your services is paramount. Technology Errors and Omissions (E&O) insurance is a specialized form of professional liability coverage designed to protect businesses from claims related to technology services and products. For behavioral clinics, this means safeguarding against potential lawsuits that could arise from errors in digital record-keeping, telehealth services, or data breaches.

With the increasing reliance on technology in healthcare, the risks associated with digital operations have grown. A study by the Ponemon Institute revealed that healthcare organizations face the highest average data breach costs, with each incident costing an average of $7.13 million1. This underscores the importance of having robust E&O insurance tailored to the unique needs of behavioral clinics.

Key Benefits of Technology E&O Insurance

Technology E&O insurance offers several critical benefits for behavioral clinics:

- Financial Protection: This insurance covers legal fees, court costs, and settlements, which can be financially crippling without adequate coverage.

- Reputation Management: In the event of a claim, E&O insurance can provide resources for managing public relations and maintaining the clinic's reputation.

- Compliance Assistance: Insurers often offer risk management services that help clinics comply with industry regulations such as HIPAA, reducing the likelihood of breaches.

By investing in a tailored E&O policy, you can ensure that your clinic is not only compliant but also prepared for any technological mishaps that may occur.

Choosing the Right Policy

When selecting a technology E&O insurance policy, it's essential to consider several factors to ensure comprehensive coverage:

- Scope of Coverage: Ensure the policy covers all digital aspects of your practice, including telehealth services, electronic health records, and patient data protection.

- Policy Limits: Evaluate the maximum payout the insurer will provide per claim and in aggregate, ensuring it aligns with your clinic’s risk exposure.

- Exclusions: Understand what is not covered by the policy to avoid surprises during a claim.

Comparing policies from different providers can help you find the most competitive rates and terms. Many insurers offer discounts for clinics that implement strong cybersecurity measures, so be sure to inquire about potential savings.

Real-World Examples and Cost Considerations

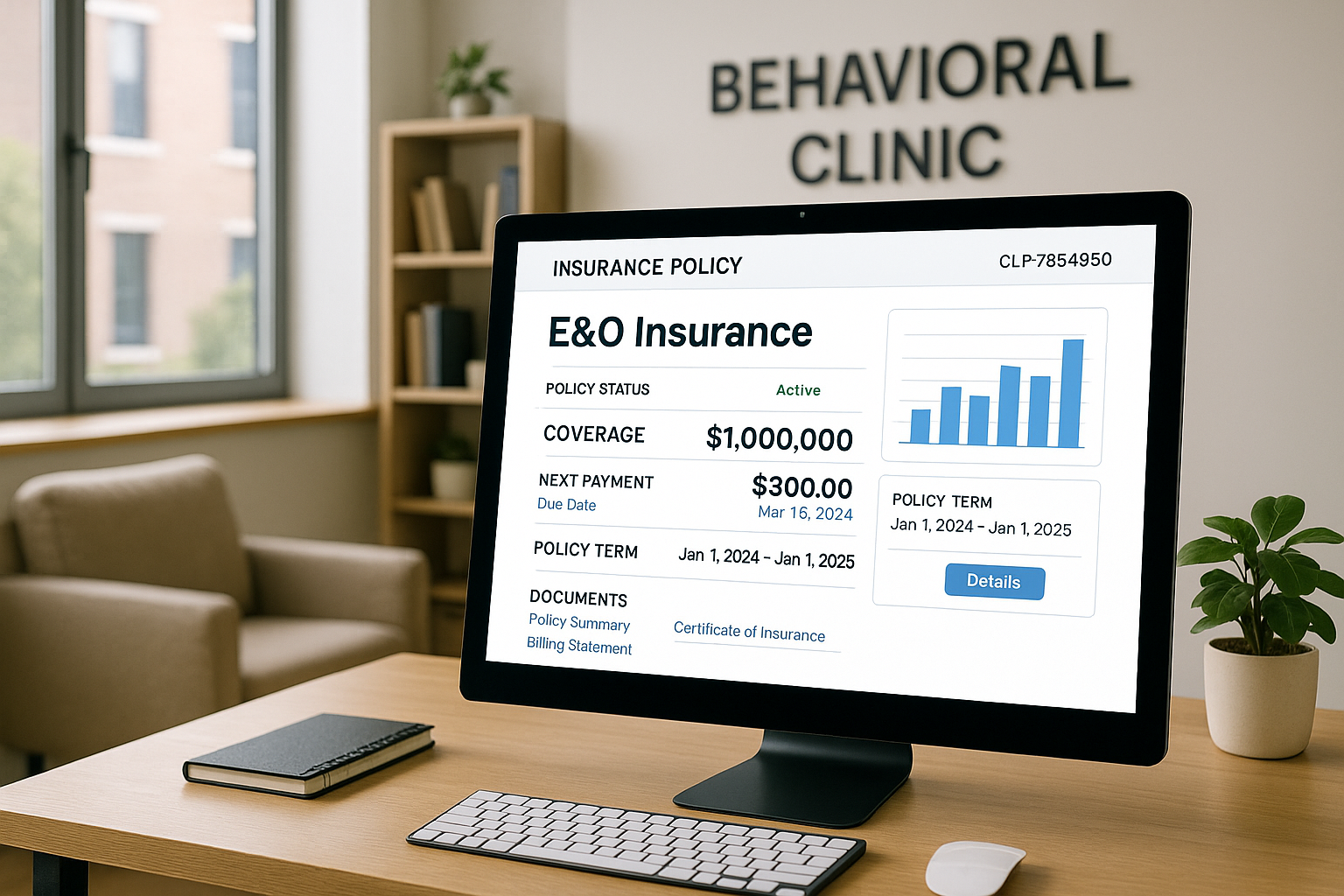

The cost of technology E&O insurance varies based on several factors, including the size of the clinic, the services offered, and the level of coverage required. On average, small to medium-sized clinics can expect to pay between $1,000 and $3,000 annually for comprehensive E&O coverage2.

For example, a mid-sized behavioral health clinic offering extensive telehealth services might pay around $2,500 per year for a policy with a $1 million limit. This investment provides peace of mind and financial security against potential claims that could arise from technological errors or breaches.

Final Thoughts

As the digital landscape of healthcare continues to expand, ensuring your behavioral clinic is protected against technology-related risks is more critical than ever. By exploring technology E&O insurance solutions, you can safeguard your practice, protect your reputation, and ensure compliance with industry standards. Visit websites offering specialized insurance solutions to find the right policy for your clinic and enjoy the peace of mind that comes with knowing you're covered.