Exploit Secret Student Loan Refinance Rate Comparison Tricks

Unlocking the best student loan refinance rates can significantly reduce your financial burden, and by exploring your options online, you can discover hidden opportunities to save money and streamline your payments.

Understanding Student Loan Refinancing

Student loan refinancing is the process of replacing your current student loans with a new loan, ideally with a lower interest rate. This can lead to substantial savings over the life of the loan, especially if you have high-interest federal or private loans. By refinancing, you can also simplify your payments by consolidating multiple loans into a single monthly payment. However, it's crucial to understand that refinancing federal loans with a private lender will forfeit federal benefits such as income-driven repayment plans and loan forgiveness programs.

Key Benefits of Student Loan Refinancing

Refinancing your student loans offers several compelling benefits:

1. **Lower Interest Rates**: By qualifying for a lower interest rate, you can reduce the overall cost of your loan. This is particularly beneficial for borrowers with high-interest private loans.

2. **Reduced Monthly Payments**: Refinancing can extend your loan term, which lowers your monthly payment, freeing up cash for other expenses.

3. **Simplified Finances**: Consolidating multiple loans into one can make managing your debt easier and reduce the likelihood of missing payments.

4. **Better Loan Terms**: Refinancing allows you to choose a lender that offers better customer service and more flexible repayment options.

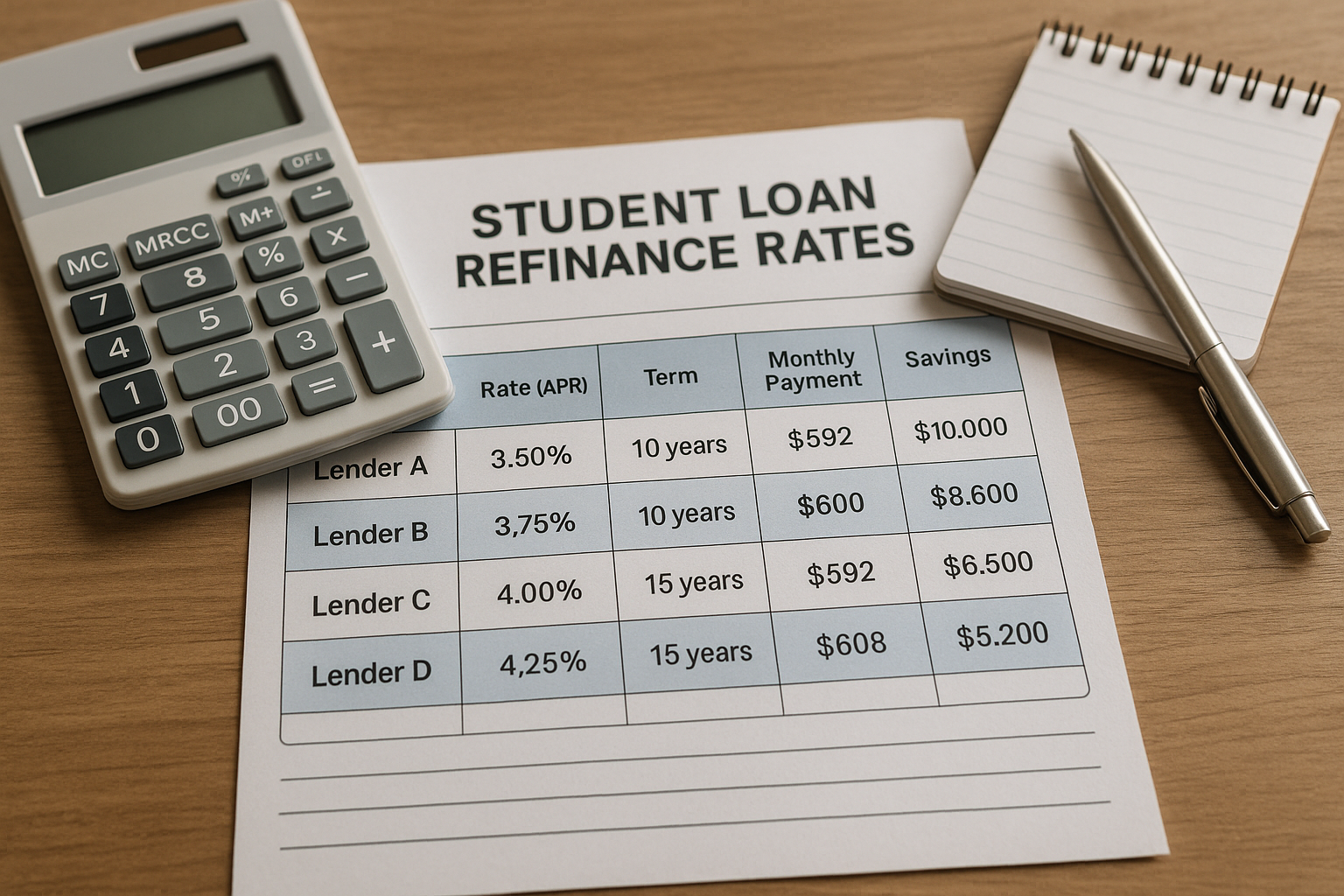

How to Compare Refinance Rates Effectively

To find the best refinance rates, it's essential to shop around and compare offers from multiple lenders. Here are some strategies to consider:

- **Check Your Credit Score**: A higher credit score can help you qualify for better rates. Before applying, check your score and take steps to improve it if necessary.

- **Use Rate Comparison Tools**: Online tools and calculators can help you compare rates from various lenders quickly and efficiently. These tools often allow you to input your loan details and see personalized rate offers.

- **Prequalify with Multiple Lenders**: Many lenders offer prequalification, which provides a rate estimate without affecting your credit score. This allows you to compare rates without committing to a hard credit check.

- **Consider Both Fixed and Variable Rates**: Fixed rates provide stability, while variable rates can start lower but may increase over time. Evaluate which option aligns with your financial goals and risk tolerance.

Real-World Examples and Statistics

According to a recent survey, the average interest rate for refinanced student loans is around 4.5% for fixed rates and 3.5% for variable rates1. However, rates can vary significantly based on your creditworthiness and the lender. For example, borrowers with excellent credit may qualify for rates as low as 2.5%2.

Additional Resources and Opportunities

For those seeking specialized solutions, many lenders offer programs tailored to specific professions, such as doctors or lawyers, which can provide even more favorable terms. Additionally, some lenders provide perks like unemployment protection or interest rate discounts for setting up automatic payments.

As you explore the possibilities of student loan refinancing, remember that browsing options and visiting websites can uncover unique deals and promotions that might not be immediately apparent. Take the time to research thoroughly, compare rates, and choose a lender that aligns with your financial needs and goals.