Florida's Secret to Thriving with Subprime Auto Loans

Are you ready to unlock the secrets of thriving with subprime auto loans in Florida and discover how you can effectively navigate your options to secure the best deals by browsing options and exploring tailored solutions?

Understanding Subprime Auto Loans in Florida

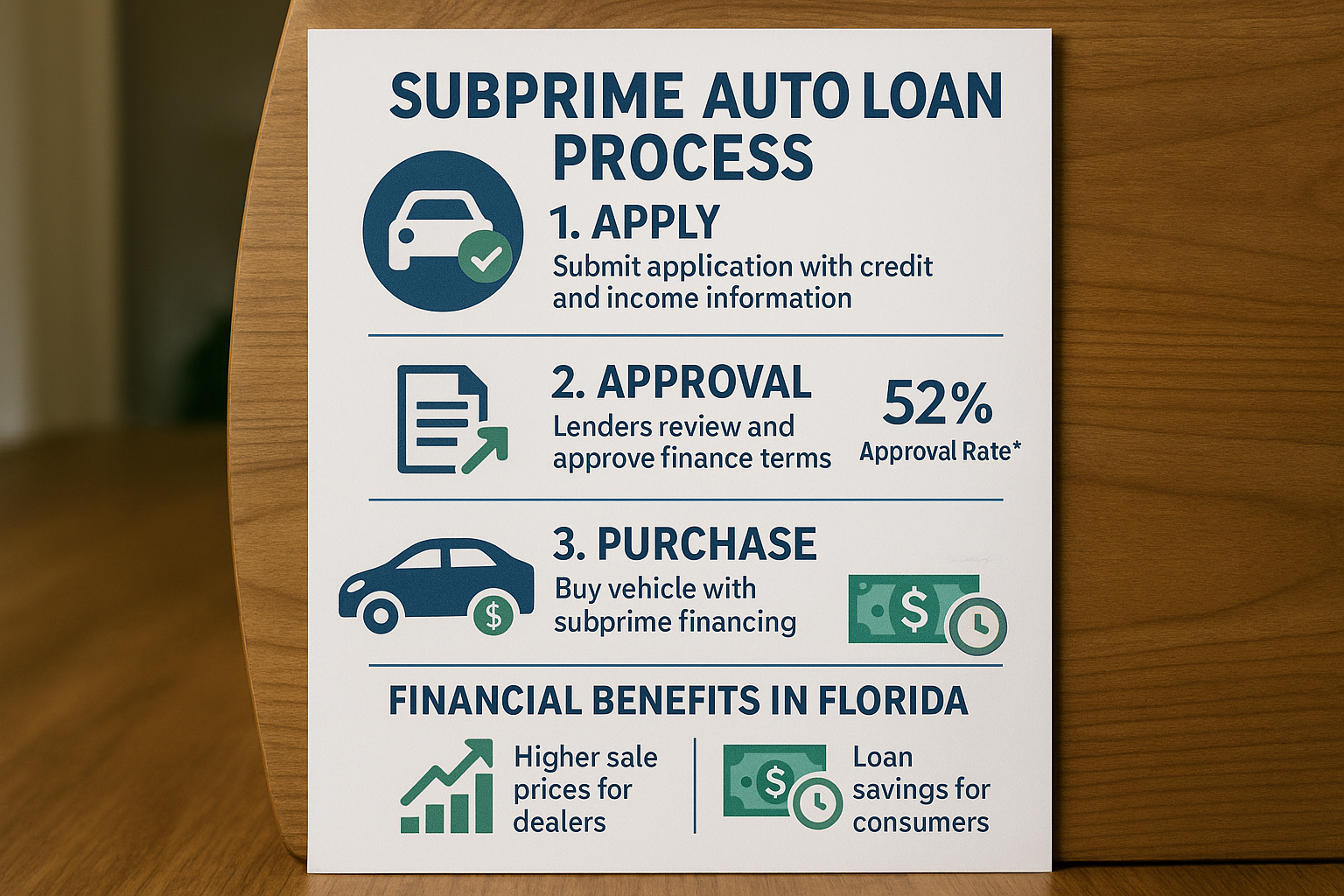

Subprime auto loans are designed for borrowers with less-than-perfect credit scores, typically below 670, and they have become a significant part of the auto financing landscape in Florida. These loans offer individuals with credit challenges the opportunity to purchase a vehicle, which can be a crucial step in rebuilding credit and improving financial stability. The key to thriving with subprime auto loans lies in understanding the terms, interest rates, and potential pitfalls associated with them.

The Appeal of Subprime Auto Loans

For many Floridians, subprime auto loans provide a lifeline to vehicle ownership. With public transportation options limited in many areas, having a reliable car is often essential for commuting to work, running errands, and maintaining a flexible lifestyle. Subprime loans make this possible by allowing individuals to finance a vehicle purchase even if they have a low credit score or past financial difficulties.

Interest Rates and Costs

Interest rates on subprime auto loans are generally higher than those offered to prime borrowers. This is because lenders perceive a higher risk of default with subprime borrowers. In Florida, interest rates for subprime loans can range from 8% to 20% or more, depending on the lender and the borrower's credit profile1. It's crucial for borrowers to shop around and compare rates from different lenders to ensure they get the best possible deal.

Strategies for Success

To thrive with a subprime auto loan, Floridians should consider the following strategies:

- Improve Your Credit Score: Before applying for a loan, take steps to improve your credit score. Pay down existing debt, make timely payments, and check your credit report for errors that could be corrected2.

- Shop Around: Don't settle for the first offer you receive. Browse options from various lenders, including banks, credit unions, and online lenders, to find competitive rates and terms.

- Consider a Co-Signer: If possible, find a co-signer with a strong credit history. This can help you qualify for better interest rates and loan terms.

- Negotiate the Deal: Be prepared to negotiate the price of the vehicle and the loan terms. Many dealerships are willing to work with buyers to close the deal.

Real-World Examples and Opportunities

Several lenders in Florida specialize in subprime auto loans, offering customized solutions to meet the needs of borrowers with varying credit profiles. For instance, some credit unions offer lower rates and more flexible terms for members, making them an attractive option for those eligible3. Additionally, online platforms allow borrowers to compare offers from multiple lenders quickly, streamlining the process of finding the best deal4.

By understanding the nuances of subprime auto loans and taking proactive steps to secure favorable terms, you can successfully navigate the Florida auto financing market. Whether you're looking to rebuild your credit or simply need a reliable vehicle, exploring the various options available can lead to a beneficial outcome.