Get Approved Fast Personal Loan For Fair Credit

When you're in need of quick cash but have fair credit, finding a personal loan that gets you approved fast can seem daunting—yet by browsing options and following the right steps, you can secure the funds you need efficiently and without hassle.

Understanding Personal Loans for Fair Credit

Personal loans can be a lifeline when you need to cover unexpected expenses, consolidate debt, or make a large purchase. However, if your credit score falls in the "fair" range, typically between 580 and 669 according to FICO, securing a loan with favorable terms can be challenging. Lenders view fair credit as a moderate risk, which may affect the interest rate and loan terms you're offered.

Despite these challenges, there are numerous lenders who specialize in providing personal loans to individuals with fair credit. These lenders often offer competitive interest rates and flexible repayment terms, making it easier for you to manage your finances. By searching options online, you can compare different lenders and find a loan that suits your needs.

How to Get Approved Quickly

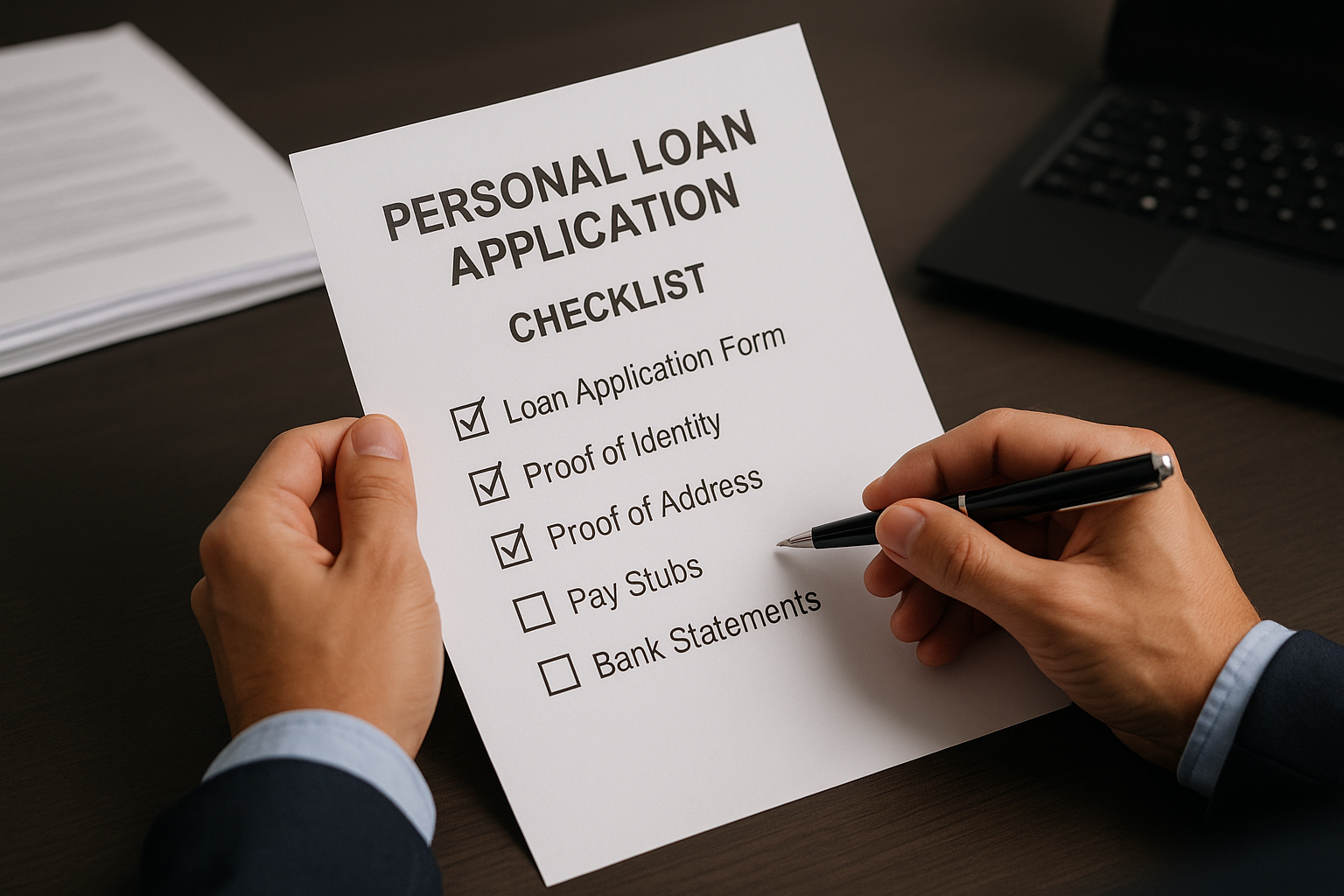

To expedite the approval process, it's essential to prepare beforehand. Here are some steps you can take to increase your chances of getting approved quickly:

- Check Your Credit Report: Before applying, obtain a free copy of your credit report from the three major credit bureaus—Equifax, Experian, and TransUnion. Look for any errors or discrepancies that could be negatively affecting your score1.

- Improve Your Credit Score: Even minor improvements in your credit score can make a significant difference. Pay down existing debt, make timely payments, and avoid opening new credit accounts before applying for a loan2.

- Gather Necessary Documentation: Lenders typically require proof of identity, income, and employment. Having these documents ready can speed up the approval process.

- Compare Lenders: By visiting websites of various lenders, you can compare interest rates, fees, and terms. Some online lenders offer pre-qualification, which allows you to see potential loan offers without affecting your credit score3.

Benefits of Personal Loans for Fair Credit

Personal loans offer several benefits that make them an attractive option for those with fair credit:

- Fixed Interest Rates: Unlike credit cards, most personal loans come with fixed interest rates, which means your monthly payments will remain consistent throughout the loan term.

- Flexible Use: You can use the funds from a personal loan for various purposes, such as home improvements, medical bills, or even a vacation.

- Debt Consolidation: If you have multiple high-interest debts, a personal loan can help you consolidate them into a single, lower-interest payment4.

Exploring Specialized Options

If you're considering a personal loan, it's worth exploring specialized options that cater to your credit profile. Some lenders offer loans specifically designed for fair credit borrowers, with features like lower interest rates or more lenient approval criteria. By visiting lender websites and reviewing their offerings, you can find a loan that aligns with your financial situation.

In summary, securing a personal loan with fair credit is entirely possible by taking the right steps and exploring the available options. By improving your credit score, gathering necessary documentation, and comparing lenders, you can increase your chances of getting approved quickly. Remember, the key is to be proactive and diligent in your search, ensuring you find the most suitable loan for your needs.