Get Exclusive Fiduciary Insurance Quotes in Seconds

If you're looking to secure fiduciary insurance quickly and efficiently, you'll want to browse options that provide instant quotes, allowing you to safeguard your financial interests without delay.

Understanding Fiduciary Insurance

Fiduciary insurance is a specialized form of coverage designed to protect individuals who manage employee benefit plans against claims of mismanagement or breaches of fiduciary duty. This type of insurance is crucial for businesses and plan administrators as it covers legal expenses, settlements, and judgments that may arise from alleged errors in managing these plans. With the complexities involved in managing benefit plans, fiduciary insurance serves as a vital safety net, ensuring that fiduciaries can perform their duties without the constant fear of legal repercussions.

The Importance of Quick Access to Quotes

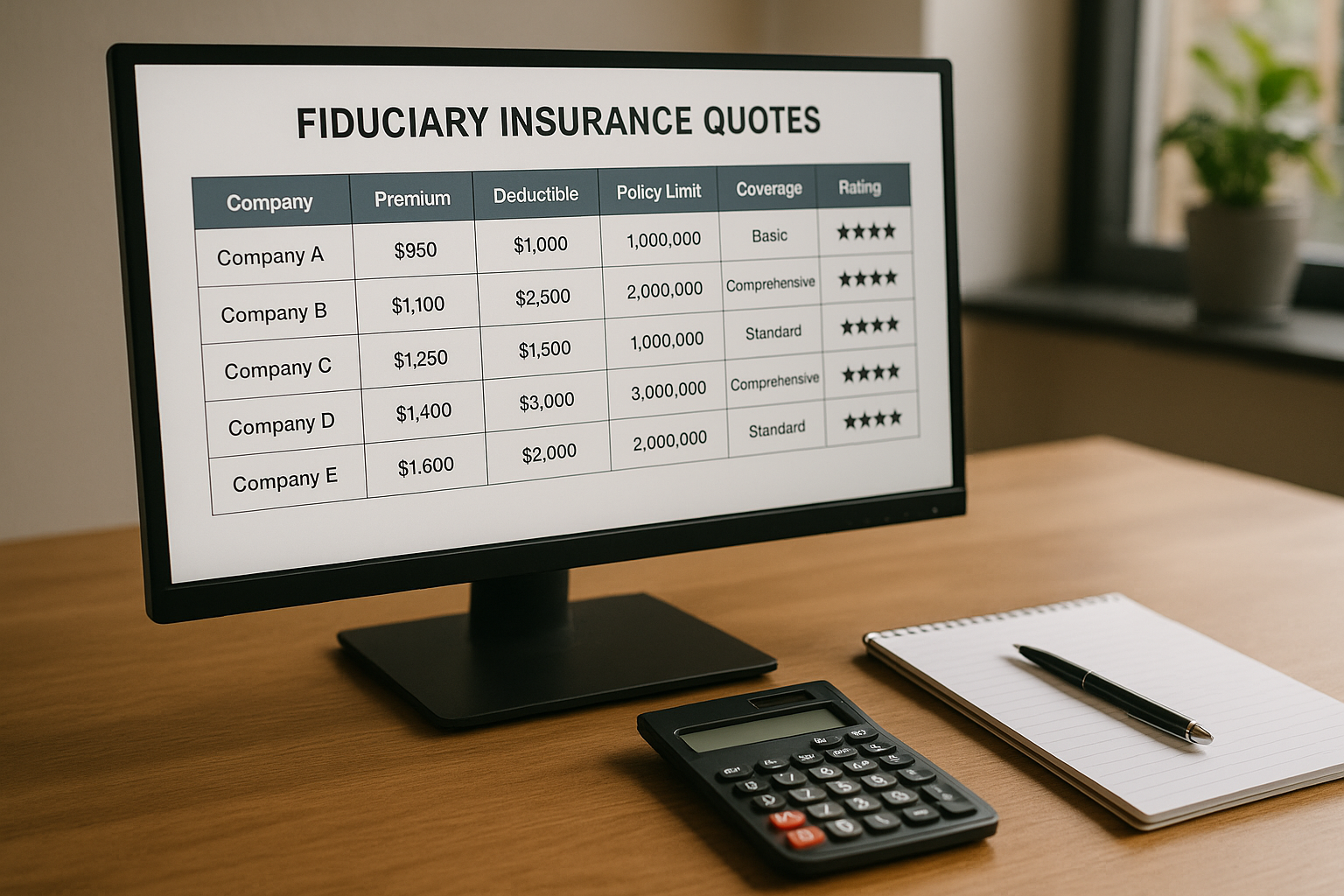

Time is often of the essence when it comes to securing fiduciary insurance. Rapid access to quotes allows businesses to compare coverage options and make informed decisions without unnecessary delays. By visiting websites that offer instant quotes, you can quickly assess different policies and find one that aligns with your specific needs and budget. This immediacy not only saves time but also provides peace of mind, knowing that your fiduciary responsibilities are covered promptly.

Factors Affecting Fiduciary Insurance Costs

Several factors influence the cost of fiduciary insurance, including the size of the company, the number of employees, the type of benefit plans managed, and the coverage limits selected. Generally, larger companies with more complex benefit plans may face higher premiums due to increased risk exposure. However, many insurers offer customizable plans that allow businesses to tailor coverage to their specific needs, potentially reducing costs while maintaining adequate protection.

Benefits of Fiduciary Insurance

Fiduciary insurance offers several key benefits, including:

- Protection against legal claims related to fiduciary breaches.

- Coverage for legal defense costs, settlements, and judgments.

- Peace of mind for fiduciaries, allowing them to focus on their duties without fear of personal liability.

- Enhancement of the company's risk management strategy.

These benefits underscore the importance of having fiduciary insurance as part of a comprehensive risk management plan. By securing this coverage, businesses can protect their financial interests and ensure compliance with regulatory requirements.

Exploring Your Options

When searching for fiduciary insurance, it's essential to explore a variety of options to find the best fit for your needs. Many insurance providers offer online platforms where you can search options and receive quotes in seconds. These platforms typically provide detailed information on coverage limits, exclusions, and pricing, allowing you to make an informed choice. Additionally, some providers may offer discounts for bundling fiduciary insurance with other types of business insurance, such as directors and officers (D&O) insurance.

Securing fiduciary insurance is a critical step for any business managing employee benefit plans. By understanding the coverage, costs, and benefits, you can make informed decisions that protect your organization and its fiduciaries. With the ability to obtain exclusive quotes in seconds, you can efficiently navigate the insurance landscape and ensure your fiduciary duties are adequately covered. Take advantage of the resources available online to explore specialized options and find the best policy for your needs.