Get Instant Technology Insurance Quotes Security Pros Trust

When you understand how to get instant technology insurance quotes that security pros trust, you unlock a world of protection and peace of mind, and by browsing options, you can ensure your business is safeguarded against unexpected tech mishaps.

Understanding Technology Insurance

Technology insurance is a specialized form of coverage designed to protect businesses that operate within the tech industry. This type of insurance is crucial as it helps mitigate risks associated with data breaches, cyber-attacks, and other technology-related incidents. With the rapid advancement of technology, businesses are increasingly vulnerable to cyber threats, making insurance an essential component of risk management.

For businesses, the stakes are high. A single data breach can cost a company millions of dollars, not to mention the damage to its reputation. According to IBM's Cost of a Data Breach Report 2023, the average cost of a data breach is $4.45 million1. Therefore, having reliable insurance coverage is not just a precaution—it's a necessity.

Types of Technology Insurance

There are several types of technology insurance policies available, each catering to different aspects of risk:

- Cyber Liability Insurance: This covers the costs associated with data breaches and cyber-attacks, including legal fees, notification costs, and credit monitoring for affected individuals.

- Errors and Omissions Insurance: This policy protects against claims of negligence or inadequate work, which is particularly relevant for technology service providers.

- Technology Professional Liability Insurance: This provides coverage for legal defense costs and damages if a client claims that your technology product or service caused them financial harm.

By understanding these options, businesses can tailor their insurance plans to meet their specific needs, ensuring comprehensive coverage.

Benefits of Instant Quotes

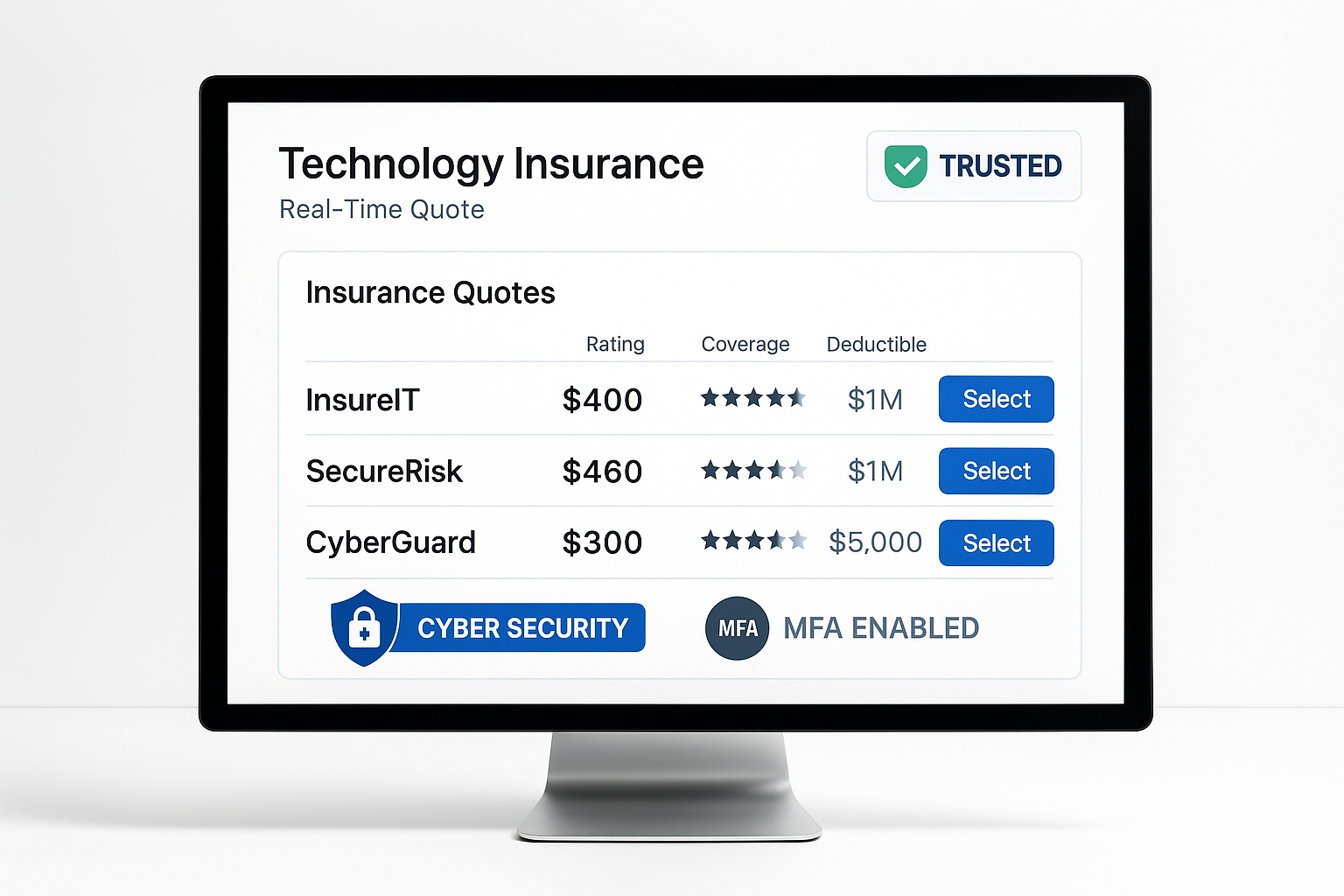

Getting an instant technology insurance quote offers numerous advantages. Firstly, it saves time. Traditional insurance quote processes can be lengthy, but with instant quotes, you receive information quickly, allowing you to make informed decisions without delay. Additionally, instant quotes often provide a range of options, enabling you to compare coverage and prices efficiently. This competitive insight is invaluable in finding the best policy that fits your budget and needs.

Moreover, many insurance providers offer discounts for those who purchase policies online. For example, some companies provide a 5-10% discount for online applications2. This not only makes the process more convenient but also more cost-effective.

How to Get Instant Quotes

To obtain instant technology insurance quotes, you can follow these steps:

- Research Providers: Start by researching reputable technology insurance providers. Look for companies with strong reviews and a history of reliable service.

- Visit Websites: Once you've identified potential providers, visit their websites to explore the options they offer. Many sites have online quote tools that allow you to input your business details and receive a quote immediately.

- Compare Quotes: After gathering several quotes, compare the coverage and costs. Pay attention to policy limits, exclusions, and any additional services offered.

- Consult an Expert: If you're unsure about which policy to choose, consider consulting with an insurance broker specializing in technology insurance. They can provide personalized advice and help you navigate complex policies.

Real-World Examples

Consider a small IT consultancy that recently secured a technology insurance policy. After experiencing a minor data breach, the company was able to cover legal fees and client notification costs without financial strain. This was possible because they had chosen a comprehensive cyber liability insurance policy that they found through an instant quote comparison tool3.

Another example is a software development firm that faced a lawsuit due to a software glitch. Their errors and omissions insurance covered the legal defense costs, protecting the company from significant financial loss4.

These cases highlight the importance of having the right technology insurance and demonstrate how instant quotes can lead to informed and beneficial decisions.

By understanding the nuances of technology insurance and taking advantage of instant quote tools, you can safeguard your business against unforeseen challenges. Whether you're looking to protect against cyber threats or ensure your professional services are covered, exploring these options can provide the peace of mind you need to focus on growth and innovation.