HELOC Home Equity Line Rates You Won't Believe

Imagine unlocking the hidden potential of your home's equity with HELOC rates so competitive you'll want to immediately browse options and explore how they can transform your financial landscape.

Understanding HELOC: A Financial Lifeline

A Home Equity Line of Credit (HELOC) is a flexible loan option for homeowners, allowing you to borrow against the equity in your home. Unlike a traditional home loan, a HELOC provides a revolving line of credit that you can draw from as needed, similar to a credit card. This financial tool can be particularly advantageous for funding home improvements, consolidating debt, or covering unexpected expenses.

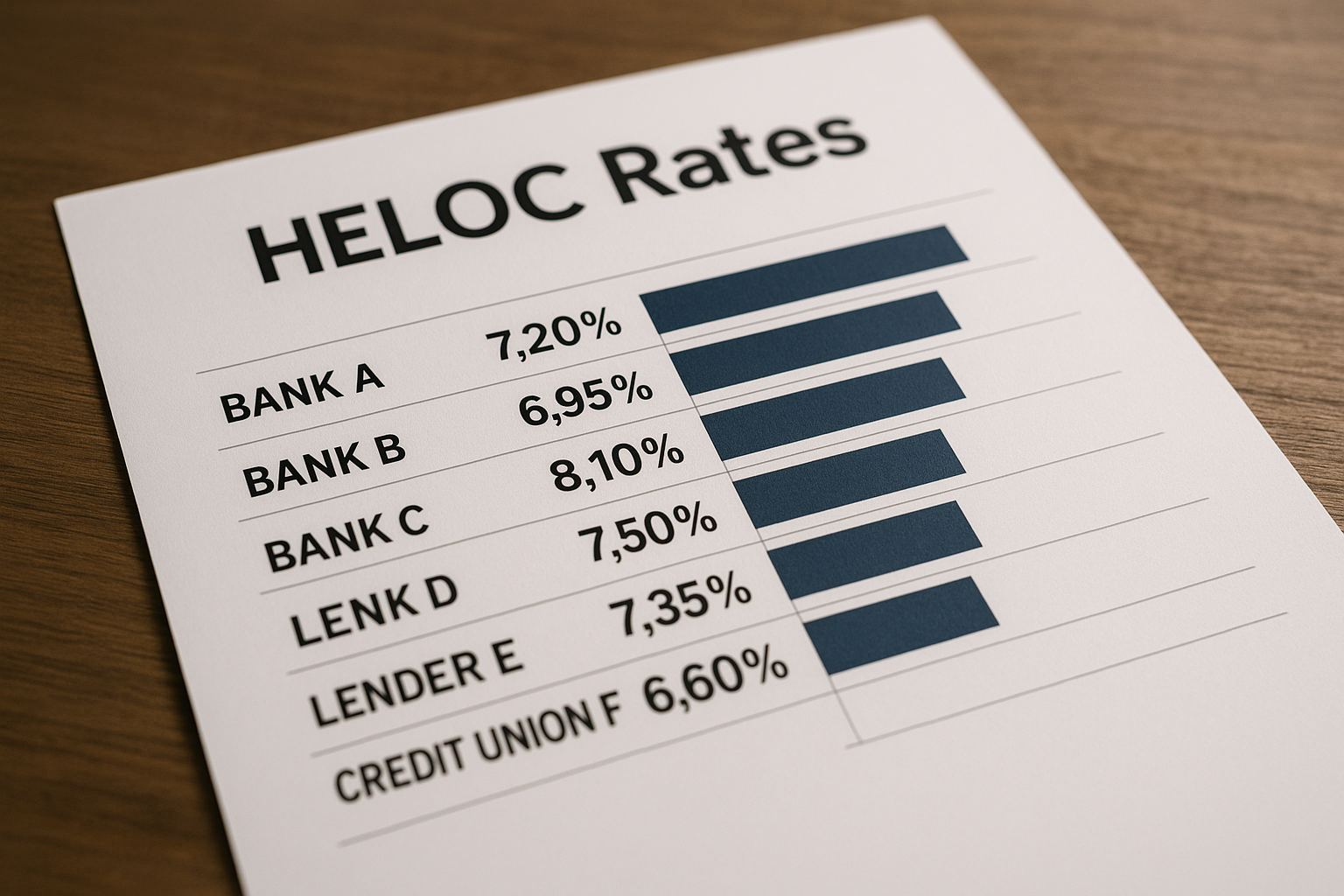

Current Trends in HELOC Rates

As of 2023, HELOC rates have been fluctuating due to economic conditions and monetary policies. Generally, these rates are influenced by the prime rate, which is determined by the Federal Reserve. Currently, many financial institutions offer introductory rates as low as 2.49% APR for the first year, with variable rates thereafter based on the prime rate plus a margin1.

Benefits of a HELOC

The primary benefit of a HELOC is its flexibility. You can utilize funds as needed and only pay interest on the amount you draw. This can lead to significant savings compared to fixed home loans. Additionally, the interest paid on a HELOC may be tax-deductible, offering further financial benefits2.

Factors Influencing HELOC Rates

Several factors determine the rates offered by lenders, including:

- Credit Score: A higher credit score can qualify you for lower rates.

- Loan-to-Value Ratio: The amount of equity you have in your home affects your rate.

- Market Conditions: Economic trends and the Federal Reserve's policies play a significant role.

How to Secure the Best HELOC Rates

To secure the most favorable HELOC rates, consider the following strategies:

- Improve your credit score by paying down existing debts and making timely payments.

- Shop around and compare offers from multiple lenders to find the best terms.

- Negotiate the terms of your HELOC to potentially lower fees and interest rates.

Potential Drawbacks

While HELOCs offer numerous advantages, they also come with risks. The variable interest rates mean your monthly payments could increase over time. Additionally, using your home as collateral means that defaulting on payments could lead to foreclosure.

Exploring Your Options

Given the potential savings and financial flexibility, it's worthwhile to explore HELOC options that align with your financial goals. Visit websites of reputable lenders to compare rates and terms. Many offer online tools to calculate potential savings and monthly payments, providing a clearer picture of how a HELOC could benefit you.

A HELOC can be a powerful tool for managing your finances, offering competitive rates and flexible borrowing options. By understanding the factors that influence rates and taking strategic steps to improve your financial profile, you can make the most of this opportunity. To dive deeper into specific offers and rates, follow the options available through trusted financial institutions.