Instantly Slash Payments with Pawn Loan Rates Comparison

Discover how you can instantly slash your payments by comparing pawn loan rates, and explore options to find the best deals available right now.

Understanding Pawn Loans: A Quick Overview

Pawn loans offer a unique and accessible way to secure quick cash without the need for a credit check. By using personal items as collateral, you can obtain a loan based on the value of these items. The process is straightforward: bring in an item of value, the pawnbroker assesses its worth, and offers a loan amount typically ranging from 25% to 60% of the item's resale value1. This makes pawn loans an attractive option for those needing immediate funds without the lengthy approval processes associated with traditional loans.

The Importance of Comparing Pawn Loan Rates

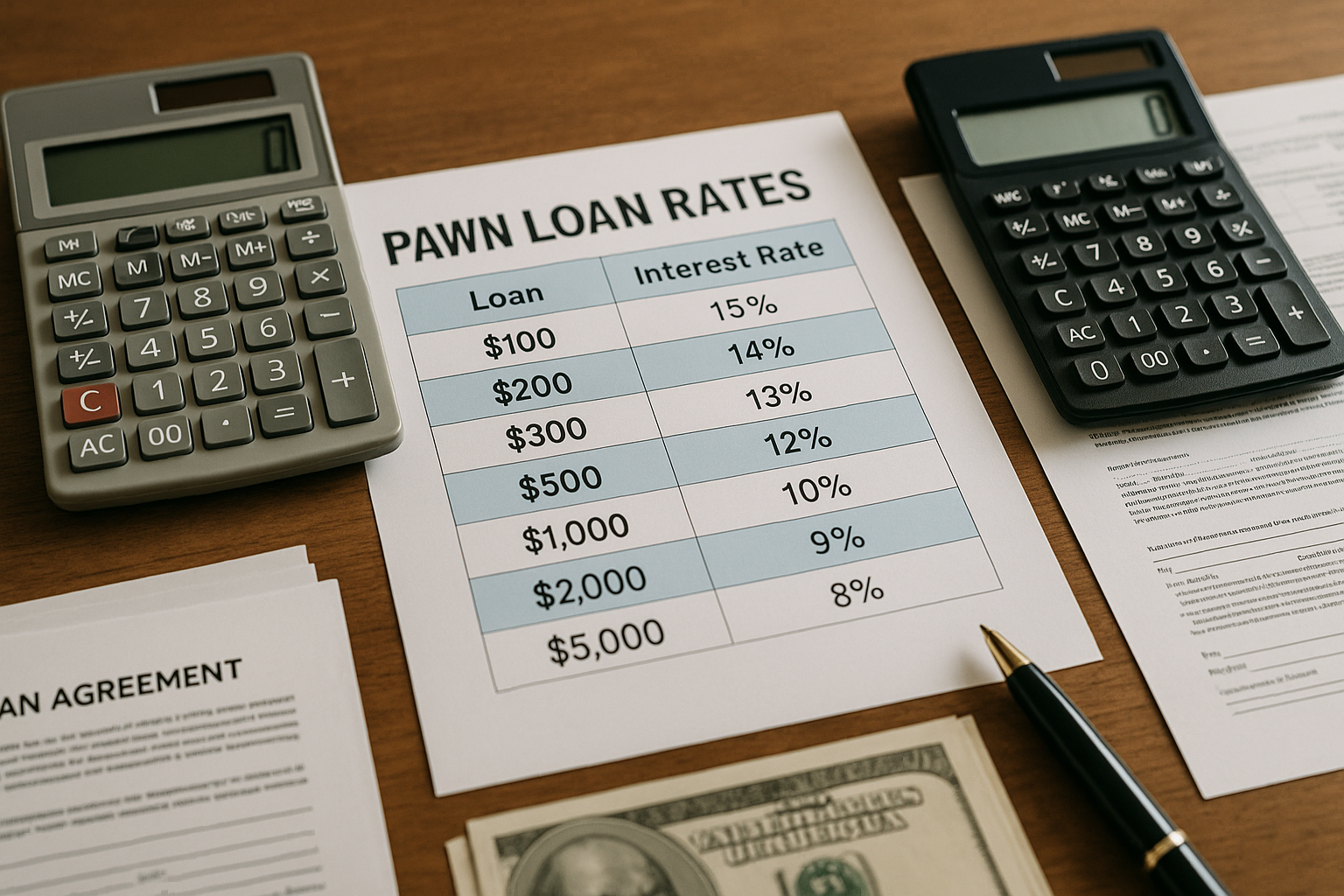

Pawn loan rates can vary significantly depending on the pawnbroker and your location. Interest rates can range from 5% to over 25% per month, making it crucial to compare options to ensure you're getting the best deal2. By browsing different pawnbrokers' offerings, you can identify those with more favorable terms, potentially saving a significant amount on interest payments over the loan's duration.

Real-World Savings: How to Slash Your Payments

To effectively reduce your payments, consider these strategies:

- Research and Compare Rates: Start by visiting websites of local pawnshops or using online platforms that aggregate pawn loan offers. This allows you to see these options side by side and choose the most cost-effective one.

- Negotiate Terms: Don't hesitate to negotiate the terms of your loan. Some pawnbrokers may be willing to offer lower rates or better repayment terms if you present a compelling case.

- Understand Additional Fees: Be aware of any additional fees that may apply, such as storage or insurance fees, which can add up over time. Clarifying these costs upfront helps avoid unexpected expenses.

- Consider Reputable Chains: Larger pawnshop chains may offer more competitive rates due to their scale and resources. Exploring their offerings could lead to better terms.

Why Pawn Loans Are a Viable Option

Pawn loans can be particularly beneficial for individuals who might not qualify for traditional loans due to poor credit histories. They provide a fast and flexible solution for urgent financial needs, ensuring that you can access funds when you need them most. Additionally, because pawn loans are secured by collateral, they don't impact your credit score if you default, as the item is simply retained by the pawnbroker3.

Future Considerations and Opportunities

As you navigate the world of pawn loans, remember that the key to slashing payments lies in diligent research and comparison. By taking the time to explore different options, you can secure a loan that meets your financial needs without excessive costs. For those interested in exploring specialized services, many online platforms now offer tools to compare pawn loan rates efficiently, providing a convenient way to find the best deals.

Ultimately, by staying informed and proactive, you can make the most of pawn loans and manage your finances effectively. Don't forget to visit websites or browse options to keep up with the latest offers and ensure you're always getting the best rate available.