Master Claims Made vs Occurrence Insurance Secrets Today

If you're navigating the complex world of insurance, mastering the secrets of claims-made versus occurrence policies can unlock substantial protection benefits and savings, so don't hesitate to browse options and see these options to secure the best coverage for your needs.

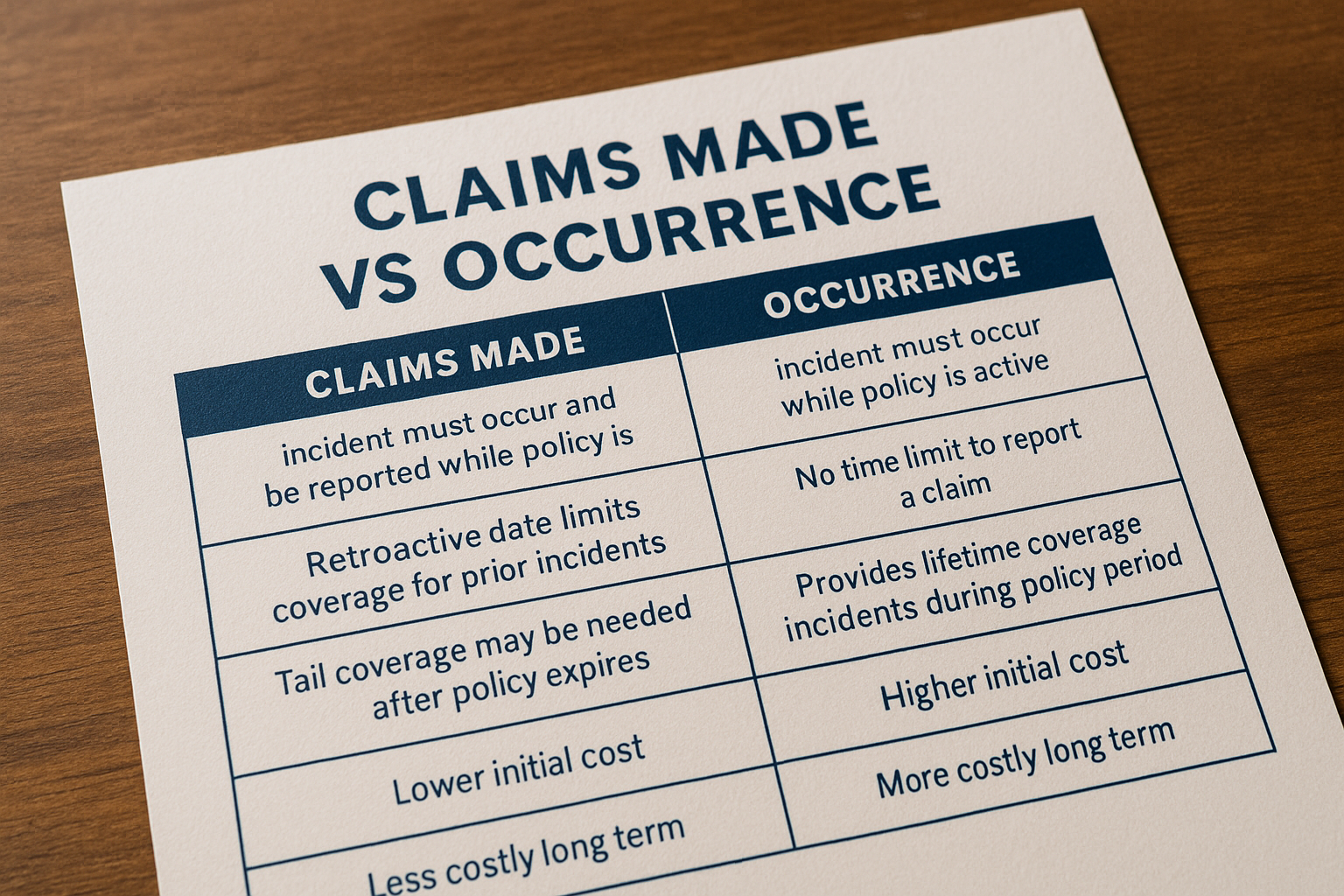

Understanding Claims-Made vs. Occurrence Insurance

Insurance is a crucial part of risk management for individuals and businesses alike. Two common types of liability insurance policies are claims-made and occurrence. Understanding the differences between these can significantly impact your coverage strategy and financial planning.

Claims-Made Insurance: A Deep Dive

Claims-made insurance policies cover claims only if the policy is active both when the incident occurs and when the claim is filed. This type of policy is particularly prevalent in professional liability insurance, such as malpractice insurance for doctors or errors and omissions insurance for consultants. One of the key advantages of claims-made policies is their typically lower initial premiums compared to occurrence policies. However, they require careful management, especially when switching carriers or retiring, as gaps in coverage can leave you vulnerable. Tail coverage, which extends the reporting period for claims, is often recommended to mitigate this risk1.

Occurrence Insurance: What You Need to Know

Occurrence policies, on the other hand, provide coverage for incidents that occur during the policy period, regardless of when the claim is filed. This means that even if a claim is made years later, the policy in effect at the time of the incident will cover it. This can offer peace of mind and is often preferred by businesses with long-tail liabilities. Although occurrence policies generally come with higher premiums, they eliminate the need for tail coverage, making them a stable option for those who want comprehensive long-term protection2.

Key Considerations When Choosing Your Policy

When deciding between claims-made and occurrence policies, consider the following factors:

- Cost: Claims-made policies usually start with lower premiums, but the cost can increase over time. Occurrence policies have higher upfront costs but offer long-term savings by covering future claims without additional fees.

- Coverage Needs: If your industry is prone to delayed claims, an occurrence policy might be more suitable. Conversely, if you anticipate frequent policy changes, a claims-made policy with tail coverage could be more flexible.

- Peace of Mind: Occurrence policies provide lasting coverage without worrying about policy renewals or tail coverage, which can be appealing for those seeking simplicity and security.

Real-World Applications and Examples

Consider a healthcare provider who faces potential malpractice claims. A claims-made policy would require them to maintain continuous coverage and possibly purchase tail coverage upon retirement. In contrast, an occurrence policy would cover any incidents during the policy period, regardless of when the claim is made, offering long-term security without additional costs3.

Exploring Your Options

Given the complexities of these insurance types, it's wise to consult with an insurance professional to tailor a policy that fits your specific needs. Many online platforms allow you to browse options and compare policies to ensure you're making an informed decision. Whether you need immediate savings or long-term security, understanding the nuances of claims-made versus occurrence insurance can help you achieve your financial and coverage goals.