Mastering Fiduciary Liability Insurance for Manufacturing Triumph

Mastering fiduciary liability insurance for your manufacturing business can unlock new levels of financial security and competitive advantage, so why not browse options to protect your assets and ensure long-term success?

Understanding Fiduciary Liability Insurance

Fiduciary liability insurance is a specialized form of coverage designed to protect businesses and their decision-makers from claims related to the mismanagement of employee benefit plans. In the manufacturing sector, where employee benefits are a crucial part of workforce retention and satisfaction, this insurance becomes indispensable. By securing fiduciary liability insurance, you safeguard your company against potential lawsuits that could arise from errors in managing pension plans, health benefits, and other employee-related funds.

The Importance of Fiduciary Liability in Manufacturing

Manufacturing companies often have complex employee benefit plans, and any misstep in managing these plans can lead to costly legal battles. With fiduciary liability insurance, you gain peace of mind knowing that legal expenses and potential settlements are covered. This allows you to focus on core business activities without the distraction of legal woes. Additionally, having this insurance can enhance your company's reputation, making it more attractive to top talent who value security and stability in their employment.

Key Benefits and Coverage Details

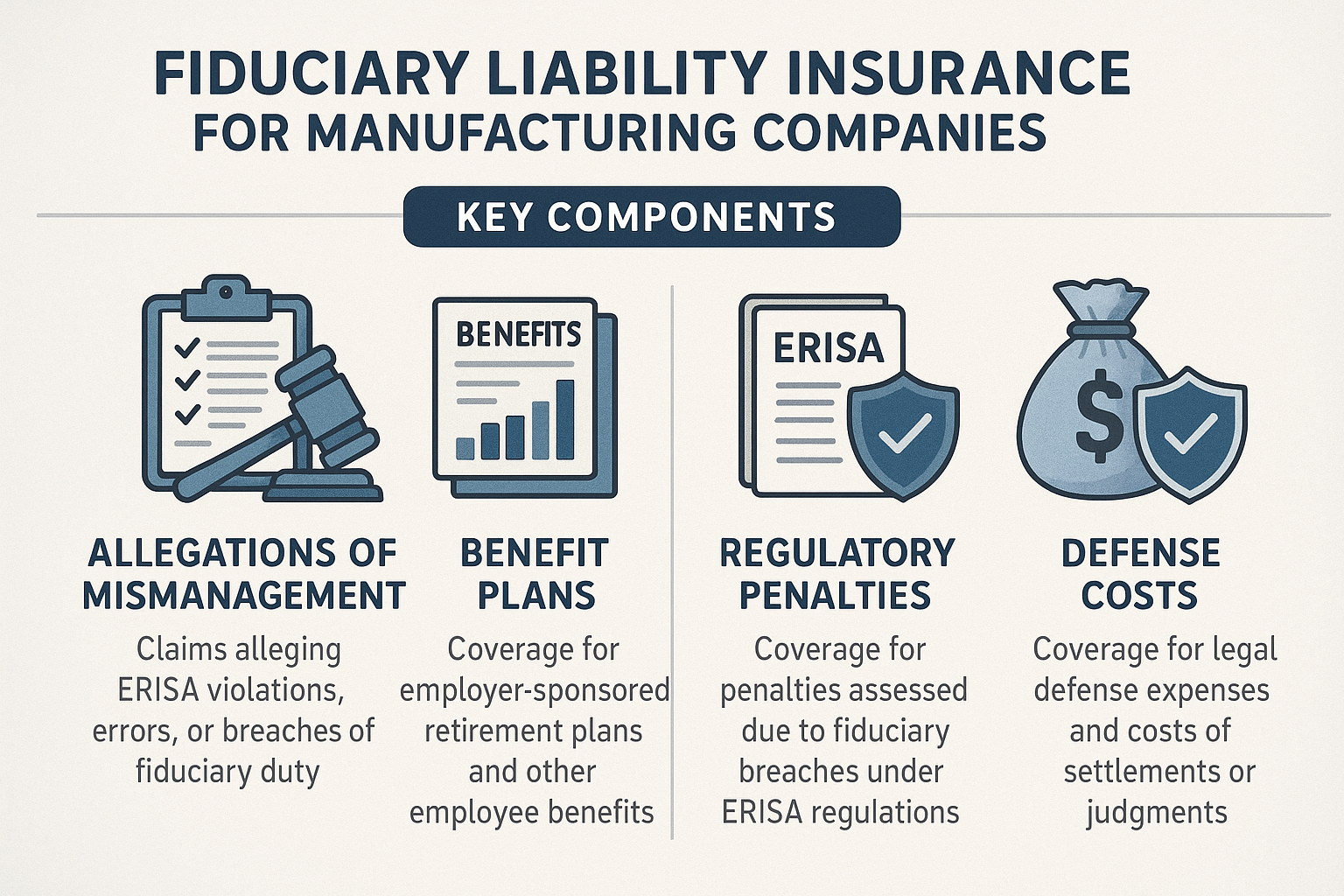

Fiduciary liability insurance covers a range of potential liabilities, including administrative errors, wrongful denial of benefits, and imprudent investment decisions. This coverage is particularly beneficial for manufacturing companies that offer retirement plans, as it protects against claims of fiduciary negligence. The insurance typically covers legal defense costs, settlements, and judgments, providing comprehensive protection.

Moreover, the cost of fiduciary liability insurance is often more affordable than the financial impact of a lawsuit. Premiums vary based on the size of the company and the complexity of the benefit plans, but many businesses find the investment worthwhile given the potential risks involved. By visiting websites of insurance providers, you can see these options and find a plan that fits your needs and budget.

Real-World Examples and Statistics

According to the U.S. Department of Labor, there are over 700,000 private retirement plans in the United States, covering more than 100 million participants1. With such a large number of plans, the potential for errors and subsequent claims is significant. A notable example is the case of a manufacturing firm that faced a $1 million lawsuit due to a clerical error in their pension plan administration2. This highlights the critical need for fiduciary liability insurance in mitigating such risks.

How to Choose the Right Coverage

When selecting fiduciary liability insurance, consider the specific needs of your manufacturing business. Evaluate the size and scope of your employee benefit plans and assess the potential risks associated with their management. It is also wise to consult with an insurance broker who specializes in manufacturing to explore tailored options. By following the options available, you can ensure that your coverage aligns with your business objectives and provides the necessary protection.

Mastering fiduciary liability insurance is a strategic move for manufacturing companies aiming to protect their assets and secure their future. By understanding the nuances of this coverage and actively searching for the best options, you position your business for sustained success and resilience in an ever-evolving industry landscape.