Maximize Profit Now D&O Insurance Secrets Urgent Care

Maximize your profits by discovering the untapped secrets of D&O insurance for urgent care centers, where you can browse options and explore the best solutions to safeguard your business while enhancing financial returns.

Understanding D&O Insurance for Urgent Care Centers

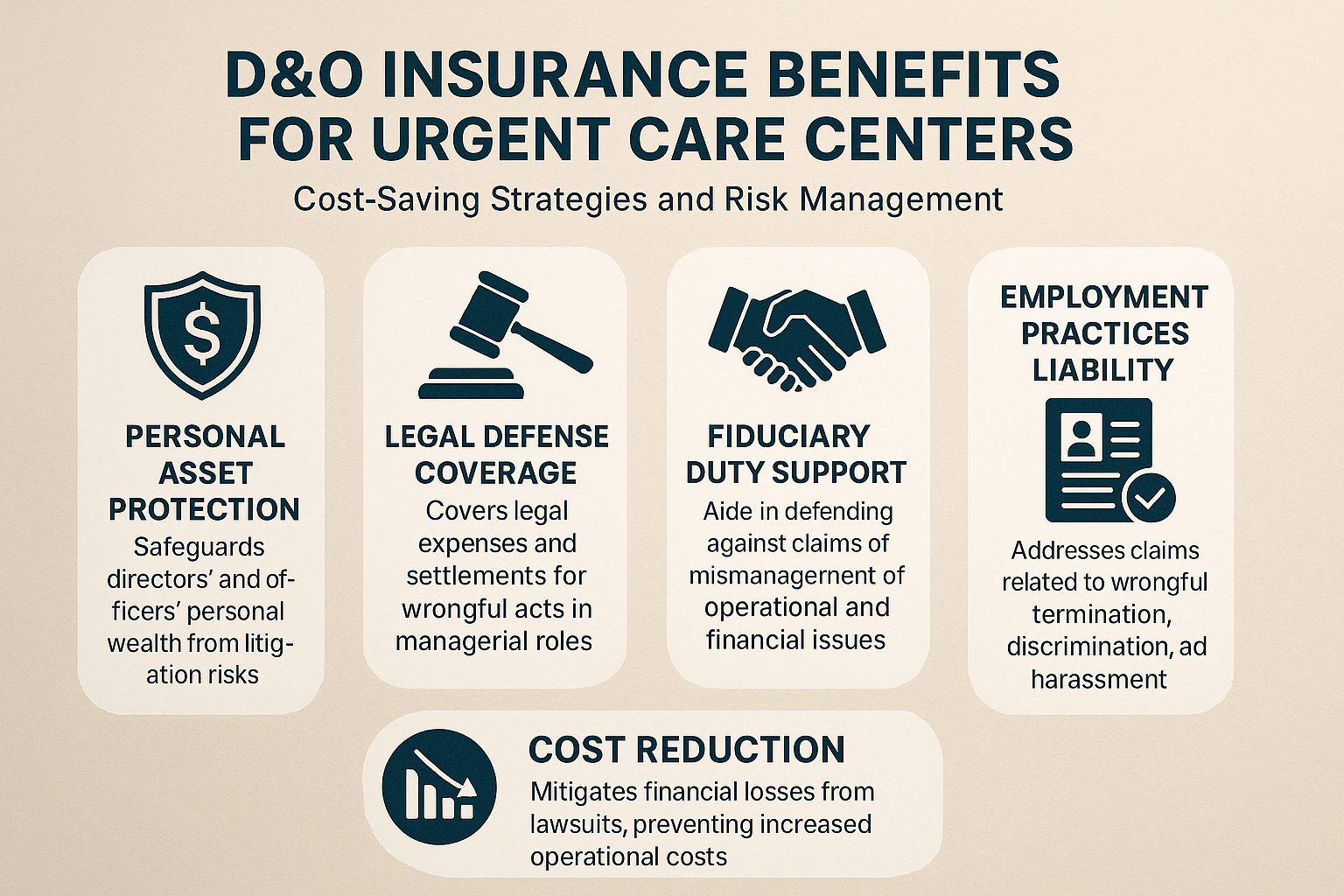

Directors and Officers (D&O) insurance is a critical component for protecting the leadership of urgent care centers against potential legal claims. This type of insurance covers the personal liability of directors and officers as they perform their duties, ensuring that their assets are safeguarded in the event of lawsuits related to their management decisions. For urgent care centers, this is particularly important given the complex regulatory environment and the increasing number of malpractice claims.

Why D&O Insurance is Essential

Urgent care centers operate in a high-stakes environment where decisions made by directors and officers can have significant legal and financial implications. D&O insurance provides a safety net, covering defense costs, settlements, and judgments arising from claims of wrongful acts. This protection is crucial not only for the individuals but also for the organization, as it helps maintain financial stability and reputation1.

Financial Benefits and Cost Considerations

Investing in D&O insurance can lead to long-term cost savings by mitigating the financial impact of potential lawsuits. While the cost of D&O insurance varies based on factors such as the size of the center, the number of employees, and the claims history, many providers offer competitive rates that can be tailored to fit specific needs2. By proactively managing risks, urgent care centers can avoid costly legal battles that can drain resources and divert attention from patient care.

Maximizing Profit Through Strategic Risk Management

Beyond the direct financial protection, D&O insurance enables urgent care centers to focus on strategic growth and operational efficiency. By transferring the risk of management-related lawsuits to the insurer, centers can allocate more resources toward expanding services, improving patient care, and investing in technology. This strategic approach not only enhances profitability but also positions the center as a leader in the competitive healthcare market3.

Exploring Your Options

To maximize the benefits of D&O insurance, urgent care centers should carefully evaluate their options and choose a policy that aligns with their specific needs. It is advisable to consult with insurance professionals who specialize in healthcare to explore tailored solutions and competitive pricing. Many insurers offer customizable policies that can be adjusted as the center grows and evolves, ensuring that coverage remains adequate and cost-effective4.

Securing D&O insurance is a strategic move for urgent care centers aiming to protect their leadership while optimizing financial outcomes. By understanding the nuances of D&O coverage and exploring various options, centers can effectively mitigate risks and focus on delivering exceptional patient care. As you navigate this essential aspect of risk management, consider visiting websites and browsing options to find the best fit for your organization's needs.