Maximize Savings on D&O Insurance Renewal Now

Maximize your savings on D&O insurance renewal by exploring strategic options, discovering hidden discounts, and leveraging expert insights that empower you to browse options and compare competitive rates effectively.

Understanding D&O Insurance

Directors and Officers (D&O) insurance is a crucial component for any business, providing liability coverage for company directors and officers to protect them from personal losses if they are sued as a result of serving as a director or an officer of a business or other type of organization. As businesses face increasing regulatory scrutiny and litigious environments, having robust D&O insurance is more important than ever. The coverage typically includes legal fees, settlements, and other costs associated with defending against lawsuits related to their corporate roles.

Why Renewal Time is Critical

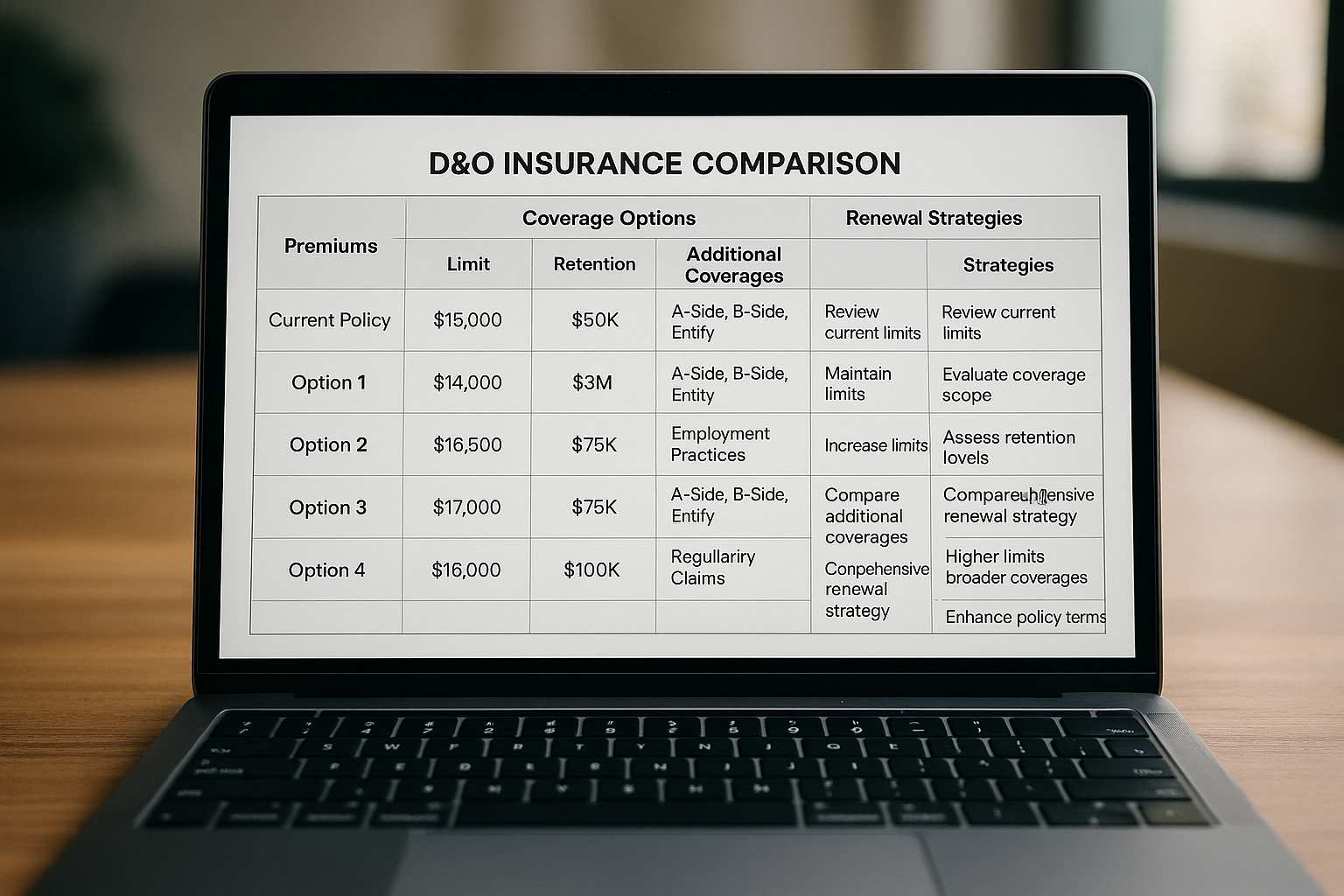

Renewal time is a strategic moment to reassess your D&O insurance needs and explore cost-saving opportunities. Insurers often adjust premiums based on market conditions, claim history, and changes in your business operations. This makes it an ideal time to negotiate better terms or switch providers if necessary. By actively engaging in the renewal process, you can ensure that your coverage remains comprehensive while also being cost-effective.

Strategies to Maximize Savings

To maximize savings on your D&O insurance renewal, consider the following strategies:

- Conduct a Risk Assessment: Evaluate your current risk profile and any changes in your business that might affect your insurance needs. This assessment can help you tailor your coverage and possibly reduce unnecessary costs.

- Shop Around: Don't settle for the first renewal quote. Browse options from multiple insurers to compare rates and coverage. Many insurers offer competitive pricing to attract new clients, which can lead to significant savings.

- Negotiate Terms: Engage with your current insurer to negotiate better terms. Highlight your clean claim history or any risk management practices you have implemented to justify lower premiums.

- Consider Higher Deductibles: Opting for a higher deductible can lower your premium costs. Just ensure that your business can comfortably cover the deductible in the event of a claim.

- Utilize a Broker: Insurance brokers have access to a wide range of policies and can help you find the best deals. They can also assist in negotiating terms and ensuring your coverage is adequate.

Exploring Additional Resources

While these strategies can significantly reduce your D&O insurance costs, further resources and specialized services are available to assist you in optimizing your insurance portfolio. Many online platforms offer tools to compare policies, and some insurers provide discounts for bundling multiple types of coverage. By visiting websites dedicated to insurance comparison and consulting with industry experts, you can uncover additional savings and tailor your coverage to your exact needs.

Renewing your D&O insurance is more than a routine task; it’s an opportunity to secure your business's financial health while optimizing costs. By actively engaging in the renewal process and exploring the options available, you can ensure that your coverage is both comprehensive and economical.