Maximize Short Term Rental Success With Essential Insurance Insight

Maximize your short-term rental success by gaining essential insurance insights, and you'll be well-equipped to protect your investment and enhance your profitability—browse options and discover how tailored coverage can make all the difference.

Understanding the Importance of Insurance for Short-Term Rentals

In the rapidly growing world of short-term rentals, ensuring that your property is adequately protected is not just wise—it's essential. With platforms like Airbnb and Vrbo offering homeowners lucrative opportunities to monetize their properties, the risks associated with hosting guests have also increased. Insurance plays a crucial role in mitigating these risks, offering peace of mind and financial protection against unforeseen events such as property damage, liability claims, or even loss of income due to cancellations.

Types of Insurance You Need for Short-Term Rentals

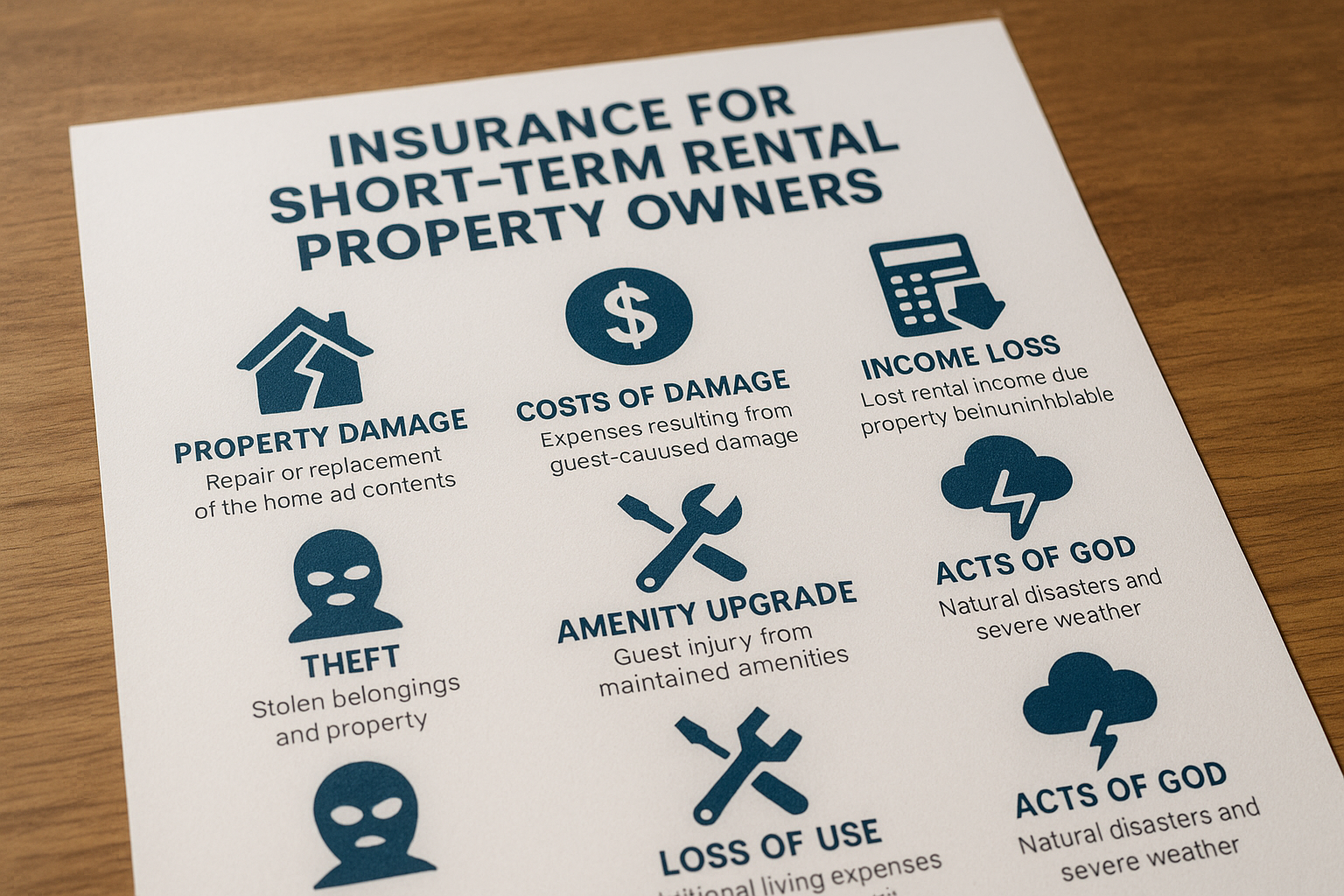

To fully safeguard your property, it's important to understand the different types of insurance available:

- Homeowners Insurance: While this is a fundamental coverage, most standard policies do not cover short-term rental activities. It's crucial to check with your provider to see if an endorsement can be added.

- Short-Term Rental Insurance: Specifically designed for rental properties, this type of insurance covers property damage, liability, and loss of income. Many insurers offer tailored packages to meet the unique needs of short-term rental hosts.

- Liability Insurance: This coverage protects you from claims related to guest injuries or property damage caused by guests during their stay.

Financial Benefits of Proper Insurance Coverage

Investing in comprehensive insurance for your short-term rental can save you significant amounts of money in the long run. For instance, liability claims can easily reach tens of thousands of dollars, and without the right coverage, you could be personally liable. Additionally, insurance can cover the costs of repairing or replacing damaged property, ensuring that your rental remains in top condition and continues to attract guests.

According to industry reports, hosts with adequate insurance coverage can see a 20% increase in occupancy rates, as guests often feel more secure booking properties that are well-protected1.

Cost Considerations and Finding the Right Policy

The cost of short-term rental insurance can vary widely based on factors such as location, property size, and the level of coverage required. On average, policies can range from $500 to $2,000 annually2. It's advisable to compare quotes from multiple providers to ensure you're getting the best deal.

When browsing options, consider insurers who specialize in short-term rental coverage, as they often provide more comprehensive and cost-effective solutions. Many companies offer discounts for bundling policies or for properties with security systems installed.

Real-World Examples and Success Stories

Many successful short-term rental hosts attribute their success to having the right insurance. For example, a host in California faced a $50,000 liability claim after a guest was injured on the property. Fortunately, their short-term rental insurance covered the claim, saving them from potential financial ruin3.

Additional Resources and Opportunities

For those eager to delve deeper into maximizing their rental's potential, numerous resources and specialized services are available. Visiting websites of leading insurance providers can offer valuable insights into policy options and coverage details. Additionally, exploring community forums and industry blogs can provide real-life advice and tips from fellow hosts.

By understanding and implementing the right insurance strategies, you can protect your investment, enhance your rental's appeal, and ultimately boost your bottom line. As you explore these options, remember that the right coverage is not just an expense but a valuable investment in your property's future.