Pay Off Debts Faster with 0 Intro APR Magic

If you're eager to eliminate your debt quickly and efficiently, exploring 0% Intro APR credit card options could be the game-changer you need, so browse options and leverage these financial tools to your advantage today.

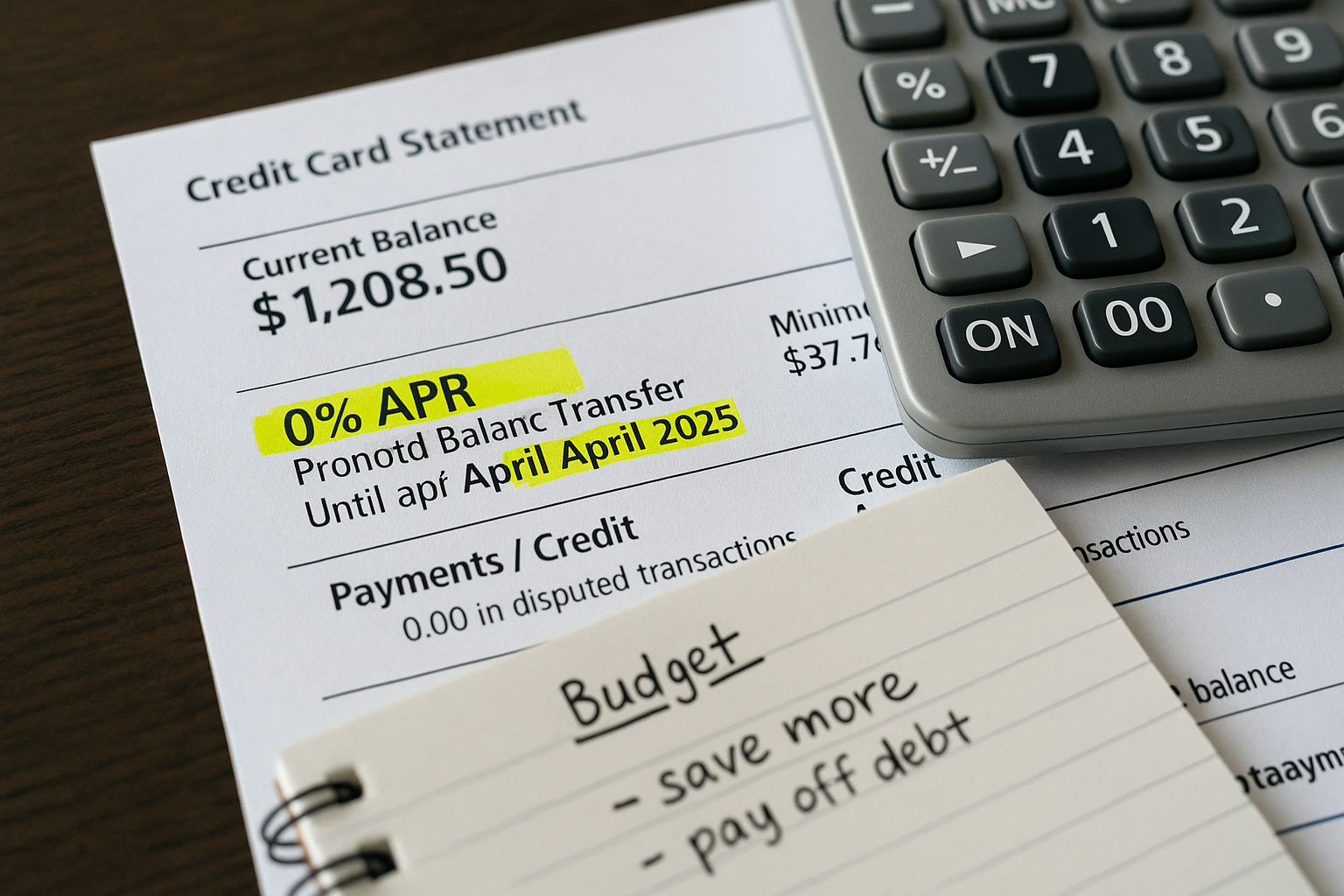

Understanding 0% Intro APR Offers

Zero percent introductory Annual Percentage Rate (APR) offers are promotional deals provided by credit card companies that allow you to make purchases or transfer balances without paying interest for a set period, typically ranging from 12 to 21 months. This can be an effective strategy for paying off existing debts faster, as every dollar you pay goes directly towards the principal balance, not interest. By strategically using these offers, you can save a significant amount on interest payments and expedite your journey to becoming debt-free.

How 0% Intro APR Works

When you sign up for a credit card with a 0% intro APR offer, you essentially have a grace period where no interest will be charged on your balance transfers or purchases. This period is an excellent opportunity to pay down debt without the burden of accruing interest. However, it's crucial to be aware that once the introductory period ends, the regular APR will apply to any remaining balance. Therefore, it's wise to create a repayment plan that ensures you can pay off the balance before the introductory period expires.

Maximizing the Benefits

To make the most of a 0% intro APR offer, consider the following strategies:

- Balance Transfers: If you have high-interest credit card debt, transferring your balance to a card with a 0% intro APR can reduce your interest costs dramatically. Be mindful of balance transfer fees, which typically range from 3% to 5% of the transferred amount. Calculate whether the savings on interest outweigh these fees.

- Debt Consolidation: Consolidating multiple debts into one card can simplify your payments and reduce your overall interest rate. This is particularly beneficial if you manage several high-interest debts.

- Budgeting and Planning: Create a detailed repayment plan to ensure you can pay off the debt within the interest-free period. This requires discipline and careful budgeting to make the most of the offer.

Real-World Examples

Many credit card issuers offer 0% intro APR deals, but terms can vary. For instance, cards like the Citi® Diamond Preferred® Card and the Chase Slate Edge℠ are known for their competitive introductory offers. According to a recent survey, consumers who utilized these offers saved an average of $1,000 in interest payments over the promotional period1.

Potential Pitfalls to Avoid

While 0% intro APR cards offer significant benefits, there are potential downsides to consider:

- Post-Promotional Rates: Be aware of the regular APR that kicks in after the introductory period. It's often higher than average, which can quickly negate savings if the balance isn't paid off.

- Fees and Penalties: Late payments can result in losing the 0% APR offer and incurring penalty rates. It's crucial to make timely payments to maintain the promotional rate.

- Overextending Credit: The temptation to spend more due to the lack of interest can lead to increased debt. Stick to your budget and avoid unnecessary purchases.

Finding the Right 0% Intro APR Card

Selecting the right card involves comparing various options and understanding the terms. Look for cards with the longest 0% APR period, minimal fees, and favorable terms for balance transfers. Many financial websites allow you to compare these offers side by side, helping you make an informed decision.

Utilizing a 0% intro APR credit card can be a powerful tool in your debt reduction arsenal. By transferring high-interest balances and focusing on paying down the principal, you can achieve financial freedom faster. Remember to explore the available options, understand the terms, and stick to a disciplined repayment plan to maximize the benefits of these offers.