Private Equity Firms Master Fiduciary Broker Comparison Secrets

Unlocking the secrets of how private equity firms expertly compare fiduciary brokers can lead you to a treasure trove of financial opportunities and strategic insights, so don't miss the chance to browse options and see these valuable strategies in action.

Understanding Private Equity Firms and Their Fiduciary Broker Needs

Private equity firms are investment managers that pool capital from high-net-worth individuals or institutional investors to acquire equity ownership in companies. These firms aim to improve the companies they invest in and eventually sell them at a profit. The role of fiduciary brokers in this context is crucial, as they ensure that the investments are managed in the best interest of the clients.

Fiduciary brokers act as trusted advisors, offering insights and strategies that align with the investor's goals. They are bound by a legal obligation to prioritize their clients' interests, which is why private equity firms place significant emphasis on selecting the right broker. The comparison of fiduciary brokers involves assessing their expertise, track record, fee structures, and the range of services they offer.

Key Factors in Comparing Fiduciary Brokers

When private equity firms compare fiduciary brokers, several critical factors come into play:

1. **Expertise and Experience**: Firms look for brokers with extensive experience in managing large-scale investments and a proven track record of successful transactions. This expertise helps in navigating complex financial landscapes and making informed decisions.

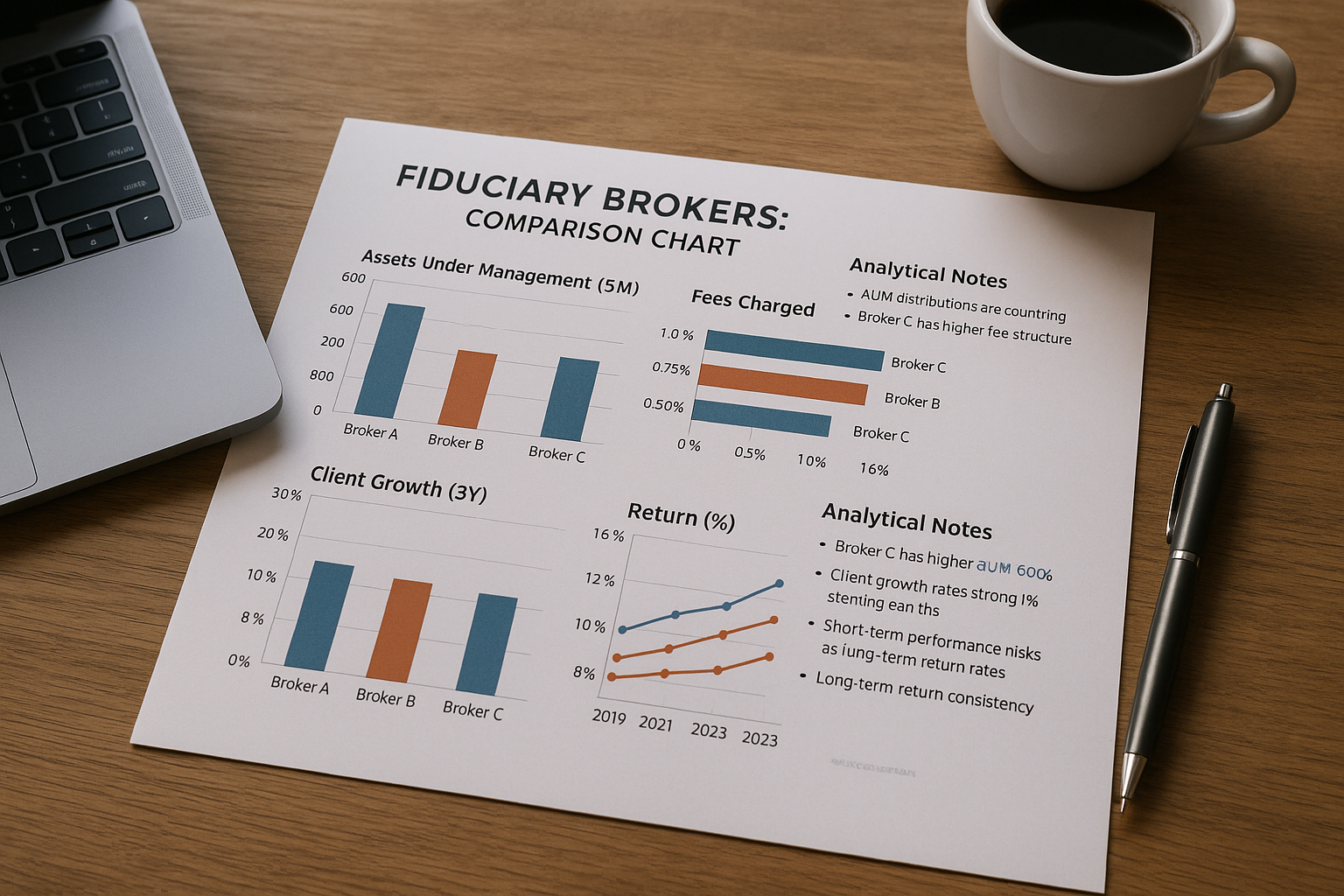

2. **Fee Structures**: Understanding the cost implications is essential. Brokers may charge fees based on a percentage of assets under management or a flat fee. Private equity firms often seek brokers who offer competitive pricing without compromising on service quality.

3. **Service Range**: The breadth of services offered by a fiduciary broker can significantly impact investment outcomes. Firms typically prefer brokers who provide comprehensive services, including investment analysis, risk management, and strategic planning.

4. **Reputation and Trustworthiness**: A broker's reputation is built on their ability to consistently act in the best interests of their clients. Private equity firms value brokers with a solid reputation for integrity and ethical conduct.

Real-World Examples and Statistics

According to a report by Preqin, private equity firms managed over $4 trillion in assets globally by the end of 20221. This immense volume of capital underscores the importance of selecting the right fiduciary broker to manage these investments effectively.

Furthermore, a survey conducted by Ernst & Young revealed that 67% of private equity firms consider the quality of fiduciary advice as a primary factor when selecting brokers2. This statistic highlights the critical role that fiduciary brokers play in the success of private equity investments.

Benefits and Opportunities

Choosing the right fiduciary broker can unlock numerous benefits for private equity firms. These include enhanced investment performance, reduced risk, and improved compliance with regulatory standards. Moreover, brokers with specialized knowledge in specific industries can provide tailored strategies that align with the firm's investment goals.

Private equity firms also gain a competitive advantage by partnering with brokers who offer innovative solutions and insights into emerging market trends. This collaboration can lead to the identification of lucrative investment opportunities that may otherwise go unnoticed.

Exploring Specialized Options

For private equity firms seeking to refine their broker comparison strategies, there are numerous resources available. Industry conferences, financial publications, and online platforms offer insights into the latest trends and best practices in fiduciary broker selection. By exploring these options, firms can stay ahead of the curve and ensure that they are making informed decisions.

Mastering the comparison of fiduciary brokers is a strategic imperative for private equity firms. By focusing on expertise, cost-effectiveness, service range, and reputation, firms can enhance their investment outcomes and drive substantial growth. As you delve deeper into this topic, remember that specialized resources and expert advice are just a click away, offering you the tools and insights needed to make the most of your investment strategies.