Save Big with Top Nonprofit Insurance Quote Comparisons Now

Imagine the savings you could achieve by exploring competitive nonprofit insurance options today, ensuring your organization is protected without breaking the bank—browse options now to discover your best fit.

Understanding Nonprofit Insurance Needs

Nonprofit organizations operate under unique circumstances that demand specialized insurance coverage. Unlike for-profit businesses, nonprofits often face challenges related to limited budgets and specific risks such as volunteer liability, fundraising event coverage, and compliance with donor requirements. Therefore, obtaining the right insurance is crucial to safeguarding their mission and ensuring operational continuity.

Types of Insurance Essential for Nonprofits

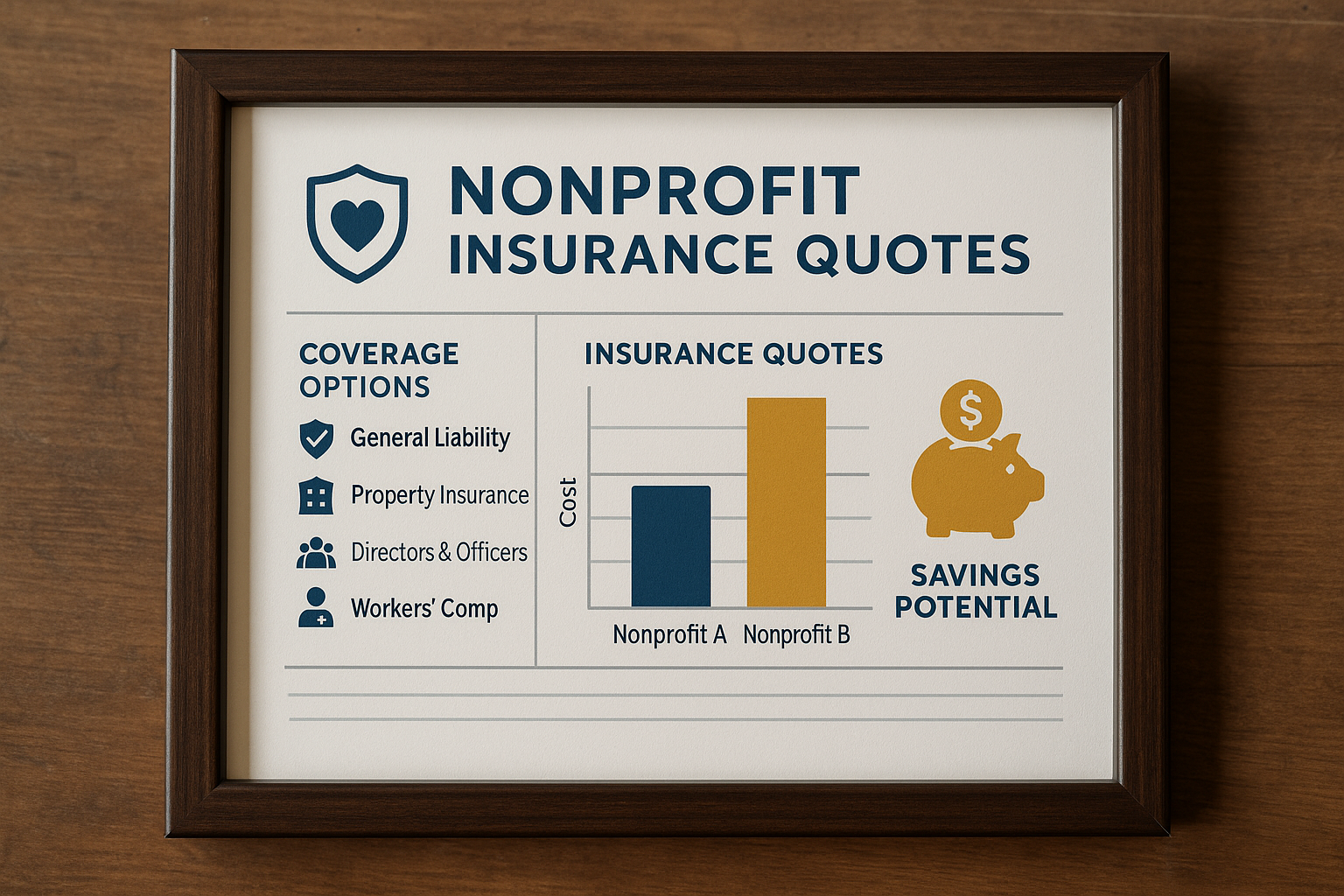

Nonprofits typically require a variety of insurance types to cover different aspects of their operations. General liability insurance is fundamental as it protects against claims of bodily injury or property damage. Directors and Officers (D&O) insurance is another critical type, offering protection to board members from personal losses due to their organizational decisions1. Additionally, property insurance, workers' compensation, and professional liability insurance can be vital depending on the organization's specific activities and size.

Benefits of Comparing Insurance Quotes

By comparing insurance quotes from different providers, nonprofits can save significantly on premiums while ensuring comprehensive coverage. This process allows organizations to assess various policy options, coverage limits, and additional features that could be beneficial. Moreover, some insurers offer discounts for nonprofits, such as reduced rates for organizations with a strong risk management history or those that bundle multiple policies2.

How to Effectively Compare Insurance Quotes

To effectively compare insurance quotes, nonprofits should start by identifying their specific coverage needs. This involves evaluating potential risks and liabilities unique to their operations. Once these needs are clear, organizations can reach out to multiple insurance providers to request quotes. It's essential to compare not only the cost but also the coverage details, exclusions, and customer service ratings of each provider. Utilizing online platforms or working with insurance brokers who specialize in nonprofit coverage can streamline this process and provide access to a wider range of options3.

Real-World Savings and Opportunities

Many nonprofits have successfully reduced their insurance costs by following a thorough comparison process. For example, a small community arts organization was able to lower its annual insurance expenses by 20% by switching providers after discovering a more comprehensive policy at a lower rate through a detailed quote comparison4. Such savings can then be redirected towards program funding or other essential operations, enhancing the organization's overall impact.

Exploring Specialized Insurance Solutions

For nonprofits with unique needs, such as those operating internationally or engaging in high-risk activities, specialized insurance solutions may be necessary. These tailored policies can address specific risks that standard insurance might not cover, offering peace of mind and protection for complex operations. Consulting with insurance experts who understand the nonprofit sector can reveal these specialized options, ensuring comprehensive and cost-effective coverage.

By taking the time to explore and compare nonprofit insurance quotes, organizations can achieve significant savings while securing the protection they need. This proactive approach not only safeguards their mission but also optimizes their financial resources, allowing them to focus more on their core objectives. Start your search today to see these options and ensure your nonprofit is well-protected.