Save More Money With Payroll Services Pricing Secrets

Unlock significant savings and streamline your business operations by exploring the hidden gems of payroll services pricing, where browsing options and visiting websites can reveal cost-effective solutions tailored to your needs.

Understanding Payroll Services and Their Impact

Payroll services are an essential component for any business, ensuring that employees are paid accurately and on time. By outsourcing payroll, companies can not only save time but also reduce errors and compliance risks. The right payroll service can handle complex calculations, tax withholdings, and even benefits administration, allowing you to focus on core business activities.

The Cost-Saving Potential of Payroll Services

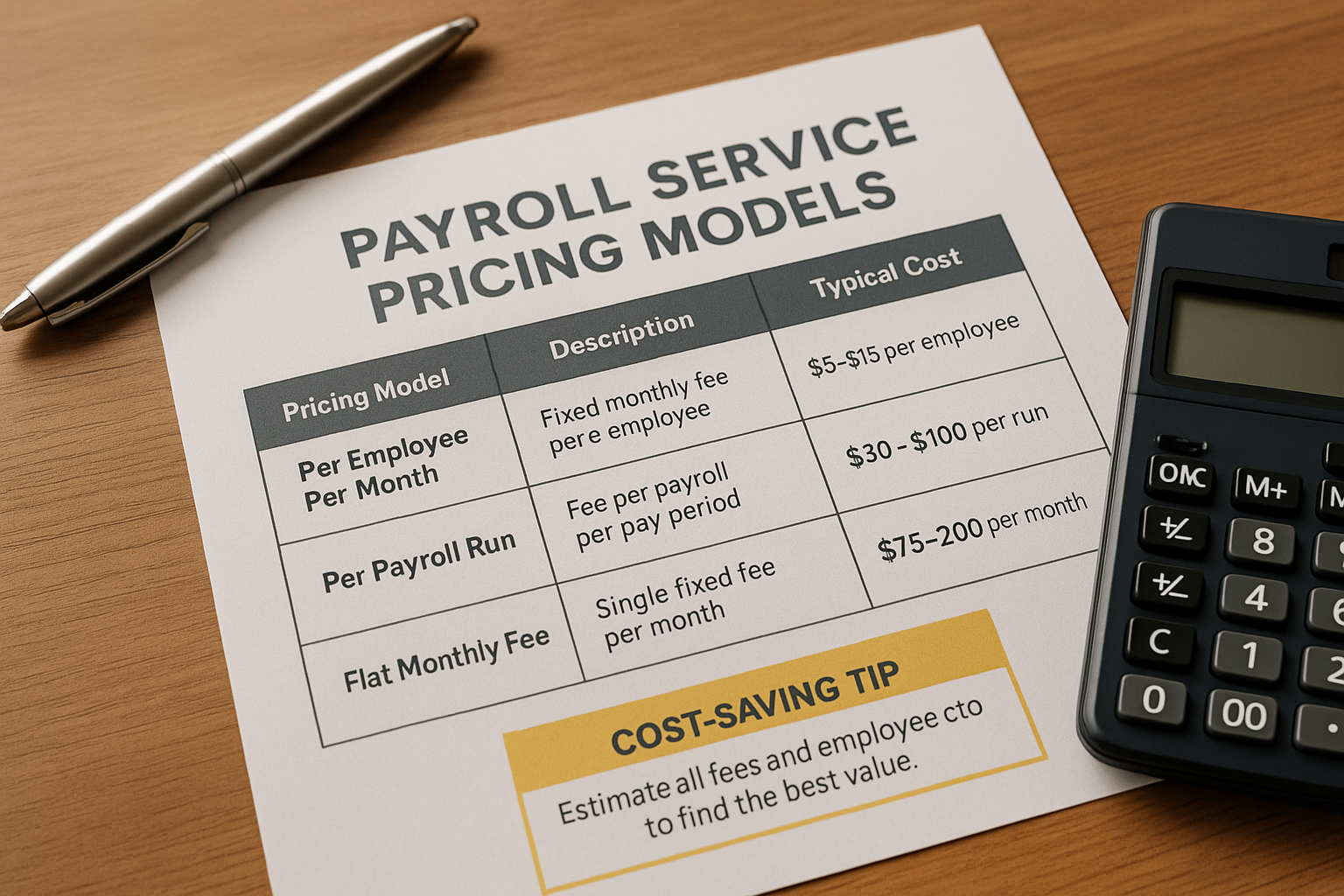

Many businesses are unaware of the potential savings that can be achieved by selecting the right payroll service. While prices can vary based on the size and needs of your business, understanding the pricing structures can help you make informed decisions. For instance, some payroll providers offer a flat-rate pricing model, which can be beneficial for businesses with a stable workforce. Alternatively, per-employee pricing might be more cost-effective for companies with fluctuating staff numbers. By comparing these options, businesses can find a model that aligns with their budget and operational requirements.

Common Pricing Structures and Deals

Payroll service providers often offer various pricing tiers and promotional deals. For example, some companies provide discounts for signing long-term contracts or bundling additional services like HR management or time tracking. Additionally, many providers offer introductory rates or waive setup fees for new clients. These deals can significantly reduce initial costs, making it worthwhile to visit websites and search options to find the best fit for your business.

Real-World Examples and Data

According to a survey by the National Small Business Association, small businesses spend an average of 5 hours per month on payroll processing1. By outsourcing this task, businesses can redirect valuable time towards growth initiatives. Furthermore, businesses that utilize payroll services report a 32% reduction in payroll errors, which can lead to significant cost savings in terms of penalties and corrections2.

Exploring Specialized Services

Beyond basic payroll processing, many providers offer specialized services that can further enhance efficiency and cost savings. These include automated tax filing, direct deposits, employee self-service portals, and compliance management. By exploring these options, businesses can tailor their payroll services to meet specific needs, ultimately leading to greater financial efficiency and employee satisfaction.

By understanding and leveraging the pricing secrets of payroll services, businesses can unlock substantial savings and operational efficiencies. As you browse options and search for the best solutions, consider the long-term benefits of a well-chosen payroll service that aligns with your business goals and budget. Whether you're looking for basic payroll processing or comprehensive HR solutions, there's a wealth of opportunities waiting to be discovered.