Secret Savings Inside Commercial Property Insurance Quote Now

Unlocking the hidden savings within commercial property insurance quotes can transform your business's financial landscape, so don't miss out on the chance to browse options and discover valuable insights that could lead to significant cost reductions and enhanced coverage.

Understanding Commercial Property Insurance

Commercial property insurance is a critical safeguard for businesses, providing protection against potential losses due to damage or destruction of physical assets. This type of insurance covers a wide range of incidents, including fire, theft, and natural disasters, ensuring that your business can recover quickly from unforeseen events. The cost of commercial property insurance varies based on several factors, such as the location of your business, the value of the property, and the specific risks associated with your industry.

Key Components of a Commercial Property Insurance Quote

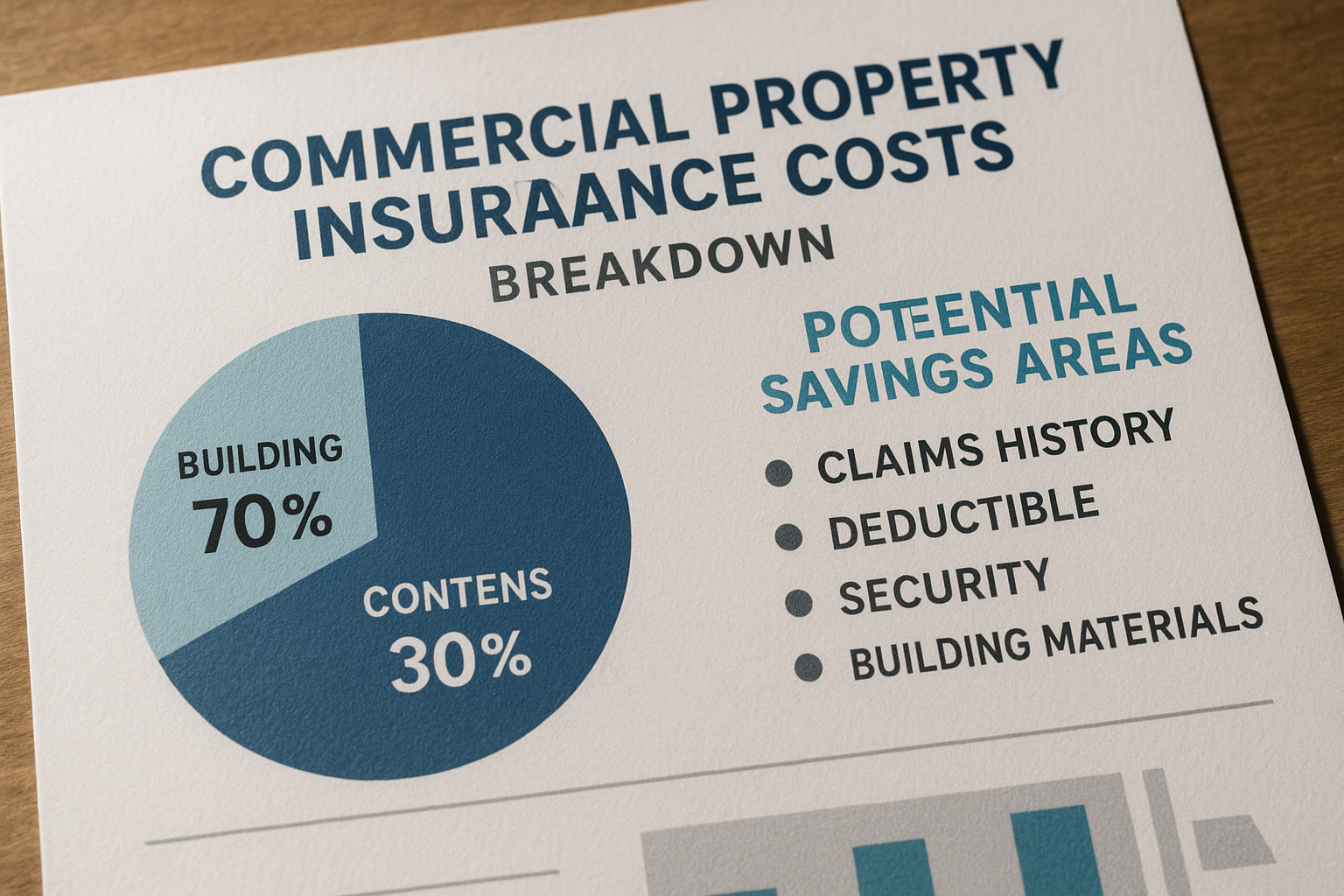

When you receive a commercial property insurance quote, it's essential to understand the various components that contribute to the overall cost. These typically include:

- Property Value: The insured value of your property is a primary determinant of your premium. Higher-value properties generally incur higher premiums due to the increased risk for insurers.

- Location: Properties in areas prone to natural disasters or high crime rates may face higher insurance costs. Insurers assess the risk level of your location to set an appropriate premium.

- Coverage Limits: The extent of coverage you choose impacts your premium. Opting for higher coverage limits provides more protection but comes at a higher cost.

- Deductibles: Selecting a higher deductible can lower your premium, but it also means you'll pay more out-of-pocket in the event of a claim.

Discovering Secret Savings

Many businesses are unaware of the potential savings that can be unlocked with a thorough evaluation of their commercial property insurance options. Here are some strategies to uncover these hidden savings:

- Bundle Policies: Many insurers offer discounts when you bundle multiple types of insurance, such as property and liability coverage, under one policy. This can lead to significant savings while simplifying the management of your insurance needs.

- Risk Mitigation: Implementing risk reduction measures, like installing security systems or fire suppression equipment, can lower your risk profile and, consequently, your insurance premiums.

- Regular Policy Review: Periodically reviewing your policy ensures that your coverage aligns with current needs and market conditions. Adjustments in coverage or deductibles can result in cost savings.

- Shop Around: Don't settle for the first quote you receive. Compare quotes from multiple insurers to find the best coverage at the most competitive price. Visiting websites and exploring different options can reveal better deals.

Real-World Examples and Statistics

According to a recent survey, businesses that regularly review and adjust their insurance policies save, on average, 10% on their premiums1. Additionally, companies that implement comprehensive risk management strategies can see reductions in premiums by up to 20%2. These statistics highlight the tangible benefits of actively managing your commercial property insurance.

Exploring Specialized Solutions

For businesses with unique needs or higher risk profiles, specialized insurance solutions are available. These tailored policies provide coverage that addresses specific industry risks, ensuring that your business is adequately protected. By exploring these specialized options, you can find insurance solutions that offer both comprehensive coverage and potential cost savings.

Understanding and optimizing your commercial property insurance can lead to significant financial benefits for your business. By taking the time to explore different options, implement risk mitigation strategies, and regularly review your policy, you can unlock hidden savings and enhance your coverage. Start your search today to discover the best insurance options tailored to your business needs.