Secure Exclusive Savings on Multifamily Insurance Renewals Today

Discover how you can unlock significant savings on multifamily insurance renewals by exploring various options and visiting websites to ensure you secure the best deal available today.

Understanding Multifamily Insurance

Multifamily insurance is a specialized form of property insurance designed to protect apartment buildings, condominiums, and other multi-unit residential properties. This type of insurance is crucial for property owners and managers as it covers a wide range of risks, including property damage, liability claims, and loss of rental income. With the complexity and scale of multifamily properties, securing comprehensive coverage at a competitive rate is essential.

The Importance of Timely Renewals

Renewing your multifamily insurance policy in a timely manner can lead to significant cost savings and prevent lapses in coverage. Insurance companies often offer discounts and incentives for early renewals, which can help reduce your overall premium costs. Additionally, reviewing and renewing your policy annually allows you to reassess your coverage needs and ensure that you are adequately protected against emerging risks.

Strategies for Securing Savings

To maximize savings on your multifamily insurance renewals, consider the following strategies:

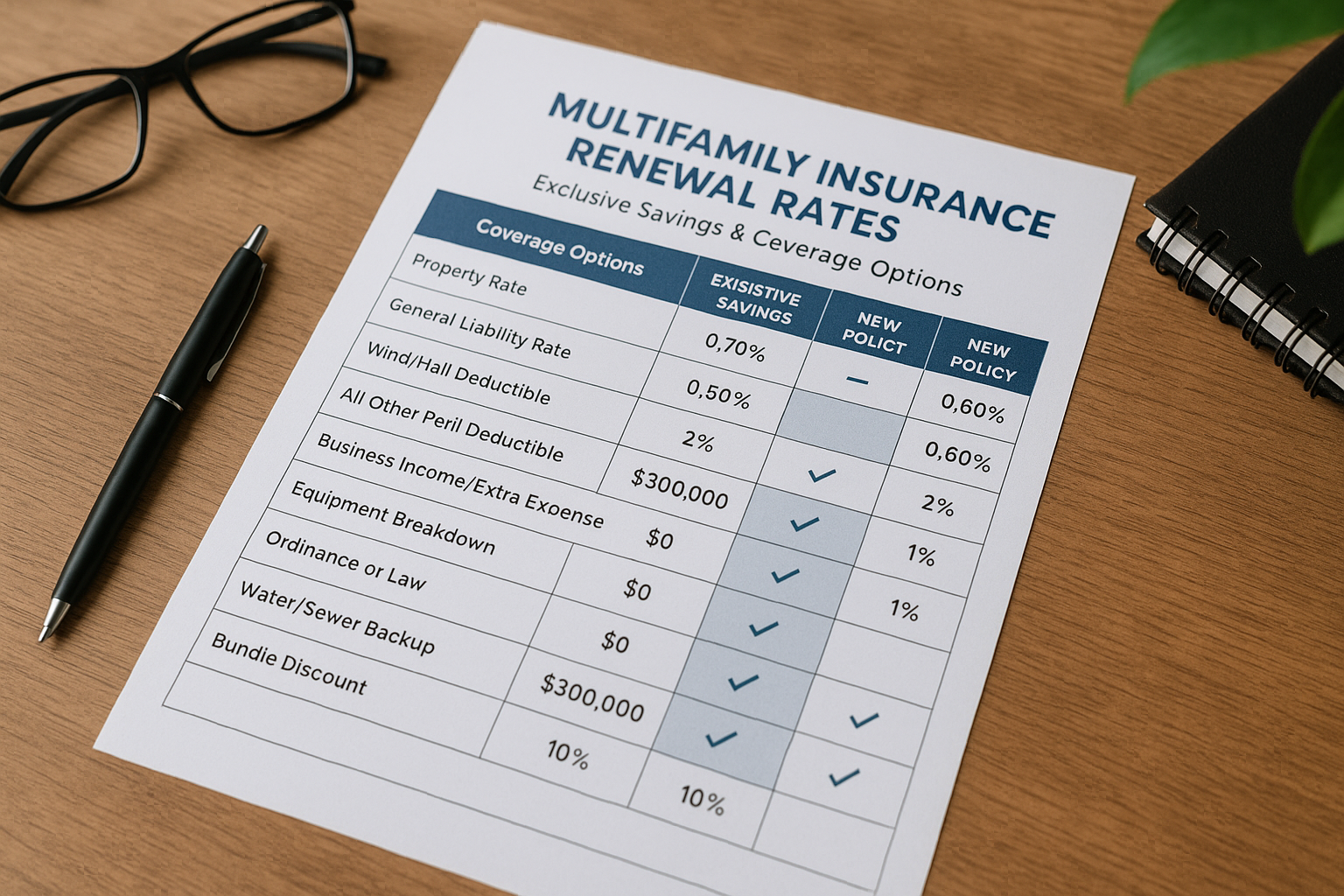

- Compare Multiple Quotes: By browsing options from different insurers, you can identify the most competitive rates and coverage options. Online platforms and insurance brokers can facilitate this process by providing access to multiple quotes in one place.

- Bundle Policies: Many insurers offer discounts for bundling multiple policies, such as property and liability insurance. This can lead to substantial savings while simplifying your insurance management.

- Implement Risk Management Practices: Reducing risks through measures such as installing security systems, regular maintenance, and tenant screening can lower your insurance premiums. Insurers often reward proactive risk management with better rates.

- Negotiate with Your Insurer: Don’t hesitate to negotiate terms with your current insurer. Highlight your loyalty, positive claims history, or improvements in property safety to secure a better renewal rate.

Real-World Savings and Examples

According to industry data, property owners who actively compare insurance quotes and implement risk management strategies can save up to 20% on their premiums1. For example, a multifamily property owner in Texas reported saving over $5,000 annually by switching insurers and bundling their policies2. These savings demonstrate the tangible benefits of being proactive in managing your insurance renewals.

Exploring Specialized Services

For those seeking tailored solutions, specialized insurance services can offer customized coverage options that address unique property needs. These services often provide expert advice and insights into emerging risks, helping property owners make informed decisions about their insurance coverage. By following the options available through these specialized providers, you can ensure that your multifamily property is adequately protected while optimizing your insurance costs.

Securing exclusive savings on multifamily insurance renewals is achievable through strategic planning and proactive management. By comparing quotes, bundling policies, implementing risk management practices, and exploring specialized services, you can enhance your coverage while reducing costs. Take the time to visit websites and search options to find the best deals and ensure your property is well-protected for the future.