Texas Windstorm Deductible Buyback Transforms Property Costs Today

If you're looking to transform your property costs and gain peace of mind, exploring Texas windstorm deductible buyback options could be your game-changer today—browse options to maximize your savings and protection.

Understanding Texas Windstorm Deductible Buyback

Texas is no stranger to severe weather conditions, especially in coastal regions where windstorms are a common threat. Property owners in these areas often face high insurance deductibles due to the increased risk of damage. The Texas Windstorm Deductible Buyback is a specialized insurance product designed to alleviate this financial burden by allowing property owners to reduce their out-of-pocket expenses when filing a windstorm claim.

How Does It Work?

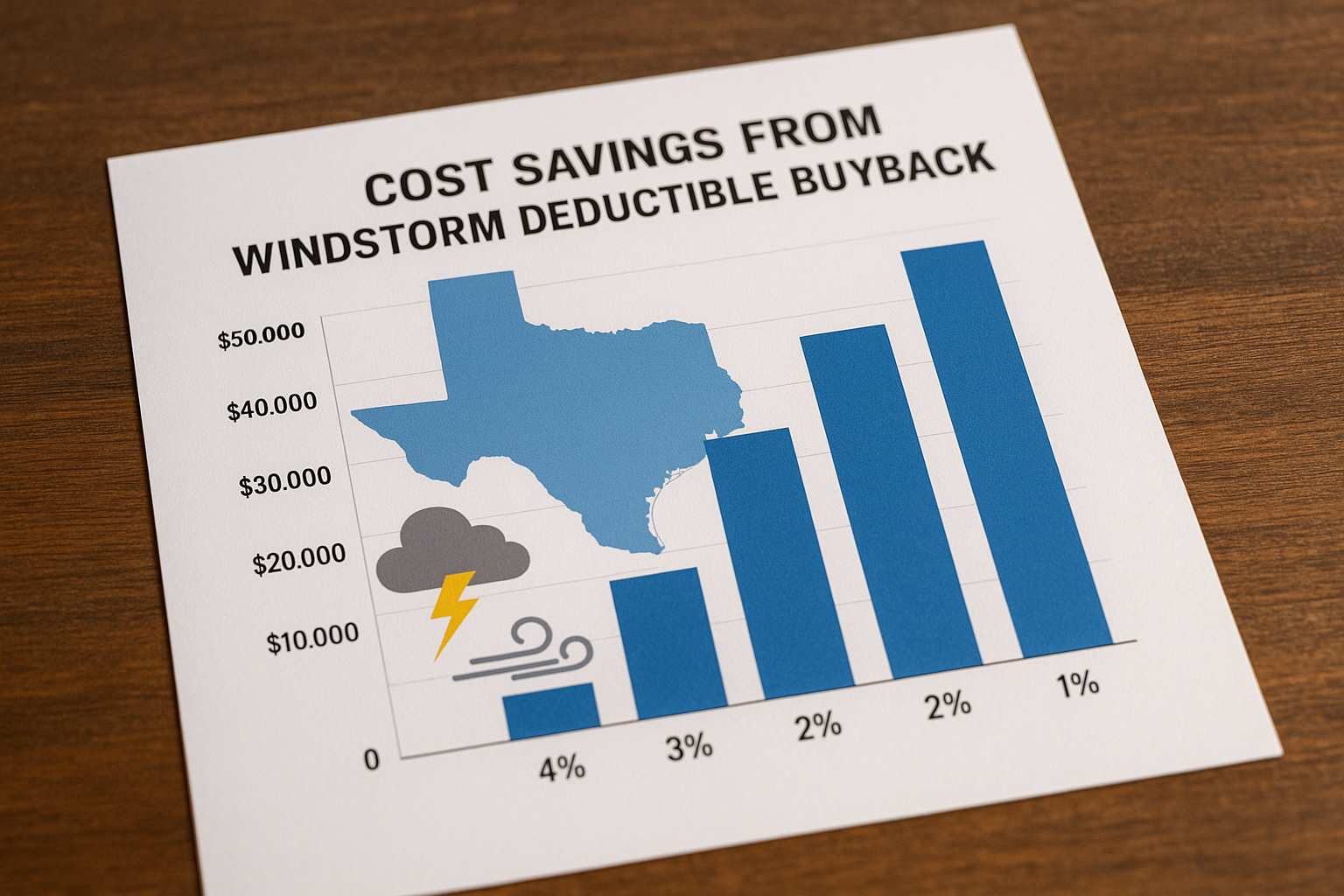

A windstorm deductible buyback policy essentially acts as a secondary insurance that covers the deductible portion of your primary windstorm insurance. For instance, if your windstorm policy has a 2% deductible on a $300,000 home, you would be responsible for $6,000 before your insurance kicks in. A buyback policy can reduce this amount significantly, sometimes to as low as $1,000, depending on the terms you select.

Financial Benefits and Cost Implications

The primary benefit of a windstorm deductible buyback is the reduction in upfront costs when a claim is made. This can be particularly advantageous for homeowners who might struggle with large, unexpected expenses. While the buyback policy itself comes with a premium, many find the peace of mind and financial predictability it offers to be well worth the investment.

According to industry data, the cost of a buyback policy can vary widely based on factors such as the location of the property, the value of the home, and the size of the deductible being covered. On average, these policies can range from a few hundred to a couple of thousand dollars annually1.

Real-World Impact

Consider the case of a homeowner in Galveston, Texas, who faced a $10,000 deductible after a major storm. By having a buyback policy in place, they reduced their immediate financial obligation to just $1,500, allowing them to focus on repairs without the added stress of financial strain. This kind of protection is especially crucial in a state where windstorms can cause widespread and costly damage.

Exploring Your Options

If you're considering a windstorm deductible buyback, it's essential to compare policies from different providers to find the best fit for your needs. Many insurance companies offer customizable options, allowing you to tailor coverage to your specific circumstances. Be sure to visit websites and consult with insurance professionals to understand the full range of options available to you2.

Additional Considerations

While a deductible buyback can offer substantial savings, it's important to weigh the cost of the policy against the potential savings. Additionally, ensure that the buyback policy terms align with your primary insurance policy to avoid any gaps in coverage. Some homeowners may also benefit from bundling this policy with other insurance products for potential discounts3.

A Texas windstorm deductible buyback policy can be a strategic financial tool for property owners in high-risk areas. By reducing the burden of large deductibles, it provides both financial relief and peace of mind. As you evaluate your options, consider consulting with insurance experts and browsing available plans to ensure you're making the most informed decision for your property and financial well-being.