Top Construction Loan Lenders Offering Game-Changing Financing Solutions

Unlock the potential of your next construction project by exploring top construction loan lenders who offer game-changing financing solutions, and see these options to transform your vision into reality.

Understanding Construction Loans

Construction loans are specialized financial products designed to cover the costs of building or renovating properties. Unlike traditional mortgages, these loans are typically short-term and offer flexible terms to accommodate the unique demands of construction projects. They usually cover the cost of land, labor, materials, and permits, providing a comprehensive solution for builders and developers.

Why Choose a Construction Loan?

A construction loan can be a critical tool in managing the financial aspects of your project. These loans often come with interest-only payment options during the construction phase, which can significantly ease cash flow. Furthermore, they provide the opportunity to finance both the construction and the land purchase in a single package, streamlining the borrowing process.

Top Lenders Offering Innovative Solutions

When it comes to choosing a lender, it's essential to consider those who offer tailored solutions that meet your specific needs. Here are some leading construction loan lenders known for their innovative financing options:

1. **Wells Fargo**: Known for its comprehensive loan options, Wells Fargo offers construction loans that can be customized to fit a variety of project sizes and types. Their expertise in the industry ensures that borrowers receive guidance throughout the construction process1.

2. **US Bank**: US Bank provides construction loans with competitive rates and flexible terms. They offer a streamlined application process and personalized service, making them a popular choice for both residential and commercial projects2.

3. **Chase**: Chase offers construction loans that are ideal for those looking to build their dream home. With options for both fixed and adjustable rates, borrowers can find a solution that fits their financial situation3.

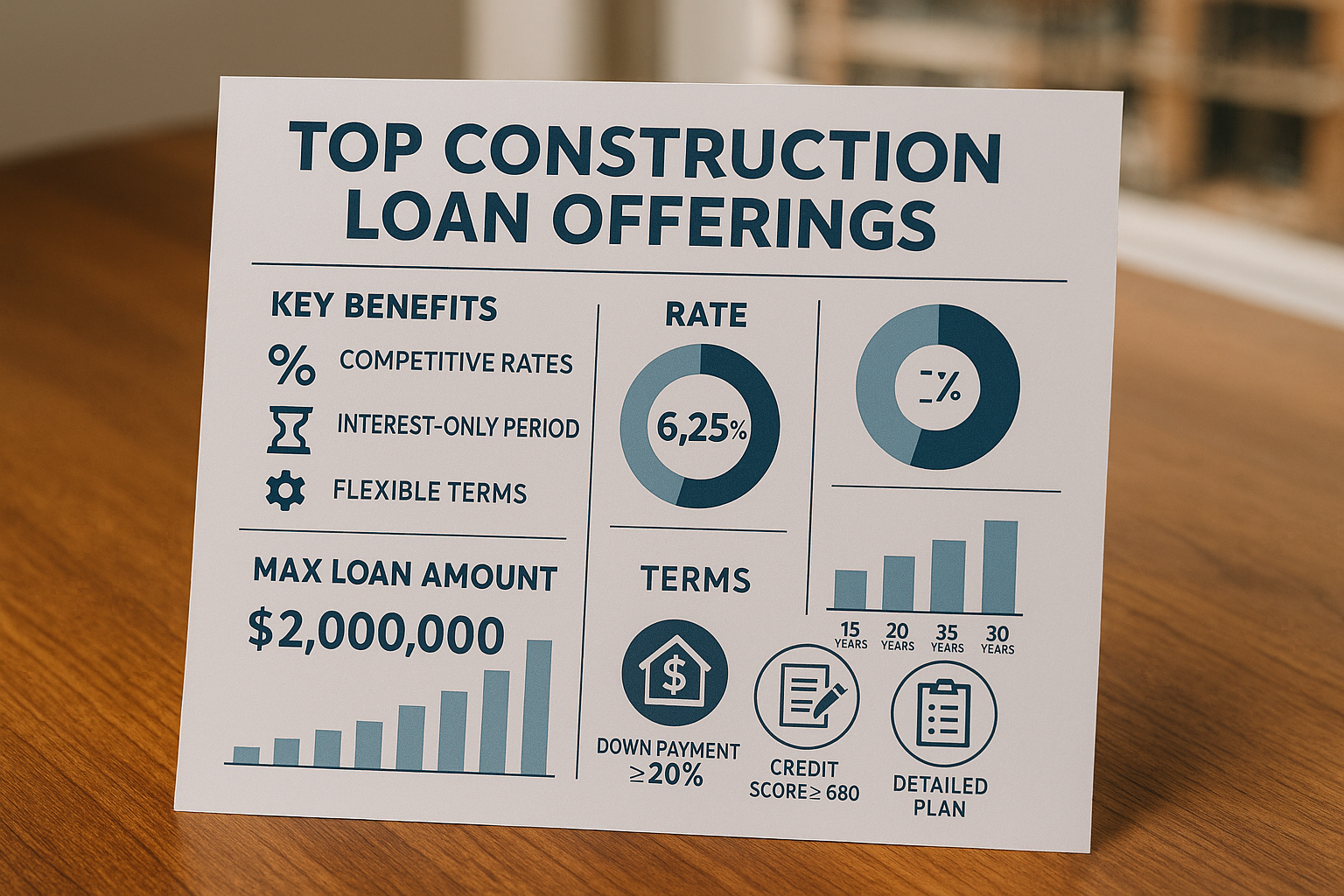

Key Benefits to Consider

Choosing the right construction loan lender can provide several advantages:

- **Customized Financing**: Lenders like the ones mentioned offer tailored solutions that can match the specific requirements of your project.

- **Expert Guidance**: With experienced lenders, you gain access to expert advice and support throughout the construction process.

- **Flexible Terms**: Many lenders provide flexible loan terms, allowing you to adjust your financing as your project progresses.

Exploring Your Options

If you're considering a construction loan, it's crucial to compare different lenders to find the best fit for your project. By visiting websites and browsing options, you can discover the unique offerings of each lender and make an informed decision.

Final Thoughts

Securing a construction loan from a reputable lender can be a game-changer for your project, offering both financial flexibility and expert support. By exploring the options available from top lenders, you can ensure that your construction project is both financially viable and successful. Whether you're building a new home or embarking on a commercial development, the right financing solution is just a click away.