Choose Wisely Guaranteed vs Indexed Life Fortune Awaits

If you're navigating the complex world of life insurance and want to secure your financial future, understanding the nuances between Guaranteed and Indexed Life Insurance can unlock opportunities you might not have considered—browse options and see these possibilities unfold.

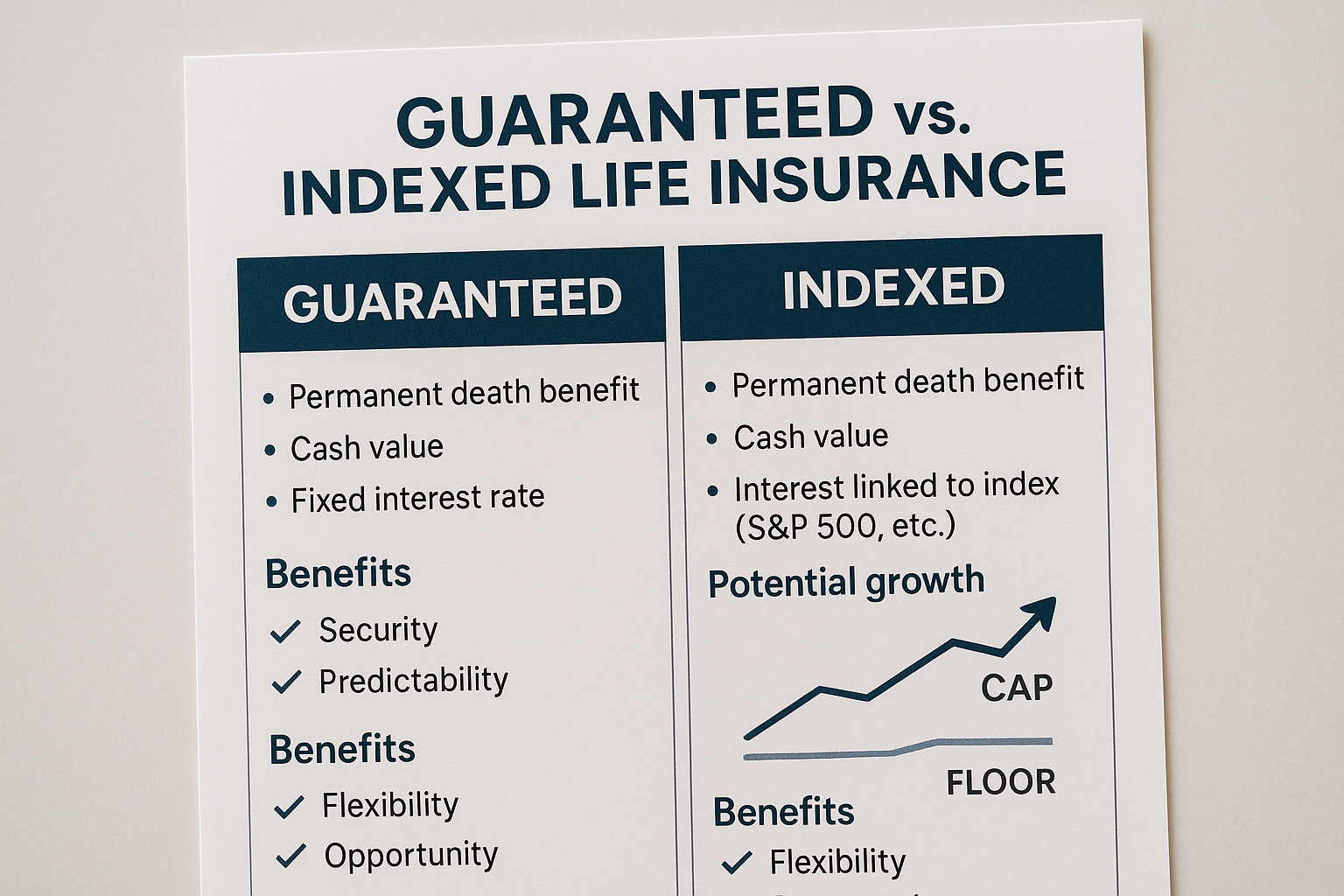

Understanding Guaranteed Life Insurance

Guaranteed life insurance, often known as whole life insurance, provides a straightforward approach to securing lifelong coverage. This type of policy guarantees a death benefit to your beneficiaries, as long as premiums are paid, and often includes a savings component that grows at a guaranteed rate. The primary benefit here is predictability; you know exactly what you're getting in terms of coverage and cash value growth. This makes it an appealing choice for those who prefer stability and a no-surprises approach to financial planning. Additionally, guaranteed policies can offer fixed premiums, meaning your payments won't increase over time1.