Secrets Insurance Companies Don't Share About Liability Limits 1 2 2

Unlocking the mysteries behind liability limits in insurance can empower you to make informed decisions that protect your assets, so why not browse options and see these opportunities for yourself?

Understanding Liability Limits in Insurance

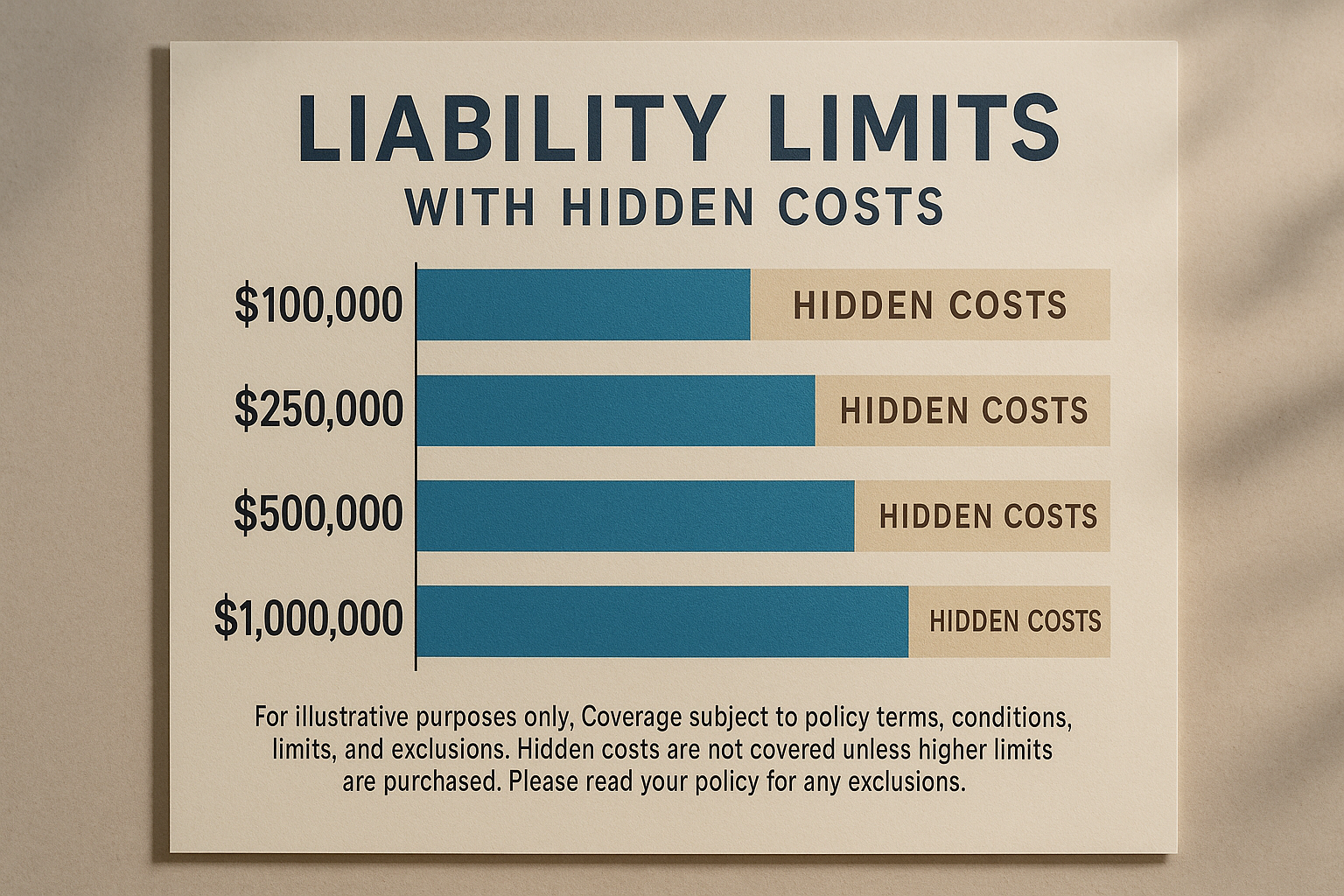

Liability limits are a crucial aspect of any insurance policy, yet they often remain shrouded in complexity. These limits dictate the maximum amount your insurance provider will pay in the event of a claim. Understanding them is vital for ensuring you are adequately protected without overpaying for coverage. Liability limits are typically broken down into two categories: per person and per incident. For instance, an auto insurance policy might have a $100,000 limit per person and a $300,000 limit per accident. This means if you are found liable for an accident, the insurance company will pay a maximum of $100,000 for each injured person, up to $300,000 total for the incident1.