Achieve Financial Freedom with Real Estate Loan DSCR

Unlock the door to financial freedom by mastering the nuances of Real Estate Loan DSCR, and as you explore these options, you'll discover the pathways to secure and sustainable wealth.

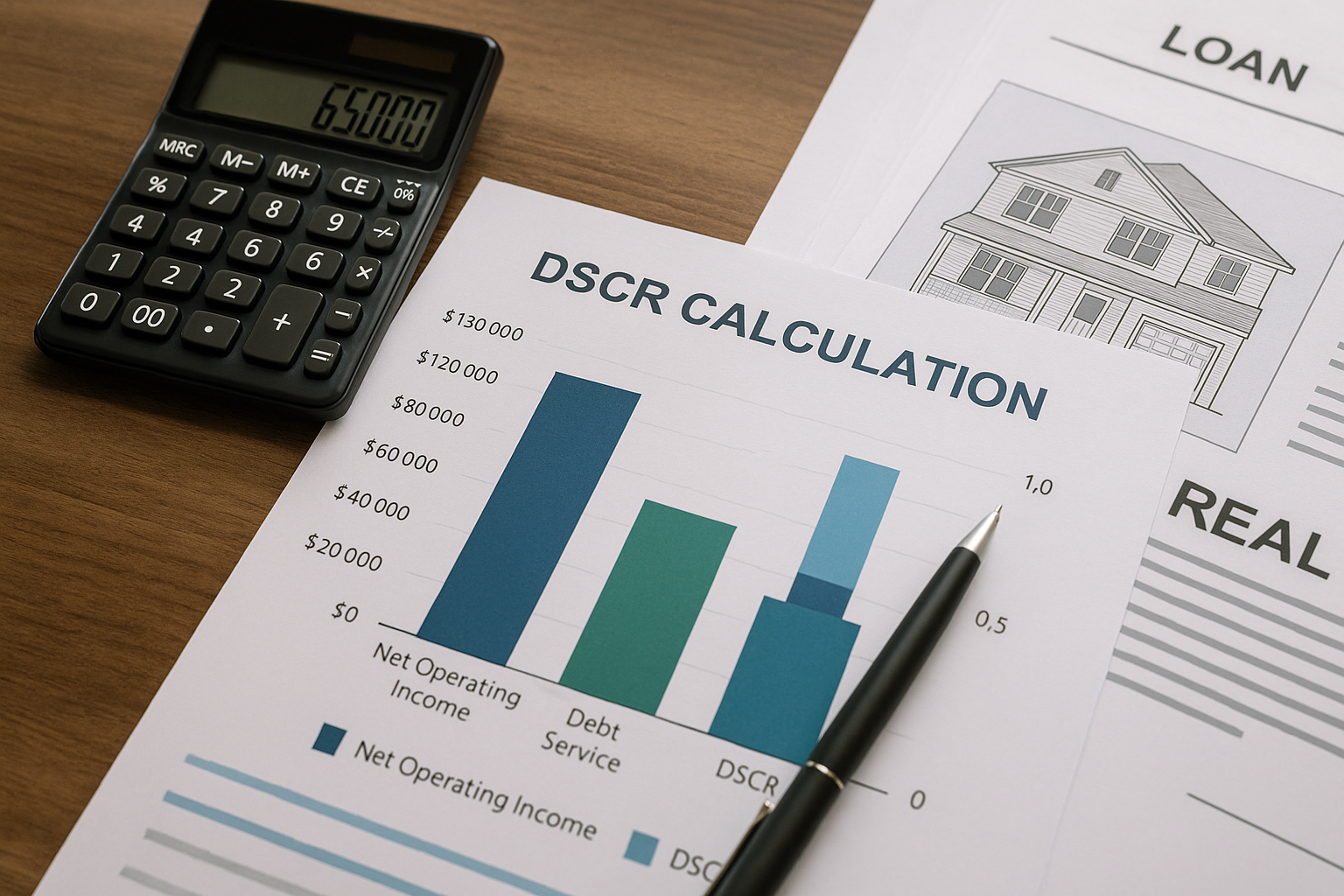

Understanding Real Estate Loan DSCR

Real estate investing has long been a proven method for achieving financial independence, with the Debt Service Coverage Ratio (DSCR) playing a critical role in securing loans for property investments. DSCR is a financial metric used by lenders to assess an investor's ability to generate enough income to cover their debt obligations. A higher DSCR indicates a stronger ability to repay loans, which can lead to more favorable borrowing terms. This makes it an essential factor for investors aiming to maximize their real estate portfolios.