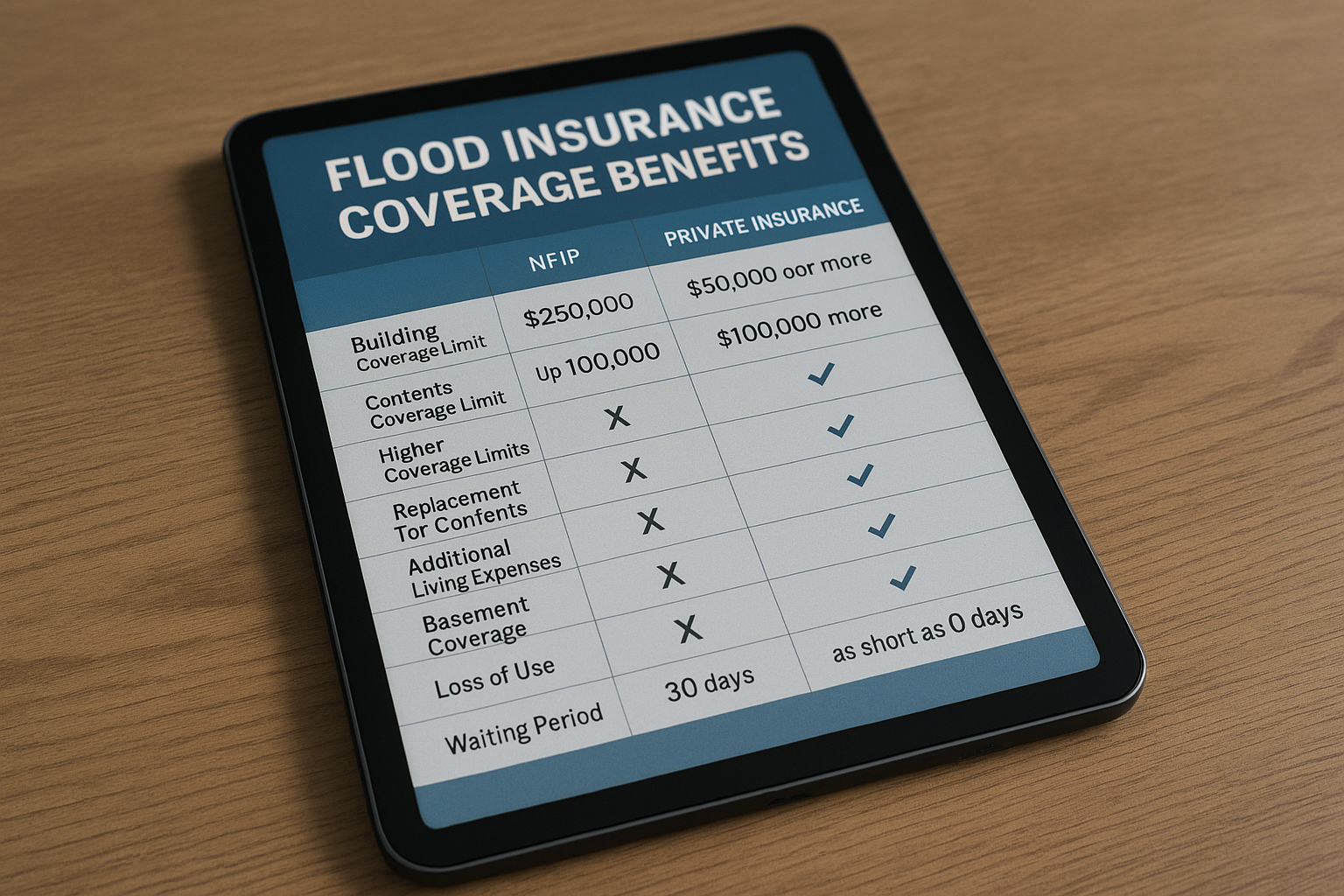

Compare NFIP and Private Get Surprisingly Better Coverage

If you're looking to maximize your flood insurance coverage and possibly save money, it's time to browse options and discover the surprising benefits of comparing NFIP and private insurance plans.

Understanding the NFIP

The National Flood Insurance Program (NFIP), managed by the Federal Emergency Management Agency (FEMA), has been the cornerstone of flood insurance for millions of Americans. Established in 1968, the NFIP provides coverage for properties in flood-prone areas, offering protection against the financial devastation that floods can cause. One of the key benefits of the NFIP is its standardized policy structure, which ensures consistent coverage terms and conditions across the board1.

While the NFIP is widely accessible, it has limitations. Coverage caps are set at $250,000 for residential buildings and $100,000 for contents, which may not be sufficient for high-value properties. Additionally, the NFIP policies have a 30-day waiting period before they take effect, which can be a critical drawback for those seeking immediate coverage2.