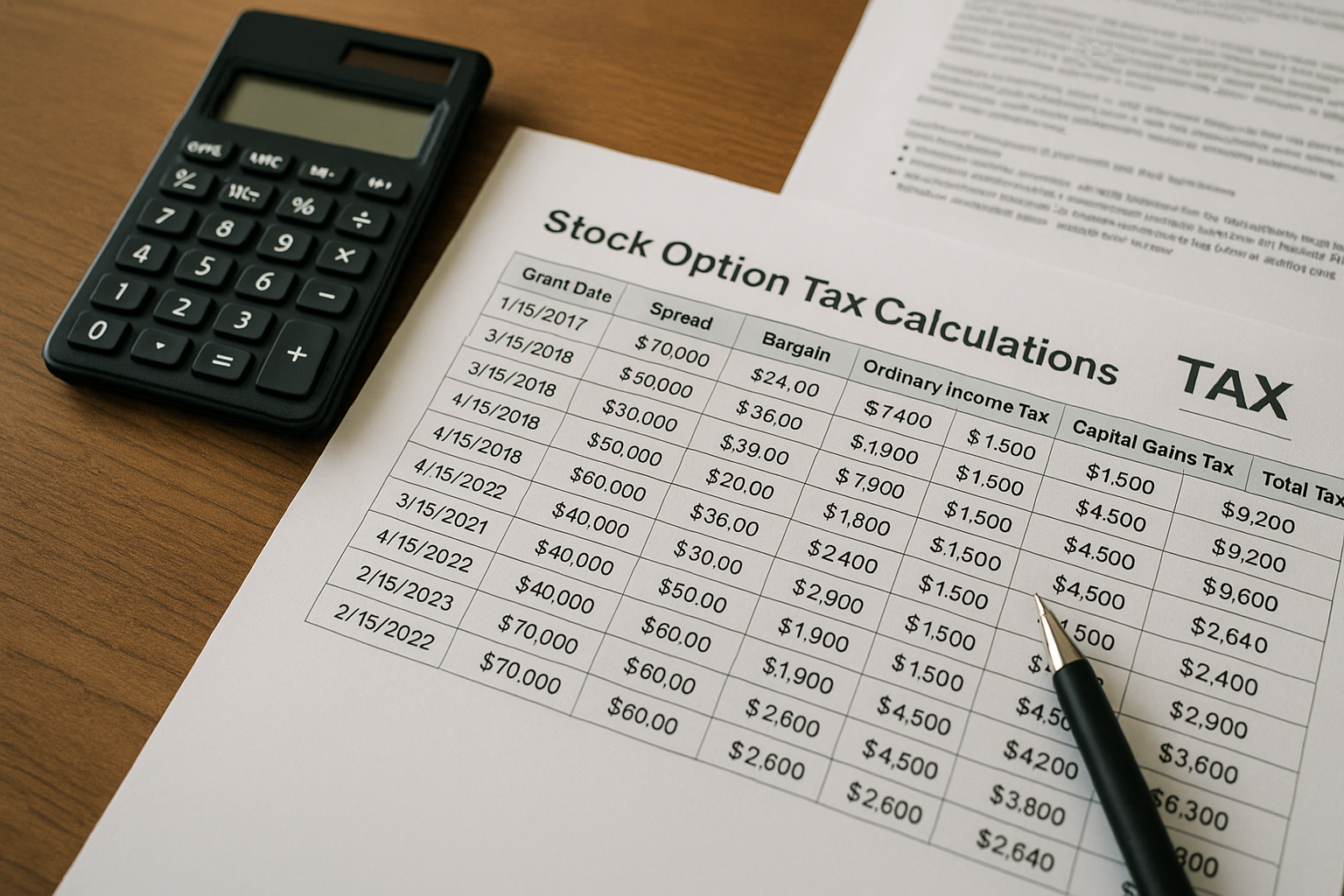

Efficiently Maximize Gains With Tax Planning For Stock Options

Efficient tax planning for stock options can significantly boost your financial gains, and by browsing options or visiting websites dedicated to this topic, you can uncover strategies to maximize your returns while minimizing liabilities.

Understanding Stock Options

Stock options are a popular form of employee compensation, granting the right to buy company stock at a predetermined price. They are primarily divided into two types: Incentive Stock Options (ISOs) and Non-Qualified Stock Options (NSOs). ISOs offer tax benefits but come with strict rules, while NSOs are more flexible but taxed as regular income1. Understanding the distinctions between these options is crucial for effective tax planning.