Effortless 401k Rollover to IRA Strategy Revealed

Effortlessly transforming your 401(k) into an IRA can unlock a world of benefits, and as you browse options or visit websites, you'll discover seamless strategies to maximize your retirement savings.

Understanding the 401(k) to IRA Rollover

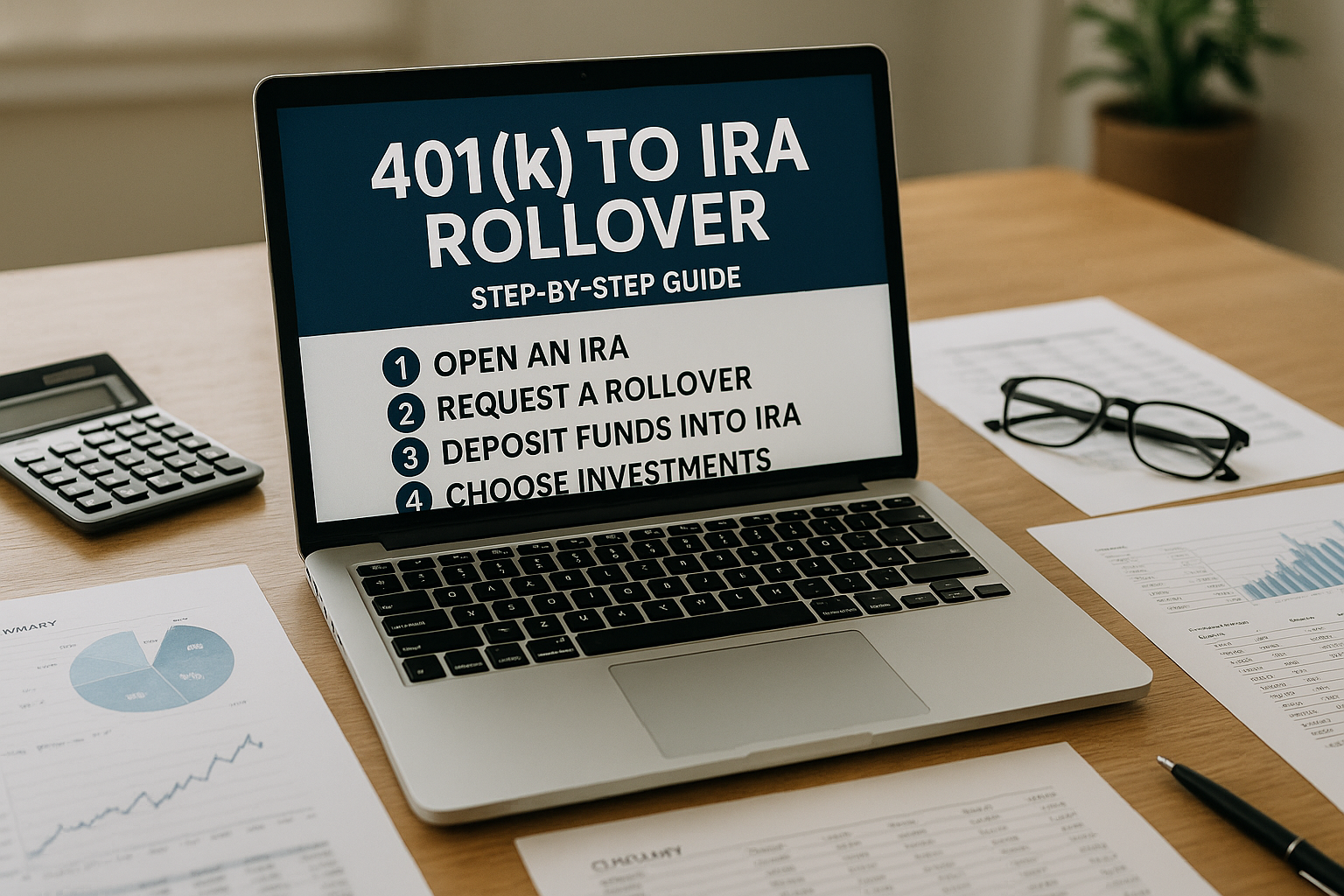

Transitioning your 401(k) into an IRA is a strategic move that offers you greater control over your investments, potentially lower fees, and a wider array of investment options. This process, often referred to as a "rollover," allows you to move funds from your employer-sponsored retirement plan to an individual retirement account without incurring taxes or penalties, provided it’s done correctly1.

The primary advantage of rolling over your 401(k) to an IRA is flexibility. Unlike a 401(k), which may have limited investment options, IRAs often provide access to a broad range of stocks, bonds, mutual funds, and ETFs. This expanded choice can be crucial for diversifying your portfolio and managing risk according to your personal financial goals.