Florida's Secret to Thriving with Subprime Auto Loans

Are you ready to unlock the secrets of thriving with subprime auto loans in Florida and discover how you can effectively navigate your options to secure the best deals by browsing options and exploring tailored solutions?

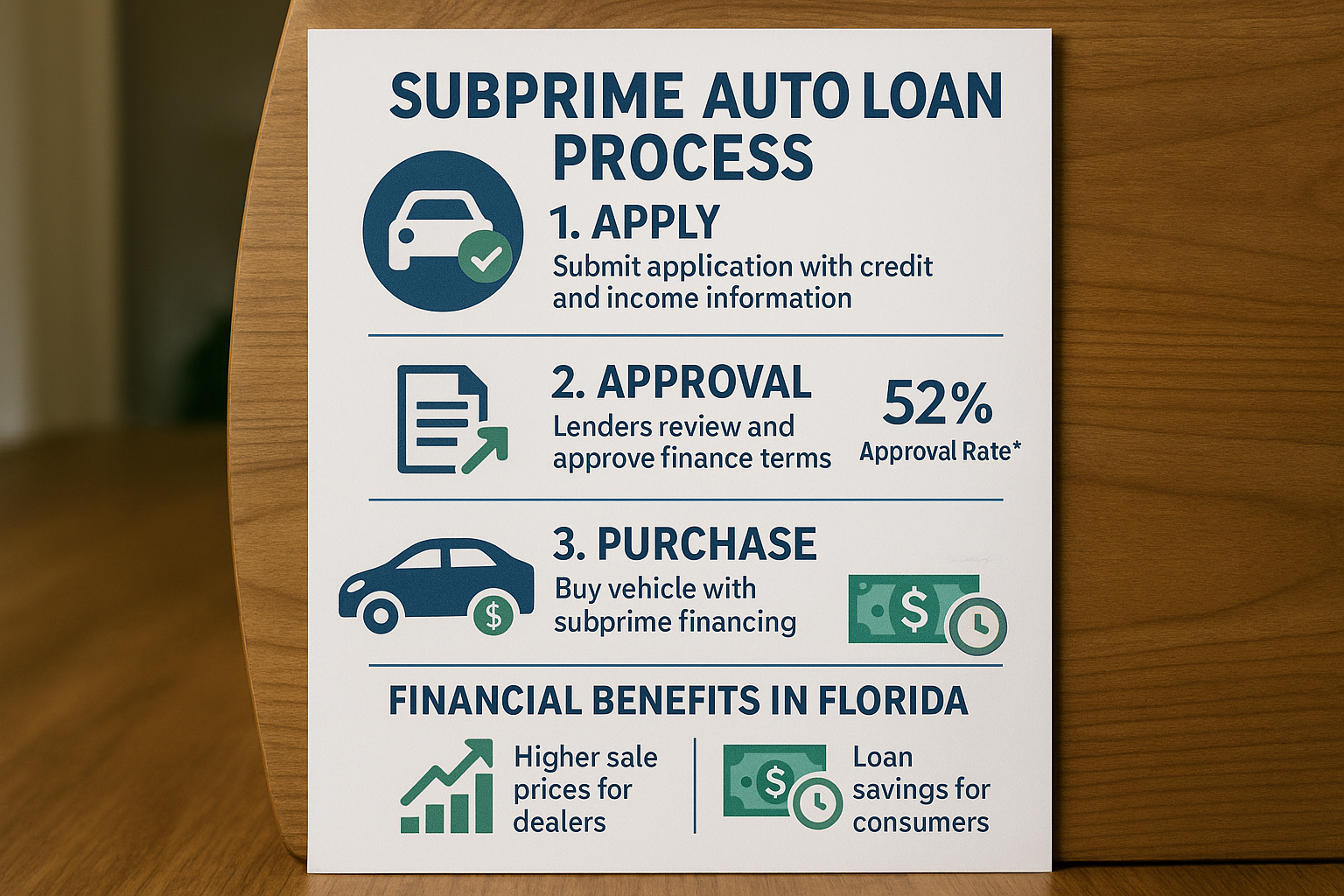

Understanding Subprime Auto Loans in Florida

Subprime auto loans are designed for borrowers with less-than-perfect credit scores, typically below 670, and they have become a significant part of the auto financing landscape in Florida. These loans offer individuals with credit challenges the opportunity to purchase a vehicle, which can be a crucial step in rebuilding credit and improving financial stability. The key to thriving with subprime auto loans lies in understanding the terms, interest rates, and potential pitfalls associated with them.