Private Equity Firms Master Fiduciary Broker Comparison Secrets

Unlocking the secrets of how private equity firms expertly compare fiduciary brokers can lead you to a treasure trove of financial opportunities and strategic insights, so don't miss the chance to browse options and see these valuable strategies in action.

Understanding Private Equity Firms and Their Fiduciary Broker Needs

Private equity firms are investment managers that pool capital from high-net-worth individuals or institutional investors to acquire equity ownership in companies. These firms aim to improve the companies they invest in and eventually sell them at a profit. The role of fiduciary brokers in this context is crucial, as they ensure that the investments are managed in the best interest of the clients.

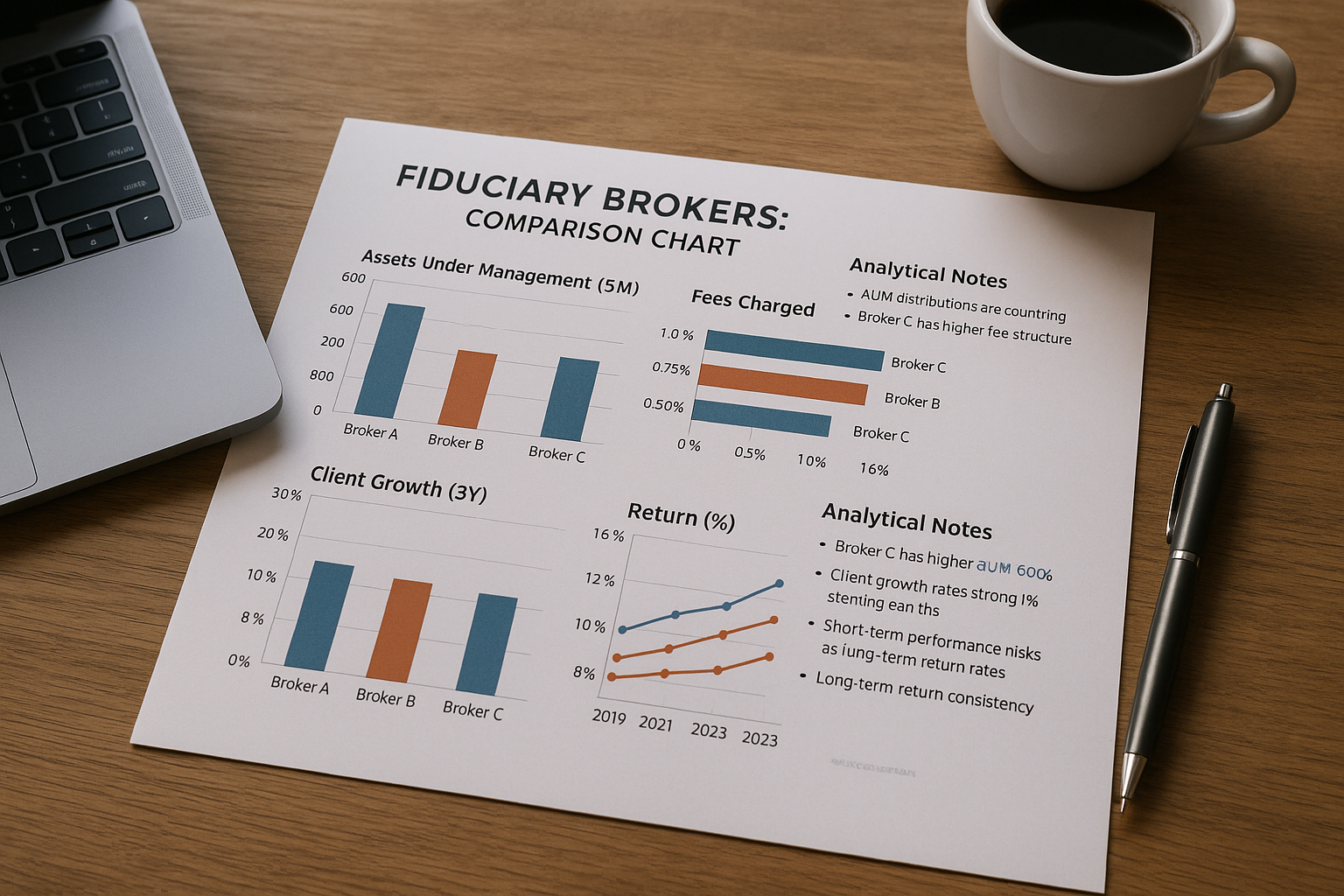

Fiduciary brokers act as trusted advisors, offering insights and strategies that align with the investor's goals. They are bound by a legal obligation to prioritize their clients' interests, which is why private equity firms place significant emphasis on selecting the right broker. The comparison of fiduciary brokers involves assessing their expertise, track record, fee structures, and the range of services they offer.