Secure Top Fiduciary Insurance Exclusively for Accounting Firms

When it comes to protecting your accounting firm, securing top fiduciary insurance is not just a wise choice—it's a critical necessity, and by taking the time to browse options, you can ensure you're getting the best coverage tailored to your specific needs.

Understanding Fiduciary Insurance for Accounting Firms

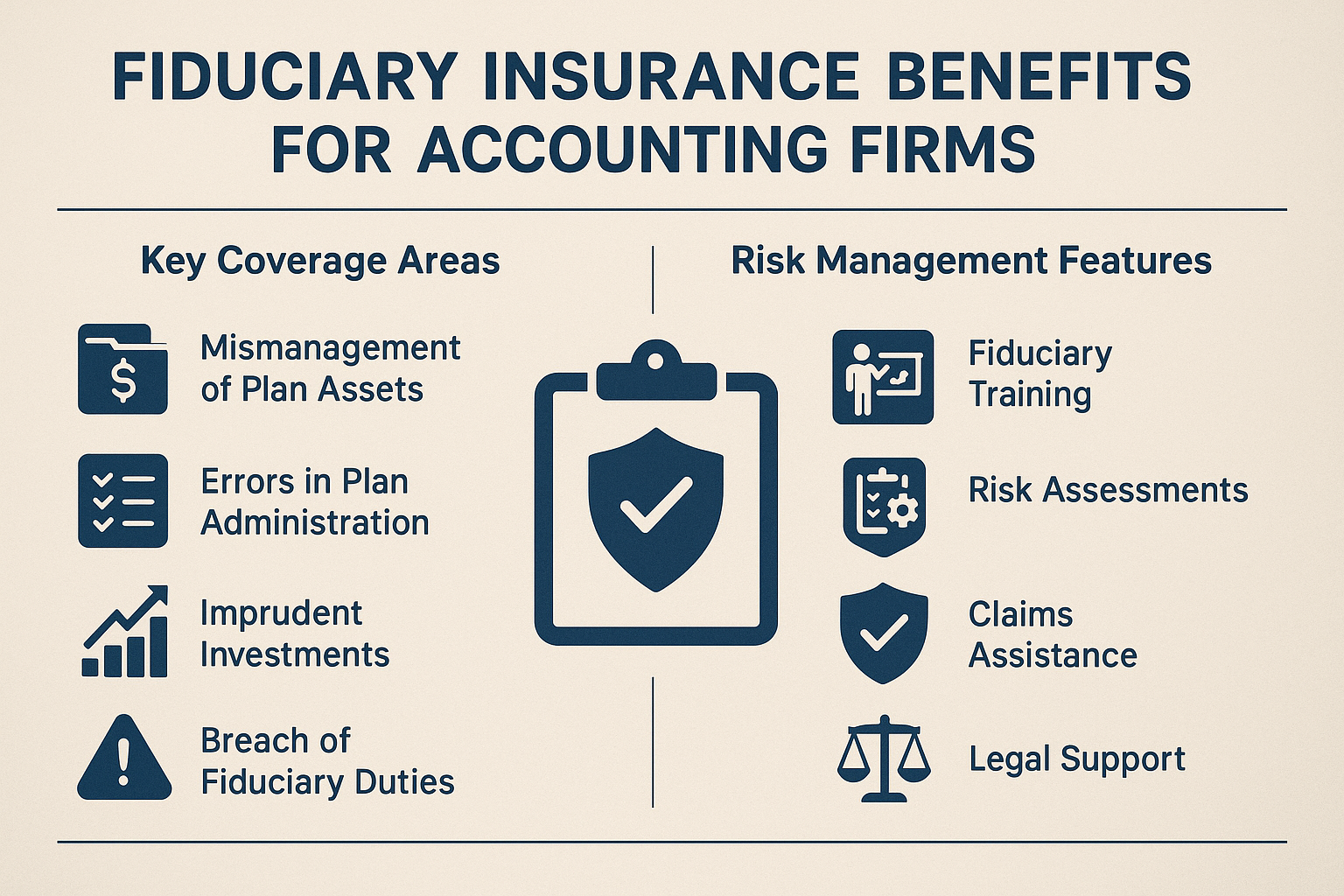

Fiduciary insurance is designed to protect businesses that manage employee benefit plans, including accounting firms, from claims of mismanagement. As an accounting firm, you are entrusted with handling sensitive financial information and guiding clients through complex financial landscapes. This insurance provides a safety net against potential lawsuits stemming from alleged breaches of fiduciary duty, such as errors in plan administration, conflicts of interest, or mismanagement of funds.

With the rise in litigation related to fiduciary responsibilities, having this insurance is increasingly crucial. According to a report by the U.S. Department of Labor, fiduciary breaches can lead to significant financial penalties and legal costs1. Thus, ensuring your firm is covered can safeguard against these potential financial burdens.