Slashing Bills Property Tax Appeal Service Reveals Secret

Are you tired of skyrocketing property taxes and ready to explore options for reducing your financial burden? Discover how Slashing Bills Property Tax Appeal Service can reveal the secrets to significantly lowering your property tax bills, and see these options that could save you hundreds or even thousands of dollars annually.

Understanding Property Tax Appeals

Property taxes are a significant expense for homeowners, often representing a considerable portion of annual household budgets. However, many property owners are unaware that they might be overpaying due to inaccurate property assessments. By understanding the property tax appeal process, you can take proactive steps to challenge and potentially reduce your tax obligations.

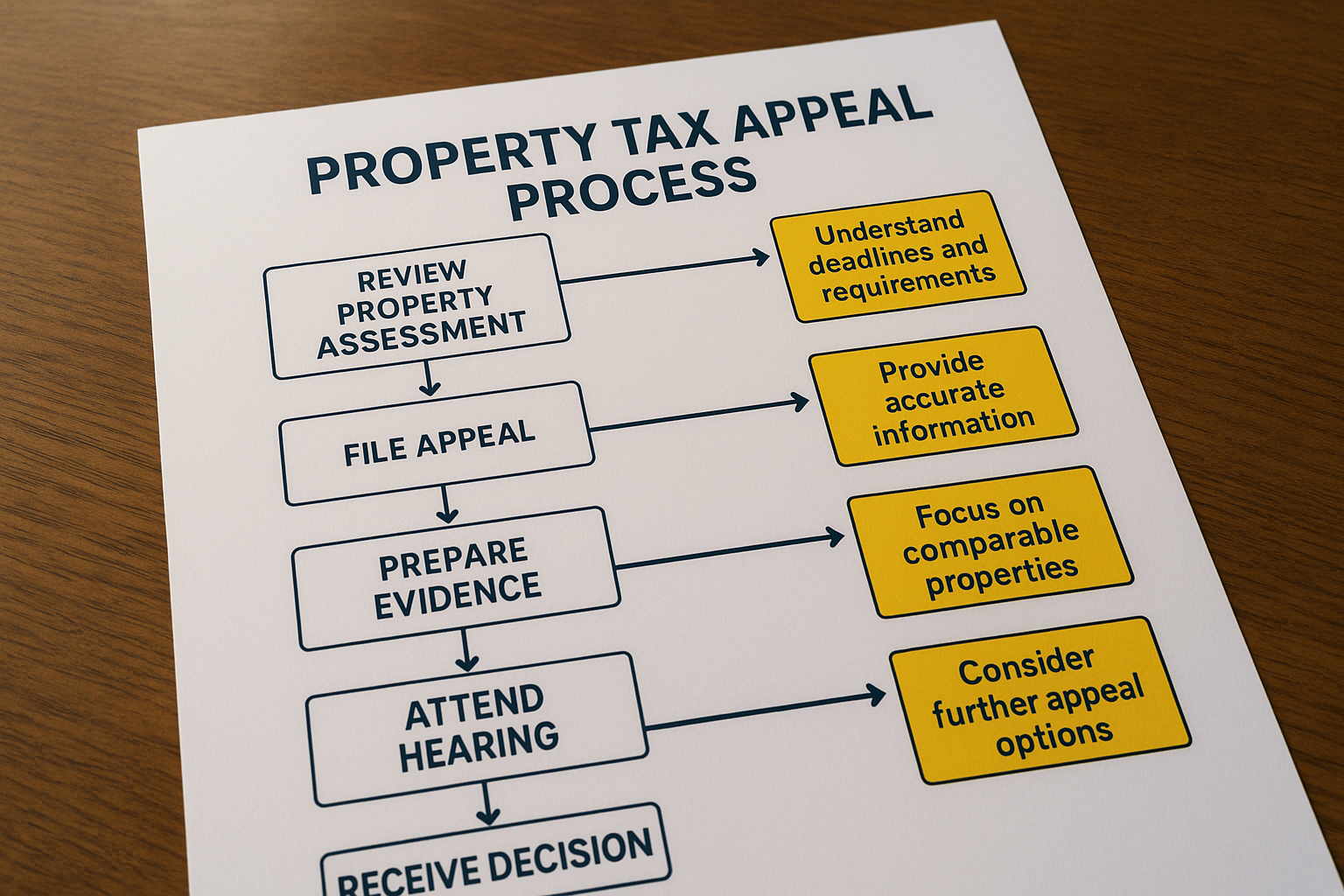

The property tax appeal process involves reviewing your property's assessed value and comparing it to market values or similar properties in your area. If discrepancies are found, you can file an appeal with your local tax assessor's office. This process can be complex and time-consuming, which is why services like Slashing Bills offer specialized assistance to streamline and simplify the appeal process for homeowners.