October Lending Platform Offers Secret Financial Breakthrough

Unlock a world of financial growth by discovering how October lending platforms offer you groundbreaking opportunities to secure your financial future—browse options now to start your journey.

The Rise of Innovative Lending Platforms

In recent years, the financial landscape has been transformed by the emergence of innovative lending platforms that promise to redefine how you access funds. These platforms offer a seamless, digital-first approach to borrowing, making it easier than ever to secure loans for personal or business needs. With the advent of peer-to-peer (P2P) lending, crowdsourcing, and other fintech innovations, you now have access to a wider array of options that can be tailored to your specific financial situation.

October, previously known as Lendix, is one such platform that has been at the forefront of this revolution. It specializes in connecting borrowers with investors, bypassing traditional banking systems to offer more competitive rates and flexible terms. This model not only democratizes access to credit but also provides investors with new avenues for portfolio diversification and potential returns.

Benefits of Using October Lending Platform

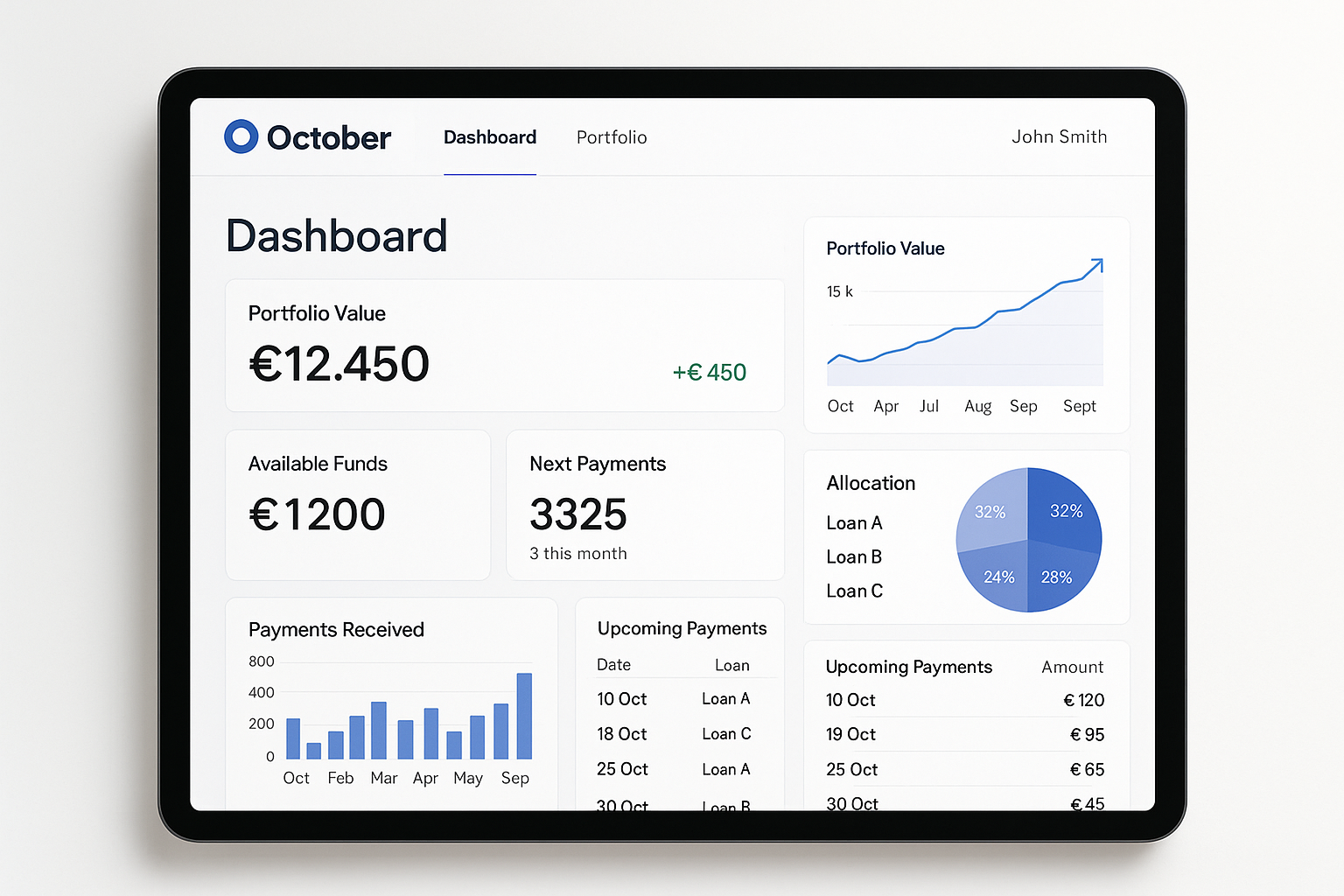

One of the standout features of the October lending platform is its user-friendly interface, which allows you to easily compare loan options and terms. You can quickly search options to find the best fit for your financial needs. The platform offers loans ranging from €30,000 to €5 million, catering to both small businesses and larger enterprises seeking expansion capital1.

Moreover, October's streamlined process significantly reduces the time it takes to secure a loan. Traditional bank loans can take weeks or even months to process, but with October, you can often receive funding in just a matter of days. This speed and efficiency can be crucial for businesses looking to capitalize on timely opportunities or manage cash flow more effectively.

Financial Breakthroughs Through Competitive Rates

October's competitive interest rates are another compelling reason to consider using their platform. By leveraging technology to assess risk more accurately, October can often offer lower rates than traditional banks. This means you can reduce your borrowing costs and allocate more resources to growth and innovation within your business.

Additionally, the platform provides transparency in its operations, allowing you to clearly understand the terms and conditions of your loan. This transparency helps you make informed decisions, ensuring that you're fully aware of the commitments you're entering into.

Exploring Specialized Solutions

For businesses in niche markets or those with unique financing needs, October offers specialized solutions that can be customized to suit specific requirements. Whether you're looking to finance a new project, invest in equipment, or manage working capital, the platform's flexible loan structures can accommodate a variety of scenarios. By visiting websites like October, you can explore these tailored solutions and find the ideal financial strategy for your business.

Furthermore, October's community of investors provides an additional layer of support and expertise. By connecting with these investors, you can gain insights into market trends and potential growth opportunities, enhancing your strategic planning and decision-making process.

As you consider your financial options, October's lending platform stands out as a powerful tool for achieving your goals. By offering competitive rates, flexible terms, and a streamlined borrowing process, it provides you with the resources you need to drive growth and success. Explore the opportunities available through October and other innovative lending platforms to take control of your financial future today.