Transform Your Equity Using HELOC Primary Residence Secrets

Transform your financial future by unlocking the hidden potential of your home's equity through Home Equity Line of Credit (HELOC) strategies, and explore options that could lead to significant savings and growth opportunities.

Understanding HELOC: A Powerful Financial Tool

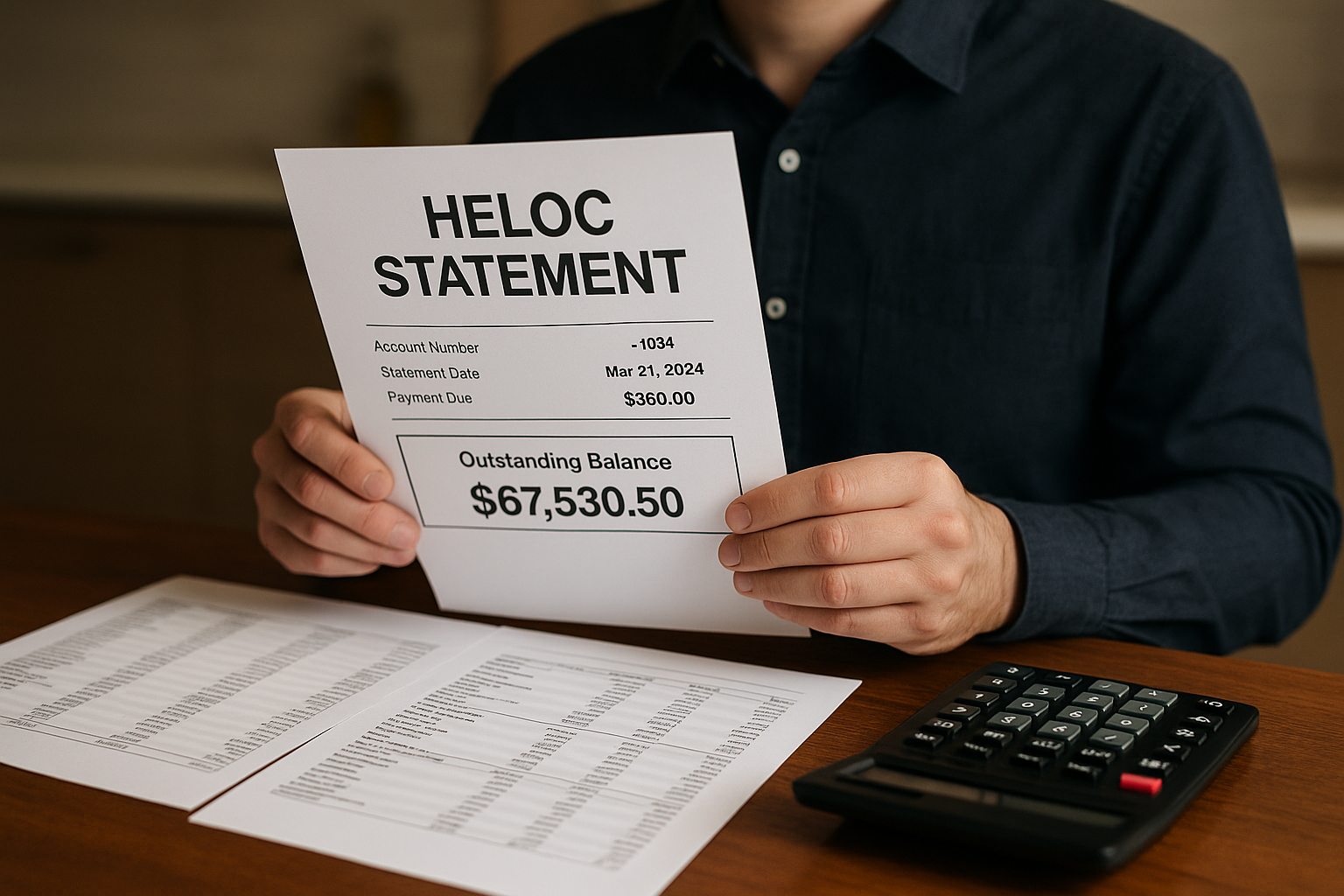

A Home Equity Line of Credit (HELOC) is a flexible, revolving line of credit that allows homeowners to borrow against the equity of their primary residence. Unlike a traditional loan, a HELOC provides the freedom to borrow up to a certain limit, repay, and borrow again, similar to a credit card. This flexibility can be particularly beneficial for managing expenses, consolidating debt, or funding home improvements, which can further increase your property's value.

The Benefits of Leveraging HELOC

One of the primary advantages of a HELOC is its typically lower interest rates compared to other forms of credit, such as personal loans or credit cards. This makes it an attractive option for homeowners looking to reduce interest expenses on existing debt. Additionally, the interest paid on a HELOC may be tax-deductible, though it's important to consult with a tax advisor to understand your specific situation1.

HELOCs also offer the opportunity to improve your financial liquidity. By converting a portion of your home equity into cash, you can invest in other opportunities, such as starting a business or investing in stocks, potentially increasing your overall wealth. It's essential to browse options and carefully assess the terms and conditions offered by various lenders to find the best fit for your financial goals.

How to Utilize HELOC for Maximum Benefit

To effectively use a HELOC, start by evaluating the amount of equity available in your home. Typically, lenders allow you to borrow up to 85% of your home's appraised value minus the amount you owe on your mortgage2. Once you have a clear understanding of your borrowing capacity, it's time to strategically plan how you'll use the funds.

Consider using a HELOC for home renovations that can increase your property value, such as kitchen or bathroom upgrades. These improvements not only enhance your living space but can also provide a solid return on investment when it comes time to sell. Additionally, consolidating high-interest debt into a HELOC can streamline your payments and reduce overall interest costs, freeing up more funds for savings or investments.

Potential Risks and Considerations

While a HELOC offers numerous benefits, it's crucial to be aware of potential risks. Since your home serves as collateral, failure to make payments could result in foreclosure. Therefore, it's essential to have a solid repayment plan in place and avoid borrowing more than you can comfortably repay.

Interest rates on HELOCs are often variable, meaning they can fluctuate over time. This can lead to increased payments if rates rise, so it's important to prepare for potential changes in your monthly obligations. Some lenders may offer fixed-rate options, which can provide more predictable payments and peace of mind3.

Exploring HELOC Options

When considering a HELOC, it's wise to compare offers from multiple lenders. Factors to consider include interest rates, fees, repayment terms, and any promotional deals that may be available. Some lenders offer introductory rates or reduced fees for a limited time, so it's beneficial to search options and see these offers on various financial institution websites.

For homeowners interested in unlocking their home's equity, visiting websites of reputable lenders can provide valuable insights into the specific terms and conditions available. Many lenders offer online tools to estimate potential borrowing limits and monthly payments, helping you make an informed decision.

In summary, a HELOC can be a versatile and powerful financial tool for homeowners looking to leverage their equity. By understanding the benefits and risks, and by carefully evaluating available options, you can make strategic decisions that enhance your financial well-being and open the door to new opportunities.