Maximize Health Savings with Top Medicare Supplement Plans

Discover how you can save significantly on healthcare costs by exploring and comparing top Medicare Supplement Plans today, and browse options to find the perfect fit for your needs.

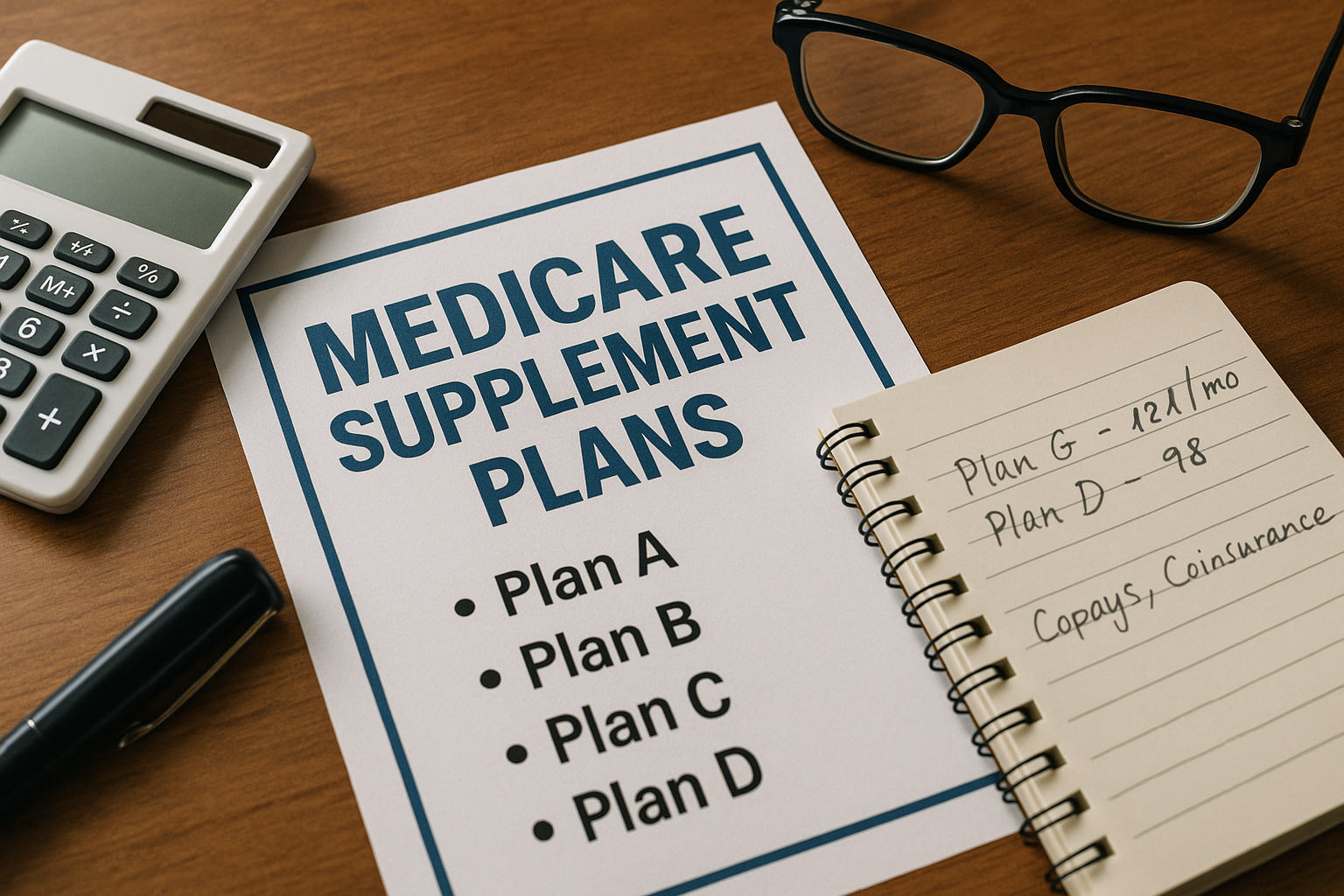

Understanding Medicare Supplement Plans

Medicare Supplement Plans, also known as Medigap, are designed to help cover some of the healthcare costs that Original Medicare doesn't cover, such as copayments, coinsurance, and deductibles. These plans are offered by private insurance companies and can provide peace of mind by reducing out-of-pocket expenses, making it easier for you to manage your healthcare budget.

Types of Medicare Supplement Plans

There are ten standardized Medigap plans available in most states, labeled A through N. Each plan offers a different combination of benefits, allowing you to choose the one that best suits your healthcare needs and financial situation. For example, Plan F is known for offering the most comprehensive coverage, while Plan G is a popular choice for those looking to balance cost and coverage1.

Benefits of Medicare Supplement Plans

One of the primary benefits of Medicare Supplement Plans is the potential for significant cost savings. By covering expenses that Original Medicare does not, these plans can help you avoid unexpected medical bills. Additionally, Medigap plans offer the flexibility to see any doctor or specialist who accepts Medicare, without the need for referrals2.

Cost Considerations

While Medicare Supplement Plans can offer substantial savings, it's essential to consider the premiums associated with these policies. Premiums can vary based on factors such as your age, location, and the specific plan you choose. On average, Medigap premiums range from $50 to $300 per month3. It's crucial to evaluate your healthcare needs and budget to determine which plan provides the best value.

How to Choose the Right Plan

Selecting the right Medicare Supplement Plan involves assessing your healthcare needs, understanding the specific benefits of each plan, and comparing costs. Start by analyzing your current medical expenses and estimating future needs. Once you have a clear picture, you can search options and compare plans to find one that aligns with your health requirements and financial goals. Remember to consider any potential changes in your health or financial situation that could impact your choice.

Additional Resources and Opportunities

For those seeking more personalized advice, consider consulting with a licensed insurance agent who specializes in Medicare plans. They can provide insights into the latest options and help you navigate the complexities of choosing a Medigap policy. Additionally, many online resources offer tools to compare plans and calculate potential savings, making it easier to make an informed decision.

Maximizing your health savings with the right Medicare Supplement Plan requires careful consideration and comparison of available options. By understanding the different types of plans and their associated costs and benefits, you can make an informed choice that supports your healthcare needs and financial well-being. Visit websites that offer detailed comparisons and expert guidance to ensure you choose the best plan for your situation.