Unveil the Secrets to Home Insurance Mastery Today

Unlock the potential to protect your home and finances by mastering home insurance today, and discover how you can browse options to find the best coverage tailored to your needs and budget.

Understanding Home Insurance: The Essentials

Home insurance is more than just a policy; it's a safety net that protects one of your most valuable assets—your home. It covers various risks, including damage from natural disasters, theft, and liability for accidents that occur on your property. Understanding the intricacies of home insurance can save you money and provide peace of mind.

Types of Home Insurance Coverage

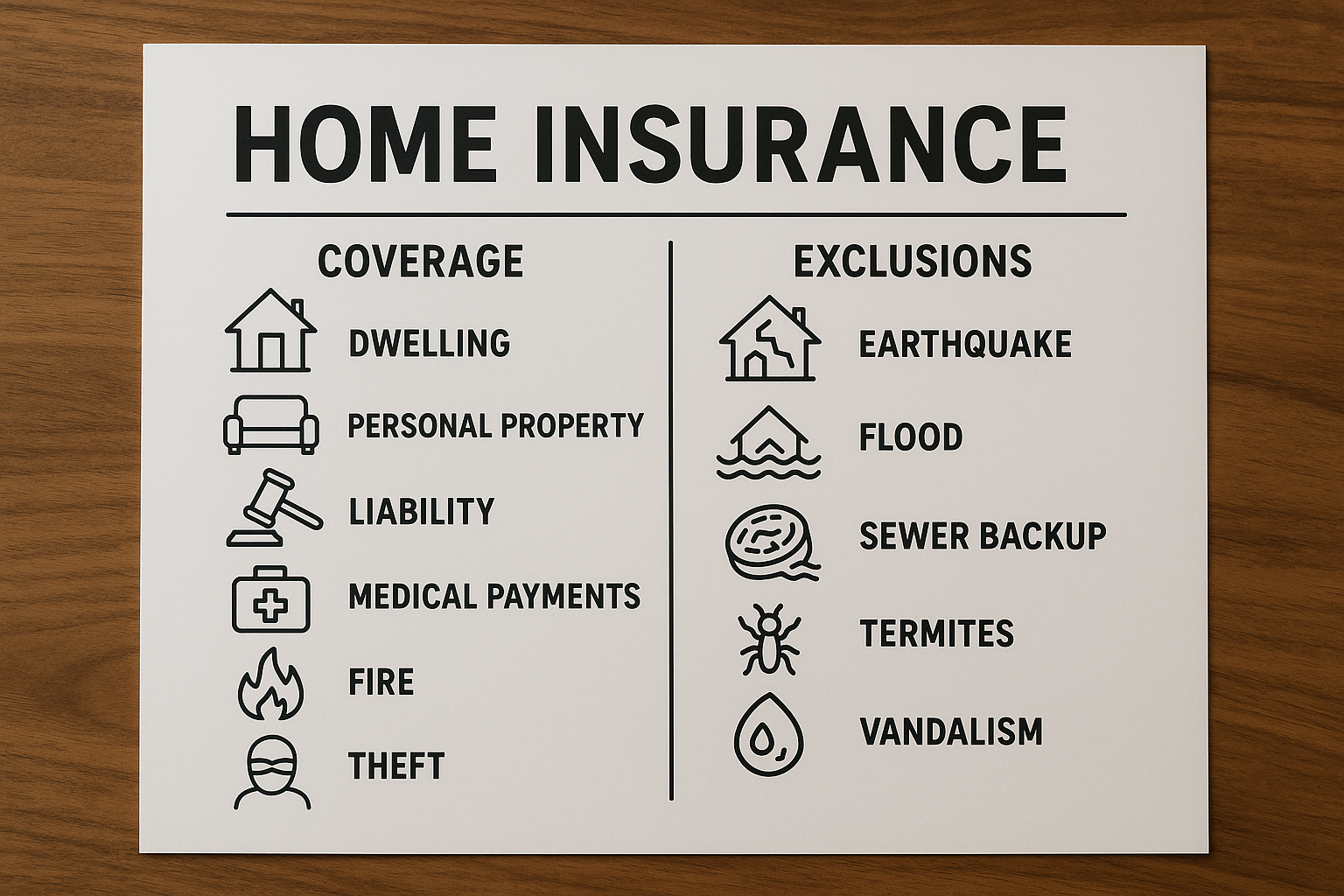

When exploring home insurance, it’s crucial to understand the different types of coverage available:

1. **Dwelling Coverage**: This covers the physical structure of your home, including walls, roof, and built-in appliances. It ensures that if your home is damaged by a covered peril, the cost of repairs or rebuilding is covered.

2. **Personal Property Coverage**: This aspect covers personal belongings inside your home, such as furniture, electronics, and clothing. If these items are stolen or damaged, personal property coverage can help replace them.

3. **Liability Protection**: If someone is injured on your property and you're found legally responsible, liability protection covers legal fees and medical expenses.

4. **Additional Living Expenses (ALE)**: If your home is uninhabitable due to a covered loss, ALE covers the cost of temporary housing and other expenses incurred while your home is being repaired.

Factors Influencing Home Insurance Costs

Several factors can affect the cost of home insurance, including the location of your home, its age and condition, and the coverage limits you choose. Homes in areas prone to natural disasters may face higher premiums due to increased risk. Additionally, the presence of safety features like smoke detectors and security systems can lead to discounts on your policy.

According to the National Association of Insurance Commissioners, the average annual premium for homeowners insurance in the U.S. is approximately $1,2001. However, this can vary significantly based on the aforementioned factors.

Opportunities for Savings

To save on home insurance, consider the following strategies:

- **Bundle Policies**: Many insurers offer discounts if you bundle home insurance with other policies, such as auto insurance.

- **Increase Deductibles**: Opting for a higher deductible can lower your premium, but ensure it's a cost you can afford in the event of a claim.

- **Shop Around**: Regularly compare quotes from different insurers to ensure you're getting the best deal. Use online tools to search options and find competitive rates.

- **Maintain a Good Credit Score**: Insurers often use credit scores to determine premiums, so maintaining a good score can result in lower costs.

Real-World Examples and Case Studies

Consider the case of a homeowner in Florida whose house was damaged by a hurricane. Thanks to comprehensive dwelling and ALE coverage, the insurance policy covered the cost of repairs and temporary housing, saving the homeowner tens of thousands of dollars2.

Resources for Further Exploration

For those eager to delve deeper into home insurance, numerous resources and specialized services are available. Websites like the Insurance Information Institute and the National Association of Insurance Commissioners provide valuable insights and tools to help you make informed decisions3, 4.

By understanding the various aspects of home insurance, you can confidently browse options and choose a policy that provides the best protection for your home and financial future. Whether you're a first-time homeowner or looking to optimize your current coverage, the right insurance policy can offer invaluable peace of mind.