Choose Wisely Guaranteed vs Indexed Life Fortune Awaits

If you're navigating the complex world of life insurance and want to secure your financial future, understanding the nuances between Guaranteed and Indexed Life Insurance can unlock opportunities you might not have considered—browse options and see these possibilities unfold.

Understanding Guaranteed Life Insurance

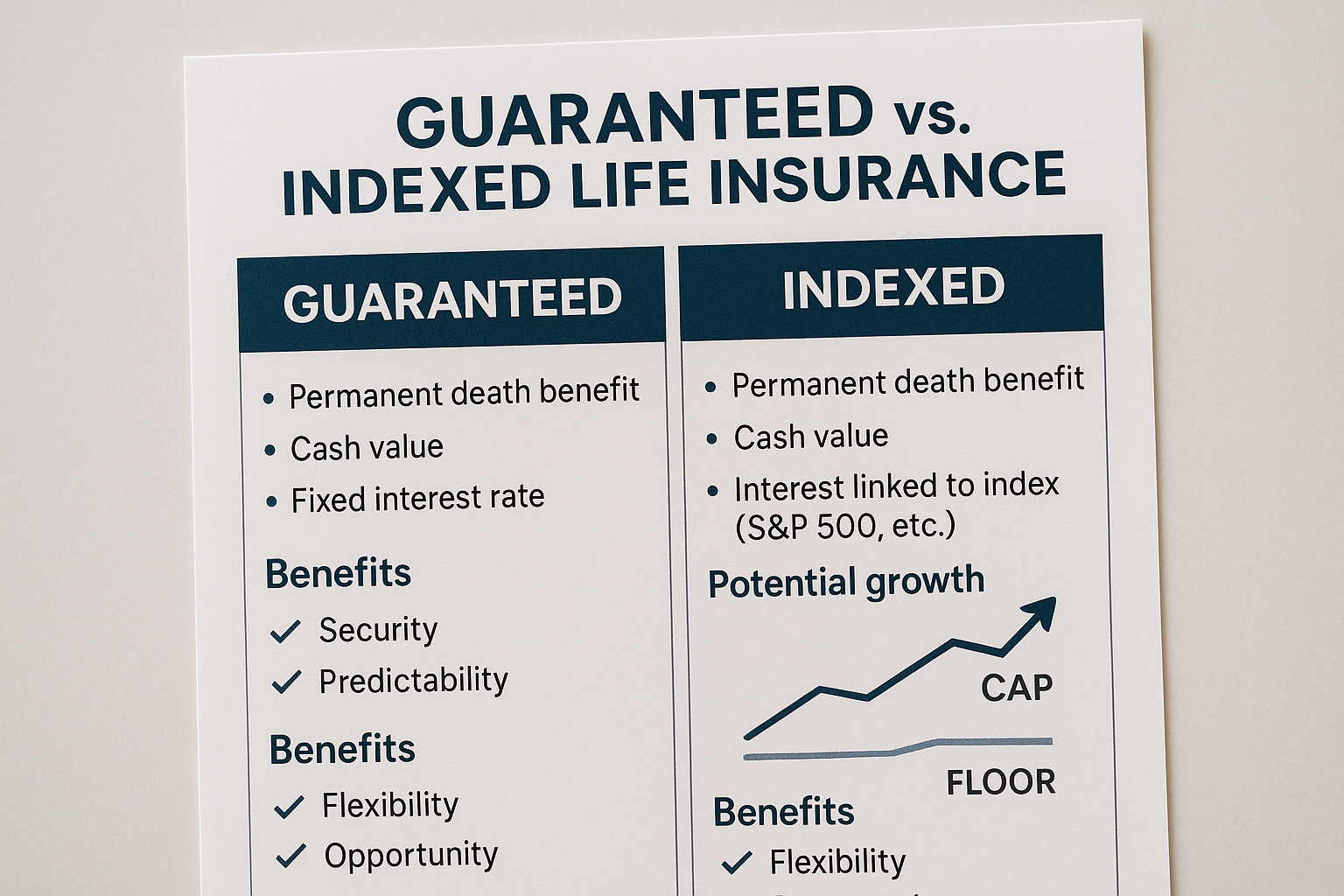

Guaranteed life insurance, often known as whole life insurance, provides a straightforward approach to securing lifelong coverage. This type of policy guarantees a death benefit to your beneficiaries, as long as premiums are paid, and often includes a savings component that grows at a guaranteed rate. The primary benefit here is predictability; you know exactly what you're getting in terms of coverage and cash value growth. This makes it an appealing choice for those who prefer stability and a no-surprises approach to financial planning. Additionally, guaranteed policies can offer fixed premiums, meaning your payments won't increase over time1.

Exploring Indexed Life Insurance

On the other hand, indexed life insurance, such as Indexed Universal Life (IUL) policies, offers a more dynamic approach. These policies tie the cash value component to a stock market index, like the S&P 500, allowing for potentially higher returns compared to traditional whole life policies. While the growth potential is greater, it also comes with more variability and risk, as returns are subject to market performance. However, many IUL policies include a floor, which protects against loss during market downturns2.

Cost Considerations and Benefits

When considering costs, guaranteed life insurance typically comes with higher premiums due to its certainty and fixed nature. However, the peace of mind and guaranteed growth can be worth the expense for many. In contrast, indexed life insurance might offer lower initial premiums and the potential for higher cash value accumulation, but it requires a more active management strategy and tolerance for market fluctuations. It's crucial to evaluate your financial goals, risk tolerance, and the level of involvement you wish to have in managing your policy3.

Making the Right Choice

Choosing between guaranteed and indexed life insurance depends largely on your personal financial situation and long-term goals. If you prefer a conservative approach with predictable outcomes, guaranteed life insurance may be the way to go. Conversely, if you're open to taking on some market risk for the chance of higher returns, indexed life insurance could be more suitable. It's essential to consult with a financial advisor to tailor your decision to your specific needs.

Additional Resources and Opportunities

For those interested in delving deeper into these options, consider visiting websites that offer detailed comparisons and personalized quotes. Many insurers provide online tools to help you visualize potential outcomes based on different scenarios. By exploring these resources, you can make a more informed decision and potentially discover tailored solutions that align with your financial aspirations.

In the dynamic landscape of life insurance, understanding the distinct advantages of guaranteed versus indexed policies can empower you to make informed decisions that secure your financial future. Whether you choose the stability of guaranteed life insurance or the growth potential of indexed options, the key is aligning your choice with your long-term goals and risk appetite.