Secrets Insurance Companies Don't Share About Liability Limits 1 2 2

Unlocking the mysteries behind liability limits in insurance can empower you to make informed decisions that protect your assets, so why not browse options and see these opportunities for yourself?

Understanding Liability Limits in Insurance

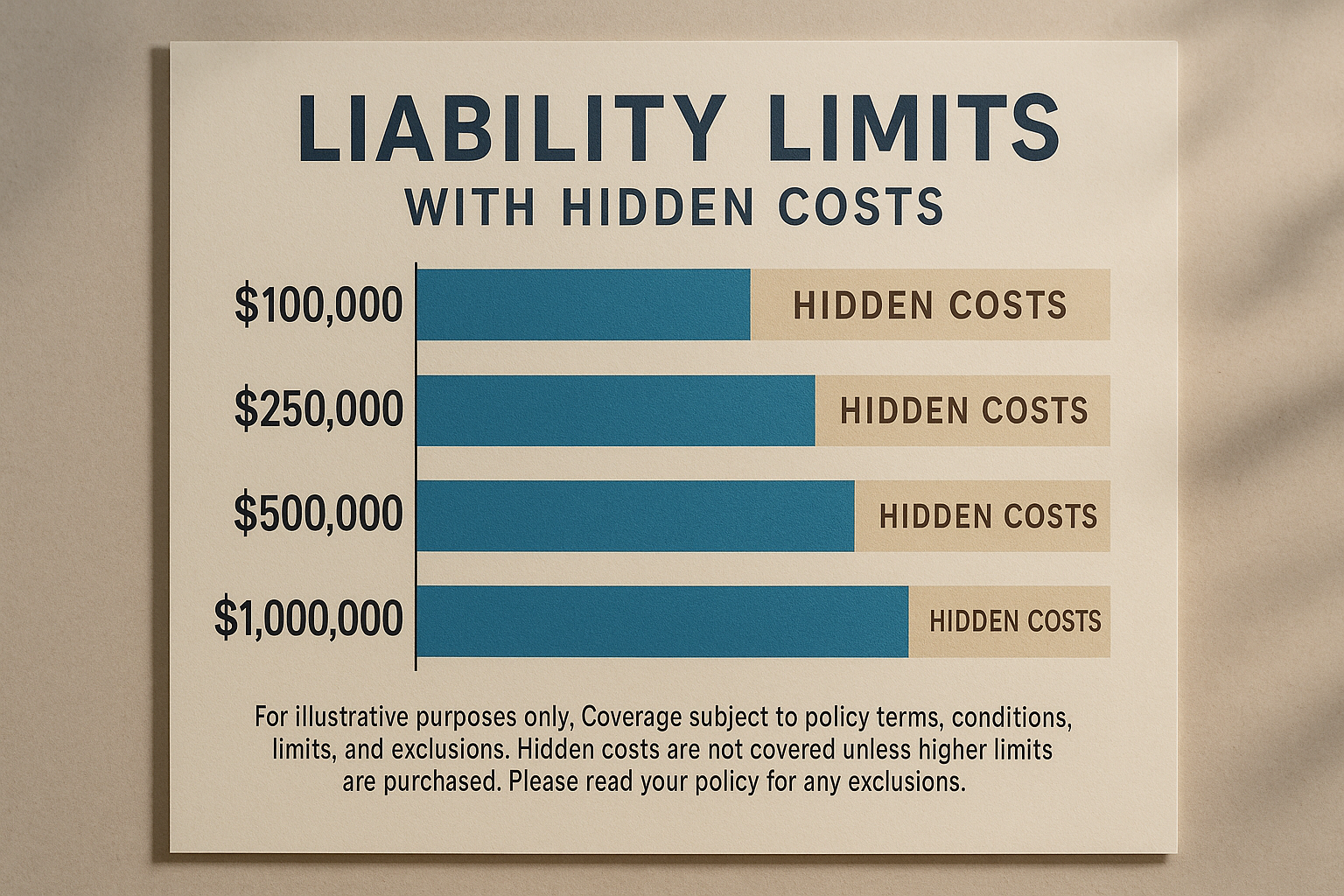

Liability limits are a crucial aspect of any insurance policy, yet they often remain shrouded in complexity. These limits dictate the maximum amount your insurance provider will pay in the event of a claim. Understanding them is vital for ensuring you are adequately protected without overpaying for coverage. Liability limits are typically broken down into two categories: per person and per incident. For instance, an auto insurance policy might have a $100,000 limit per person and a $300,000 limit per accident. This means if you are found liable for an accident, the insurance company will pay a maximum of $100,000 for each injured person, up to $300,000 total for the incident1.

Why Liability Limits Matter

Selecting the right liability limits is essential not only for your financial security but also for peace of mind. If your liability coverage is too low, you could be personally responsible for any amount exceeding your policy limits. This can lead to significant financial strain, potentially jeopardizing your assets. Conversely, opting for unnecessarily high limits could result in paying more in premiums than necessary. Therefore, it's important to assess your risk exposure and financial situation to find a balance. Many insurers offer online calculators and tools to help you determine the appropriate coverage, making it easier than ever to search options and tailor your policy to your needs2.

Common Misconceptions About Liability Limits

One common misconception is that higher liability limits always equate to better protection. While it's true that higher limits can offer more coverage, they should be aligned with your specific risk profile. Another misunderstanding is that liability limits are fixed and non-negotiable. In reality, most insurance policies are customizable, allowing you to adjust your limits based on your unique circumstances. This flexibility means you can often find competitive rates by tailoring your coverage. It's advisable to visit websites of various insurers to compare options and find the best fit for your needs3.

Real-World Examples and Statistics

Consider the case of a homeowner with a liability limit of $300,000. If a guest were to suffer a severe injury on their property, medical costs and legal fees could quickly surpass this amount. According to the Insurance Information Institute, the average liability claim for bodily injury is about $18,417, but severe cases can be much higher4. This highlights the importance of evaluating your coverage needs carefully. Additionally, a survey by J.D. Power found that policyholders with a clear understanding of their coverage options tend to be more satisfied with their insurance provider5.

Exploring Additional Resources

For those looking to delve deeper into their insurance options, numerous resources are available. Many insurance companies offer personalized consultations to help you navigate your coverage needs. Additionally, online platforms provide comparison tools that allow you to evaluate different policies side-by-side. By following these options, you can ensure that you are not only adequately protected but also receiving the best value for your investment.

Understanding and optimizing your liability limits can safeguard your financial future. By taking the time to explore your options and tailor your coverage, you can achieve both protection and peace of mind. Don't hesitate to visit websites and browse options to find the best policy for your needs.