Transform Duplex Insurance into Lifetime Savings Powerhouse Today

Unlock the hidden potential of your duplex insurance and turn it into a lifetime savings powerhouse by exploring the many options available to you, including browsing options that can enhance your financial future.

Understanding Duplex Insurance: A Financial Asset

Duplex insurance is more than just a protective measure; it's a strategic financial tool that can significantly impact your long-term savings. By insuring your duplex property, you not only safeguard your investment but also create opportunities for substantial financial growth. This type of insurance typically covers the structure of the building, liability for injuries on the property, and may even include loss of rental income in certain policies.

The key to transforming your duplex insurance into a savings powerhouse lies in understanding the full spectrum of benefits it offers. For instance, some policies allow for coverage customization, enabling you to tailor the insurance to meet specific needs, which can result in cost savings. Additionally, insurance providers often offer discounts for bundled services or for implementing safety features like security systems and fire alarms. It's crucial to search options and compare different policies to find the best fit for your needs.

Maximizing Savings Through Strategic Insurance Choices

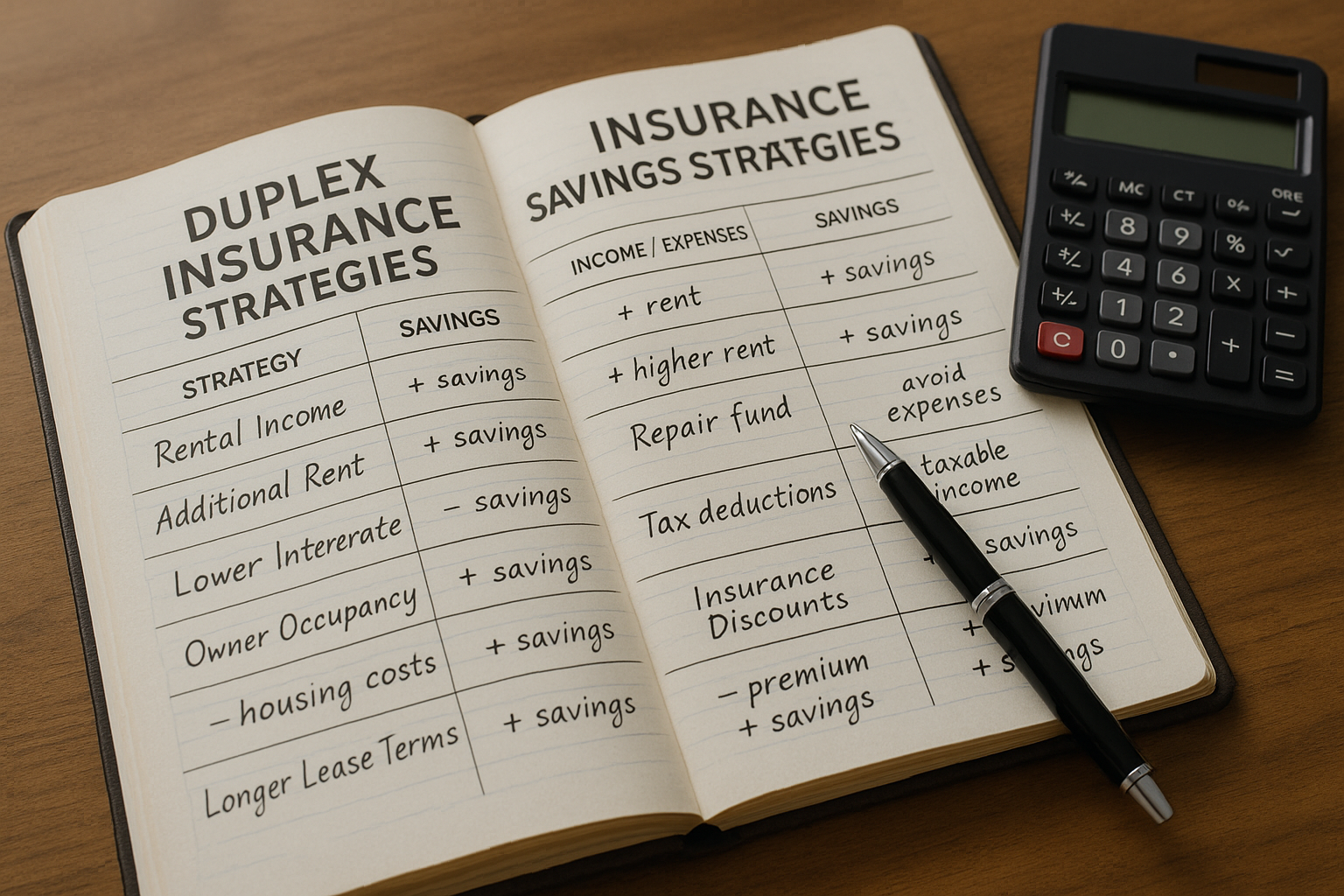

To maximize savings, consider the following strategies:

- Shop Around for Competitive Rates: Insurance premiums can vary significantly between providers. By visiting websites and comparing quotes, you can find a policy that offers the best value for your money.

- Bundle Policies: Many insurers offer discounts if you combine your duplex insurance with other policies, such as car or life insurance. This can lead to substantial savings over time.

- Increase Deductibles: Opting for a higher deductible can lower your monthly premiums. Ensure that you have enough savings to cover the deductible in case of a claim.

These strategies not only help reduce costs but also enhance the overall value of your insurance investment. According to recent data, policyholders who actively manage their insurance options can save up to 30% annually on premiums1.

The Role of Insurance in Long-Term Financial Planning

Incorporating duplex insurance into your long-term financial planning can yield significant benefits. A well-structured insurance policy acts as a safety net, protecting your asset and ensuring steady income through rental coverage. This stability is crucial for maintaining a healthy cash flow, which is a cornerstone of effective financial planning.

Moreover, some insurance policies offer additional benefits like inflation protection and guaranteed replacement cost coverage, which can further secure your financial future. By leveraging these features, you can ensure that your property remains a valuable asset, even in the face of economic fluctuations.

Exploring Specialized Insurance Solutions

For those seeking tailored solutions, specialized insurance products are available that cater to unique needs. These may include policies designed for historic properties, eco-friendly buildings, or properties in high-risk areas. By exploring these options, you can find coverage that not only meets but exceeds your expectations.

It's advisable to consult with insurance experts or use online tools to see these options and determine the best course of action. This proactive approach ensures that you are not only protecting your investment but also optimizing it for future growth.

Transforming your duplex insurance into a lifetime savings powerhouse requires a strategic approach and informed decision-making. By understanding the full potential of your insurance policy, maximizing savings through smart choices, and exploring specialized solutions, you can secure a prosperous financial future. Take the first step today by exploring the available options and aligning your insurance strategy with your long-term financial goals.